Starting October 15, 2025, Singapore’s seven major retail banks will implement stringent new safeguards designed to protect customers from digital scams. These measures represent a significant shift in how financial institutions balance security with convenience, introducing automated transaction holds that could affect millions of banking customers. With $456.4 million lost to scams in just the first half of 2025, these safeguards mark an aggressive intervention in Singapore’s ongoing battle against increasingly sophisticated financial fraud.

The Mechanics: How the Safeguards Work

The 50% Threshold Rule

The cornerstone of the new system is deceptively simple: when cumulative withdrawals within a 24-hour period exceed 50% of an account’s balance, the system triggers protective measures. The transaction that breaches this threshold, along with all subsequent transactions, will be either held for 24 hours or rejected outright.

This mechanism is specifically designed to combat “account draining” scams, where victims are manipulated into rapidly transferring large portions of their savings to scammers. The 24-hour cooling-off period provides a critical window for victims to recognize they’ve been deceived and cancel fraudulent transactions.

Scope and Coverage

Accounts Covered:

- Current and savings accounts, including joint accounts

- Minimum balance requirement: $50,000

- All seven major retail banks: DBS Bank, OCBC Bank, UOB, Citibank, HSBC, Maybank, and Standard Chartered

Transactions Affected:

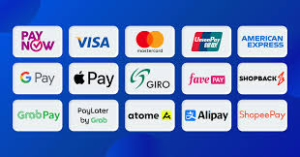

- All digital banking transactions via mobile apps and internet banking

- Peer-to-peer transfers

- Bill payments (except to designated billing organizations)

- Fund transfers to external accounts

Transactions Exempted:

- Cash withdrawals at bank branches

- ATM withdrawals

- Recurring standing instructions

- Recurring Giro or eGiro payments

- Bill payments to entities classified as billing organizations

This selective application suggests banks are targeting the primary vector of scam losses—digital transfers initiated through compromised decision-making—while preserving the flow of routine, pre-authorized payments.

Deep Dive: The Scam Landscape in Singapore

The Numbers Tell a Story

Singapore’s scam epidemic has reached crisis proportions. In the first half of 2025 alone:

- $456.4 million lost to scams

- Nearly 20,000 cases reported

- Average loss per case: approximately $22,800

While the article notes that losses were lower than the same period in 2024, the absolute numbers remain staggering. This represents not just financial damage but also psychological trauma, eroded trust in financial systems, and countless hours of investigation and remediation.

Common Scam Patterns

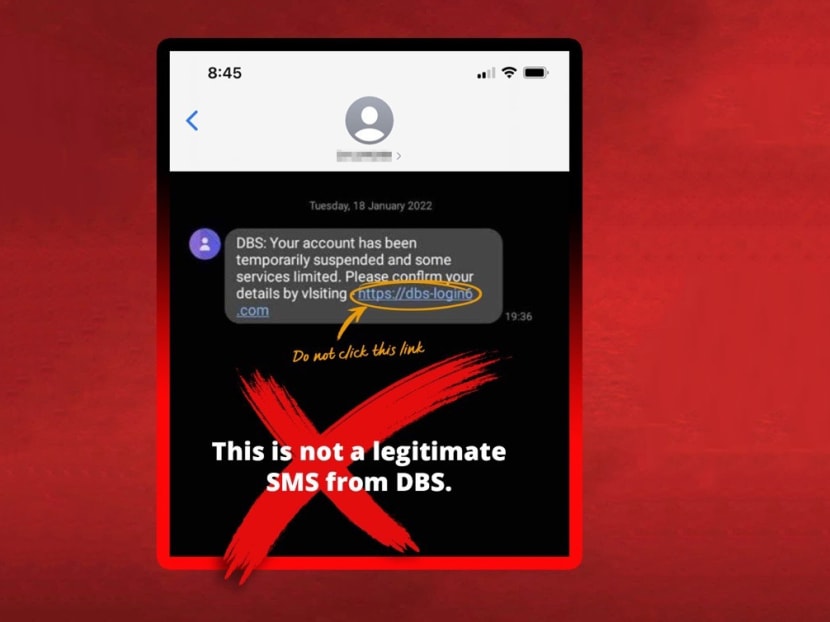

The safeguards specifically target phishing scams, where victims are tricked into:

- Clicking malicious links in SMS or email

- Providing login credentials to fake banking websites

- Authorizing large transfers under false pretenses

- Acting quickly under manufactured urgency

The “account draining” pattern typically follows this sequence:

- Scammer gains access to victim’s account or persuades victim to make transfers

- Multiple rapid transactions empty the account

- By the time the victim realizes what happened, funds have disappeared through complex layering schemes

The 50% threshold and 24-hour hold are engineered to interrupt this sequence before irreversible damage occurs.

Impact Analysis: Winners and Losers

Potential Benefits

1. Scam Prevention and Loss Reduction

The most obvious benefit is preventing completed scams. If even 10-20% of scam attempts are stopped by the 24-hour cooling period, this could save tens of millions of dollars annually. The measure is particularly effective against:

- Impersonation scams (fake bank officials, government agencies)

- Phishing attacks that create panic and urgency

- Romance scams where victims are manipulated over time into making large transfers

2. Behavioral Intervention

The 24-hour delay functions as a forced “cognitive break”—a moment where the spell of manipulation can be broken. Scammers rely on creating urgency and emotional states that bypass rational thinking. A mandatory pause disrupts this psychological control.

3. Systemic Risk Reduction

For the banking sector and Singapore’s reputation as a financial hub, reducing scam losses protects:

- Consumer confidence in digital banking

- Singapore’s attractiveness for fintech innovation

- The broader financial ecosystem’s integrity

4. Shared Responsibility Model

By implementing industry-wide standards, banks create a collective defense that makes it harder for scammers to exploit gaps between institutions. This also distributes the friction cost across all customers rather than penalizing individual banks for being more cautious.

Potential Drawbacks and Challenges

1. Legitimate Transaction Delays

The most immediate impact will be felt by customers making legitimate large transfers:

- Home purchases: Downpayments often exceed 50% of liquid savings

- Investment opportunities: Time-sensitive stock purchases, property deals

- Medical emergencies: Urgent overseas treatment requiring large payments

- Business operations: Entrepreneurs paying suppliers, making inventory purchases

These delays could result in:

- Missed opportunities

- Late payment penalties

- Failed transactions with consequences

- Damaged business relationships

2. Financial Exclusion Concerns

The $50,000 minimum threshold creates a two-tier system:

- Wealthier customers receive automatic protection

- Lower-balance accounts remain vulnerable

- This could be seen as prioritizing protection for the affluent

However, this design choice likely reflects practical considerations:

- Accounts with $50,000+ balances have more to lose in absolute terms

- Smaller accounts may legitimately empty more frequently for rent, large purchases

- False positive rates would be unacceptably high for lower-balance accounts

3. Adaptation by Scammers

Sophisticated scammers will inevitably adapt:

- Multiple smaller transactions staying just below 50% threshold

- Spreading transfers across multiple accounts

- Longer-term grooming to manipulate victims into making transfers over multiple days

- Targeting customers with multiple bank accounts

The safeguards may simply slow down scammers rather than stop them entirely.

4. Operational and Customer Service Burden

Banks will face:

- Increased call center volume from customers needing urgent verification

- Complex exception handling processes

- Customer frustration and complaints

- Need for rapid verification systems that don’t compromise security

5. Privacy and Surveillance Concerns

The system requires continuous monitoring of customer transaction patterns. While this data was already collected, the active intervention based on behavioral patterns may raise questions about:

- Financial privacy

- Algorithmic decision-making

- Transparency in how “risk factors” are determined

The Broader Anti-Scam Ecosystem

These safeguards don’t exist in isolation. Singapore has been building a multi-layered defense:

Previous Measures:

- Money Lock: Customers can lock portions of their balance, making funds inaccessible for transactions

- Fraud surveillance systems: AI-powered monitoring of suspicious patterns

- Cognitive breaks: Delays and warnings when suspicious activity detected

- Digital tokens: Two-factor authentication for transactions

Upcoming Measures: The article mentions banks will introduce in-app push notifications for digital token users when receiving calls purporting to be from the bank. This addresses “vishing” (voice phishing) attacks where scammers impersonate bank officials.

Regulatory Environment: The Infocomm Media Development Authority’s age assurance requirements for app stores (mentioned in related stories) show Singapore’s holistic approach to digital safety, extending beyond just financial fraud.

International Context and Comparisons

Singapore’s aggressive stance reflects a broader trend:

United Kingdom: Introduced mandatory reimbursement for scam victims under certain circumstances, shifting liability to banks Australia: Implemented the Scam-Safe Accord with verification requirements for high-risk transactions India: UPI payment limits and additional authentication for large transfers

Singapore’s approach is distinctive in its:

- Universal application across major banks

- Focus on automatic holds rather than customer-initiated locks

- Balance-based percentage threshold rather than absolute amounts

Implementation Challenges

Technical Infrastructure

Banks must ensure their systems can:

- Calculate rolling 24-hour transaction totals in real-time

- Handle high transaction volumes without performance degradation

- Coordinate across multiple accounts for joint account holders

- Process verification requests rapidly during the 24-hour hold period

Customer Communication

The success of these measures depends heavily on customer understanding and acceptance. Banks face challenges:

- Explaining complex rules clearly to diverse customer base

- Managing expectations about transaction timing

- Providing easy-to-use verification channels

- Maintaining trust during the adjustment period

Edge Cases and Exceptions

Real-world scenarios will test the system:

- What happens when someone legitimately needs to empty an account (closing it, major purchase)?

- How are joint account dynamics handled when one holder is potentially compromised?

- What verification is required to release held transactions?

- How do time zones affect international transfers?

Long-Term Implications

Behavioral Changes

Over time, these safeguards may reshape banking behavior:

- Customers may maintain higher balances to avoid triggering the threshold

- Pre-planning for large transactions becomes necessary

- Multiple smaller transactions may become the norm for large transfers

- Increased use of Money Lock and other voluntary protective features

Evolution of Scam Tactics

As with any security measure, scammers will evolve:

- More sophisticated social engineering to stay below detection thresholds

- Longer-term relationship building to establish trust over multiple small transactions

- Targeting of business accounts or lower-balance personal accounts

- Exploitation of the verification process itself

Policy Questions

The implementation raises broader questions:

- Should there be regulatory requirements for minimum protection levels?

- How should banks balance security with convenience?

- What liability framework is appropriate when scams still succeed?

- Should there be consumer choice in opting in or out of such protections?

Recommendations for Stakeholders

For Bank Customers

Before October 15:

- Review typical transaction patterns

- Set up Money Lock for funds not needed for regular expenses

- Ensure contact information with banks is current

- Plan ahead for any large transactions

Ongoing:

- Be skeptical of urgent requests for large transfers

- Verify bank contact details independently before responding

- Use the 24-hour cooling period to verify suspicious requests

- Maintain awareness of common scam tactics

For Banks

Short-term:

- Robust customer communication campaign

- Streamlined verification processes

- Adequate call center staffing for increased inquiries

- Clear escalation paths for genuine emergencies

Long-term:

- Monitor false positive rates and adjust thresholds

- Invest in AI/ML for more nuanced fraud detection

- Develop faster verification technologies (biometrics, video verification)

- Share threat intelligence across the industry

For Policymakers

- Monitor effectiveness and unintended consequences

- Consider complementary measures (scammer liability, platform accountability)

- Evaluate whether protection should extend to lower-balance accounts

- Strengthen law enforcement capabilities for cross-border scam operations

Conclusion: A Necessary Friction

The October 15 safeguards represent a pivotal moment in Singapore’s approach to digital security. By introducing deliberate friction into digital transactions, banks are making a calculated trade-off: accept some inconvenience for all customers to provide substantial protection for the vulnerable.

This approach reflects a sobering reality—technological convenience has created attack surfaces that education and individual vigilance alone cannot defend. The $456.4 million lost in just six months demonstrates that the status quo is unsustainable.

However, the true test of these measures will come in the months following implementation. Success metrics should include:

- Reduction in completed scam losses

- Number of scams prevented during the 24-hour window

- Customer satisfaction and friction levels

- Scammer adaptation and evolution

- False positive rates and their impact on legitimate commerce

The safeguards are not a silver bullet—scammers are adaptable, and determined criminals will find workarounds. But by buying time, creating decision checkpoints, and forcing deliberation in moments of potential manipulation, these measures could save millions and protect thousands of Singaporeans from financial devastation.

As the Association of Banks in Singapore noted, this is a “societal safeguard” requiring patience and understanding. In an era where a single click can drain a lifetime of savings, perhaps a 24-hour pause is a small price to pay for security.

The October 15 implementation date is approaching. Singapore’s banking customers should prepare not just for procedural changes, but for a fundamental shift in how digital finance balances speed with safety. In the ongoing arms race between security and fraud, this represents a decisive move—one that prioritizes protection even at the cost of convenience.

In an increasingly interconnected and digital world, the threat of scams has become a pervasive challenge, demanding innovative and collaborative solutions. Recognizing this urgent need, the Singapore Police Force’s (SPF) Anti-Scam Centre (ASC) has forged a powerful alliance with four major banks – DBS Bank, OCBC Bank, Standard Chartered Bank, and UOB Bank – resulting in the successful disruption of over 900 ongoing scams. This concerted effort, spanning the beginning of 2025, targeted a diverse range of fraudulent activities, including enticing job scams, high-pressure investment scams, emotionally manipulative fake-friend call scams, and deceptive e-commerce scams. The tangible outcome of this partnership is the prevention of significant financial losses, highlighting the effectiveness of proactive collaboration in the fight against cybercrime.

A key element underpinning the success of this partnership lies in the strategic implementation of Robotic Process Automation (RPA) technology. This innovative approach has fundamentally altered the speed and efficiency of information sharing between the ASC and the participating banks. RPA allows for the rapid and automated exchange of critical data related to potentially fraudulent transactions and suspicious activities. This, in turn, enables the swift identification of potential scam victims, providing a crucial window of opportunity for timely intervention and the prevention of further financial losses. The real-time intelligence provided by RPA empowers both the ASC and the banks to act decisively and proactively, staying one step ahead of the ever-evolving tactics of scammers.

Between January 1, 2025, and February 28, 2025, the collaborative efforts of the ASC and its banking partners manifested in a proactive communication strategy. Over 9,000 targeted SMS messages were dispatched to more than 7,000 bank customers who had been identified as potential scam victims. These messages served as crucial warnings, alerting individuals to suspicious activity and prompting them to take immediate action to protect their accounts. This proactive measure proved remarkably effective, averting over $58 million in potential losses. These were funds that would have otherwise been siphoned off by malicious actors, underscoring the significant impact of the collaborative and technology-driven approach. The sheer magnitude of the averted losses serves as a stark reminder of the financial devastation that scams can inflict on individuals and the importance of preventative measures.

Beyond the direct intervention efforts, the Singapore Police Force recognizes the critical role of public awareness and education in preventing scams. The SPF urges the public to adopt a proactive approach to scam prevention by remembering to “ACT” against scams, an easily memorable acronym that encapsulates key preventive steps.

ADD: This component emphasizes the importance of enhancing digital security. Individuals are encouraged to bolster their online defenses by adding security features such as the ScamShield application, which helps to identify and block scam calls and messages. Enabling two-factor authentication (2FA) for personal accounts, including bank accounts, social media profiles, and Singpass accounts, adds an extra layer of protection, making it significantly more difficult for scammers to gain unauthorized access. Furthermore, setting transaction limits for internet banking, including PayNow, can help limit potential losses in the event that an account is compromised. These measures act as a digital shield, minimizing vulnerability to scam tactics.

CHECK: Vigilance is paramount in the fight against scams. This component encourages individuals to be observant and carefully check for potential signs of a scam. This includes asking probing questions, verifying requests for personal information or money transfers, and meticulously confirming the legitimacy of online listings and reviews. The SPF emphasizes the importance of pausing and checking before acting impulsively on any request or offer. This critical pause allows individuals to assess the situation rationally and identify potential red flags. A key principle to remember is that if an offer seems too good to be true, it likely is a scam. This healthy skepticism can be a powerful tool in avoiding falling victim to fraudulent schemes.

TELL: Reporting scam encounters is crucial not only for personal protection but also for contributing to the broader fight against cybercrime. This component encourages individuals to report scam encounters to the authorities, providing valuable information that can help to track down and apprehend scammers. Reporting scams to the bank, ScamShield, or by filing a police report allows law enforcement to investigate and disrupt ongoing scam operations. Additionally, sharing information about ongoing scams and preventive steps with friends and family helps to raise awareness and protect others from falling victim to similar schemes. Reporting fraudulent pages and accounts to the relevant platforms helps to remove them from circulation, preventing further harm. By sharing information and reporting suspicious activity, individuals can actively contribute to a safer online environment.

The Singapore Police Force’s commitment to combating scams extends beyond reactive measures and focuses on fostering a culture of awareness and proactive prevention. By empowering the public with the knowledge and tools to “ACT” against scams, the SPF aims to create a more resilient and secure society.

For more information on scams, individuals are encouraged to visit www.scamshield.gov.sg or call the ScamShield Helpline at 1799. Anyone with information on scams can call the Police Hotline at 1800-255-0000 or submit information online at www.police.gov.sg/iwitness. All information will be kept strictly confidential, ensuring that individuals can report suspicious activity without fear of reprisal.

The successful collaboration between the Singapore Police Force, the Anti-Scam Centre, and partner banks serves as a powerful example of how proactive partnerships, technological innovation, and public awareness can effectively combat the growing threat of scams in the digital age. By remaining vigilant, informed, and proactive, individuals and organizations alike can contribute to creating a safer and more secure online environment for all.

Analysis of Singapore’s Scam Prevention Approach

Government and Institutional Measures

Based on the article, Singapore has implemented several institutional approaches to combat scams:

- Monetary Authority of Singapore (MAS) Initiatives:

- Working directly with banks to enhance digital banking security

- Implementing new protective measures like eliminating clickable links in official emails/SMSes

- Requiring a minimum 12-hour delay before activating new soft tokens on mobile devices

- Providing specific guidance to banking customers on safe practices

- Police Force Involvement:

- The Singapore Police Force (SPF) actively tracks and reports on scam statistics

- Conduct investigations of scammers and money mules (as evidenced by the case involving 170 men and 89 women)

- Shares examples and screenshots of scams to raise public awareness

- Banking Sector Protections (specifically highlighted for DBS):

- Stopping non-essential SMSes with links

- Sending only essential communications like security notifications and OTP authentication

- Implementing default transaction notification thresholds (S$100)

- Providing in-app security features like card locking and customizable spending limits

- Offering digital tokens with enhanced encryption

Effectiveness Analysis

The approach appears to be multi-faceted, combining:

- Technical barriers: Implementing security features that make scamming more difficult

- Public education: Raising awareness about standard scam techniques

- Enforcement: Actively investigating scam cases

However, the rising scam statistics mentioned (16% increase in cases, with amounts cheated rising from S$63.5M to S$168M) suggest these measures may be struggling to keep pace with evolving scam techniques.

Strengths of Singapore’s Approach

- Coordinated response: Collaboration between regulatory bodies (MAS), law enforcement (SPF), and financial institutions

- Customer-focused solutions: Tools that give customers more control over their security

- Practical implementation: Specific, actionable measures rather than just general advice

Potential Gaps and Recommendations

- Technology gap: The article doesn’t mention advanced detection technologies like AI for identifying unusual transaction patterns

- Demographic considerations: No specific mention of tailored approaches for vulnerable groups like seniors

- Private sector cooperation: Limited discussion of how businesses beyond banks are involved in prevention

- International coordination: No mention of cooperation with other countries to address overseas-based scammers

Singapore’s approach appears to be comprehensive but could potentially benefit from more advanced technological solutions and broader cooperation across sectors and borders to address the evolving nature of scams.

Social Engineering: Anatomy of Manipulation and Defense

Social Engineering Techniques

Psychological Manipulation Strategies

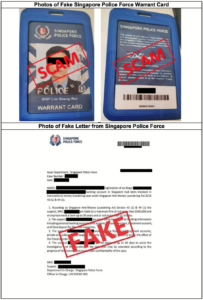

- Authority Impersonation

- Scammers pose as official representatives (e.g., bank officers, government officials)

- Exploit victims’ respect for authority and tendency to comply with perceived authoritative figures.

- Use official-sounding language, titles, and fabricated credentials.

- Fear and Urgency Tactics

- Create artificial time pressures to prevent critical thinking

- Trigger emotional responses like panic or anxiety

- Common threats include:

- Legal consequences

- Financial penalties

- Account suspension

- Potential criminal investigations

- Trust Building and Rapport

- Develop a seemingly genuine conversational flow

- Use personal details to appear credible

- Gradually escalate requests, starting with minor, seemingly innocuous asks

- Exploit human tendency to be helpful and avoid confrontation

- Information Harvesting

- Collect fragmentary personal information from multiple sources

- Use social media, public databases, and previous data breaches

- Craft highly personalized, convincing narratives

Technical Manipulation Methods

- Phishing Techniques

- Spoofed communication channels

- Lookalike websites and email addresses

- Malicious links and attachments

- Screen sharing and remote access exploitation

- Multi-Stage Scam Progression

- Complex narratives involving multiple fake personas

- Gradual erosion of victim’s skepticism

- Continuous redirection and technical jargon

Prevention Strategies

Personal Awareness and Education

- Critical Thinking Development

- Always verify unsolicited communications independently

- Use official contact methods from verified sources

- Never click links or download attachments from unknown sources

- Recognize and resist emotional manipulation

- Communication Red Flags

- Unsolicited contact requesting personal information

- Pressure to act immediately

- Requests for financial transfers

- Communication via unofficial channels

- Threats or aggressive language

Technical Protective Measures

- Digital Security Practices

- Use multi-factor authentication

- Regularly update software and security systems

- Install reputable antivirus and anti-malware solutions

- Use dedicated communication and banking apps

- Enable transaction notifications

- Information Protection

- Minimize public personal information sharing

- Use privacy settings on social platforms

- Create complex, unique passwords

- Regularly monitor financial statements

- Use virtual credit cards for online transactions

Institutional and Technological Interventions

- Technological Defenses

- Implement AI-driven fraud detection systems

- Develop advanced caller ID and communication verification tools

- Create comprehensive scam reporting mechanisms

- Educational Initiatives

- Regular public awareness campaigns

- School and workplace training programs

- Clear, accessible resources on emerging scam techniques

- Collaborative efforts between government, tech companies, and financial institutions

Psychological Resilience

- Emotional Intelligence

- Recognize personal emotional triggers

- Practice calm, methodical responses to unexpected communications

- Develop healthy skepticism without becoming paranoid

- Community Awareness

- Share scam experiences

- Supporting vulnerable community members

- Create support networks for scam victims

Emerging Trends

- Increasing sophistication of AI in social engineering

- Cross-platform information integration

- More personalized, contextually relevant scam attempts

Conclusion

Social engineering exploits fundamental human psychological vulnerabilities. Comprehensive defense requires a multi-layered approach combining technological solutions, personal awareness, and continuous education.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.