The NFT market is on a meteoric rise, showcasing extraordinary liquidity that has captured global attention. In 2021 alone, transactions for non-fungible tokens soared to a staggering $25 billion. This surge was highlighted by the sale of an NFT artwork at Christie’s auction house, which fetched a jaw-dropping $69.3 million.

Major brands are not standing on the sidelines; giants like Coca-Cola and Gucci have jumped into the NFT phenomenon. Within just months of launching traded NFTs, transaction volumes exceeded one billion dollars, indicating a profound shift in how digital assets are valued and exchanged.

This trend only accelerated, with quarterly transactions climbing to a billion dollars and eventually reaching nearly one billion every month. According to data from nonfungible.com, these historic figures underscore the increasing momentum behind NFTs. By 2022, total sales reached an impressive $11.8 billion, solidifying NFTs as a vital part of the contemporary art and collectables landscape. The excitement surrounding this new frontier shows no signs of slowing down anytime soon.

Fintech Trends

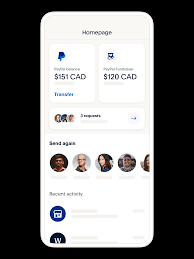

Fintech encompasses a wide array of categories, each reshaping our financial landscape in unique ways. One of the most visible and widely adopted areas is mobile wallets and payment apps.

Services like PayPal, Venmo, Square, Apple Pay, and Google Pay have revolutionised how individuals handle transactions. These platforms allow users to seamlessly send money to friends or family with just a few taps on their smartphones. Additionally, they enable merchants to receive payments from customers efficiently, eliminating the need for cash or checks.

Another exciting frontier in fintech is crowdfunding platforms. Websites such as Kickstarter and GoFundMe have fundamentally altered traditional funding methods. Instead of relying solely on banks or wealthy investors, entrepreneurs can now invite everyday people to contribute funds for their projects or causes.

These innovations not only democratise access to capital but also foster community engagement around new ideas and initiatives. In a world where finance is becoming increasingly digitised, these categories of fintech are leading the charge toward a more connected economy.

Cryptocurrency and blockchain technologies have emerged as dominant forces in the fintech landscape, transforming how we perceive and handle money. Platforms like Coinbase and Gemini empower consumers by allowing them to buy or sell cryptocurrencies with unprecedented ease.  This digital currency revolution not only offers new investment opportunities but also challenges traditional financial systems.

This digital currency revolution not only offers new investment opportunities but also challenges traditional financial systems.

Blockchain technology goes further; it has the potential to redefine various industries by minimising fraud and enhancing transparency. This shift paves the way for a more reliable ecosystem that can operate beyond mere profit motives.

Meanwhile, robo-advisors such as Betterment and Ellevest leverage advanced algorithms to provide tailored portfolio strategies. These services make investment accessible, guiding users toward smarter financial decisions without the need for human advisors.

Stock trading apps like Robinhood and Acorns have also gained popularity, enabling users to trade stocks directly from their smartphones. This convenience democratises access to financial markets, allowing individuals to invest any time and anywhere—no broker required. Through these innovations, fintech is reshaping our relationship with finance, making it more personal and intuitive than ever before.

CO strives to provide individuals with insights from esteemed experts in various fields. However, before making significant business decisions, it’s crucial to consult professional advisors. This ensures that you receive tailored financial guidance customised to your unique circumstances.

Fintech in Singapore

The fintech landscape in Singapore has been burgeoning. The total transaction value in the Digital Payments segment alone is estimated to reach a staggering US$11.2 billion in 2021. Even more exciting is the projected growth: an impressive compound annual growth rate (CAGR) of 22.7% from 2021 to 2025.

This translates to an anticipated total transaction value of approximately US$25.4 billion by 2025. Among the components of this thriving market, Digital Commerce stands out as the largest segment, expected to account for around US$7.3 billion in transactions this year.

When viewed on a global scale, China leads by leaps and bounds with an astonishing cumulated transaction value of nearly US$2.9 trillion in 2021. These figures reflect not just numbers but also a dynamic shift towards digital solutions that redefine how we think about commerce and finance worldwide.

How Maxthon Empowers Fintech Use

- Integrated Security Features

Maxthon prioritises user security by employing cutting-edge encryption techniques and advanced security protocols. This ensures that sensitive financial data remains protected against unauthorised access.

- Lightning-Fast Performance

With its optimised browsing technology, Maxthon provides quick loading times and seamless navigation. This speed is crucial for financial transactions and real-time market analysis, allowing users to make informed decisions instantly.

- Cross-Platform Compatibility

Maxthon is available on multiple devices, including desktops, tablets, and smartphones. This flexibility enables fintech professionals to manage their activities on the go, ensuring they take advantage of critical updates and trading opportunities.

- Customizable User Interface

Users can personalise their browser environment to suit their specific fintech needs. Whether through custom bookmarks or tailored dashboards, Maxthon allows for an organised workspace that enhances productivity.

- Advanced-Data Management Tools

The platform includes powerful tools for data organisation and management. Finance professionals can effortlessly save and categorise necessary resources, making it easier to access essential information when needed.

- Efficient Collaboration Features

Maxthon supports collaborative functions such as sharing links and content with colleagues in real time. This promotes teamwork among fintech teams working on shared projects or initiatives.

- Innovative Add-Ons and Extensions

The browser offers a range of extensions explicitly designed for finance-related tasks. From currency converters to stock trackers, these tools enhance the functionality of the platform and cater to diverse needs within the fintech sector.

- Seamless Integration with Financial Services

Maxthon collaborates with various financial service providers, enabling smooth integration of critical services directly within the browser environment. This makes it easier for users to engage with banking apps and investment platforms.

- Commitment to Continuous Improvement

Regular updates ensure that Maxthon remains at the forefront of technological advancements in both web browsing and fintech capabilities, continually enhancing user experience and functionalities offered through the platform.

By harnessing these features, Maxthon empowers fintech users to operate more efficiently while safeguarding their interests.