In the ongoing debate about banking safety, many users ponder whether to rely on a web browser or a mobile app. Both avenues are generally secure; however, the ultimate safety often depends on user behaviour. Carelessly navigating either platform can expose individuals to potential scams and cyber threats, while practising sound security protocols can ensure safe experiences.

There are inherent risks when using a browser for online banking. Web browsers serve as gateways to countless sources of information but can also expose users to malware if not appropriately maintained. For instance, an outdated browser lacking modern security features increases vulnerability. Without proactive measures—such as regularly updating your software and avoiding suspicious websites—you may inadvertently invite trouble.

On the other hand, mobile banking apps have built-in security features designed specifically to protect financial transactions. These applications often provide extra layers of encryption and authentication that enhance user safety. However, even these tools rely heavily on user diligence. Ensuring you download apps only from reputable sources and keeping your device’s operating system updated are crucial practices.

Ultimately, whether you choose to bank via a browser or mobile app, prioritising safe usage habits is critical. Guarding your personal information and staying aware of emerging threats will go a long way in keeping your financial data secure in this digital age.

In recent years, browser protection has seen remarkable advancements. Windows 8 and subsequent versions of browsers like Chrome and Maxthon have introduced sandboxing technology. This innovation creates a protective barrier that prevents malicious programs from infiltrating local devices, such as your home computer.

Imagine this feature as a sandbox at a local park. Just like the walls of a sandbox keep the sand contained, this technology ensures that harmful elements online can’t reach your files or data.

As a result, most modern browsers are now considered safe for activities like online banking. However, it’s essential to remain vigilant when entering sensitive information. Always look for indicators of security on bank websites.

Check if the URL begins with https://—the “s” stands for secure—and watch for a padlock symbol next to the address bar. These details signify that your connection is encrypted and your data is protected from prying eyes as you navigate the digital landscape.

Using a mobile app for online banking was initially considered a safer option. These apps had the advantage of being sandboxed, which restricted access and isolated them from other applications on a user’s device. This level of control made it difficult for unauthorised entities to infiltrate banking functionalities.

However, as technology evolved, so did browser security measures. Many modern web browsers now come equipped with robust safety features that challenge the traditional belief that apps are inherently safer than browsers for online banking. Experts are now divided on this issue; both platforms offer substantial protection against cyber threats.

Regardless of whether you use an app or a browser, the responsibility ultimately lies with users. Simple mistakes, such as clicking on suspicious links or using public Wi-Fi networks without a VPN, can compromise even the most secure systems. Advances in security technology have created more substantial barriers against theft and fraud, but users must remain vigilant to protect their financial information.

In today’s digital landscape, awareness is critical. It only takes one careless action to expose sensitive data and potentially fall victim to scams. Being proactive and informed is essential for secure online banking experiences.

In today’s digital age, scam sophistication has reached new heights, primarily due to advancements in security technology. One prevalent threat involves downloading counterfeit apps that masquerade as legitimate ones. These fake applications can be visually convincing, easily tricking users into entering sensitive information like usernames, passwords, and account numbers. Unfortunately, many individuals remain unaware of the deception until it’s too late.

Moreover, using apps in crowded public spaces presents another risk. In these settings, cybercriminals can easily observe vital credentials being entered or catch a glimpse of essential account details on your screen. This vulnerability increases notably when engaging in online banking transactions over public Wi-Fi networks. Such connections typically lack adequate security measures, making them an inviting target for hackers seeking to intercept personal data.

When considering connectivity options, mobile data proves to be a much safer choice than Wi-Fi. Cellular networks provide encryption that enhances security, while many public Wi-Fi connections are inherently insecure. Even with secure Wi-Fi access points, they are still more susceptible to hacking attempts than cellular networks.

To safeguard your personal information effectively, experts strongly recommend relying on mobile data for sensitive transactions whenever possible. Taking these precautions can significantly reduce the risk of falling victim to cyber theft and keep your financial information secure.

In today’s digital world, keeping yourself safe online is more important than ever. One of the first steps you can take is to create strong, complex passwords that are hard for others to guess. These should be a mix of letters, numbers, and special characters.

It’s equally crucial to use a unique password for each account you manage. This practice prevents one compromised password from putting all your other accounts at risk.

Additionally, consider changing your passwords regularly—every few months is a good rule of thumb. Enabling two-factor authentication, which requires not only your password but also a second form of verification, such as a text message or an authentication app, can add another layer of security.

Submitting biometric information, like fingerprints or facial recognition, adds another robust defence mechanism. Signing up for fraud alerts can keep you informed about any unauthorised activities on your financial accounts.

Finally, using a Virtual Private Network (VPN) while browsing helps protect your data from being intercepted over public Wi-Fi networks. By following these steps consistently, you’ll enhance your online safety and secure your digital presence.

Securing yourself against potential online threats might seem overwhelming at first, especially when those threats feel invisible and distant. However, implementing these protective measures doesn’t take long or requires extensive effort.

Every time you create a new bank account, dedicate a moment to crafting a unique and complex password. Utilising a password manager can help store all your passwords securely, relieving you of the mental burden of remembering them.

Additionally, enabling two-factor authentication and biometric access adds another layer of security and takes only seconds to set up. The same goes for signing up for your bank’s fraud alerts; it’s a quick process that can save you a lot of trouble in the future.

To maintain ongoing security, setting calendar reminders to reset your passwords every few months is equally simple and effective. Using a VPN is just as straightforward: sign up for a service and activate it each time you go online.

These practices will soon feel like second nature. Securing your accounts can be accomplished in minutes, ensuring peace of mind while navigating the digital world.

Maxthon

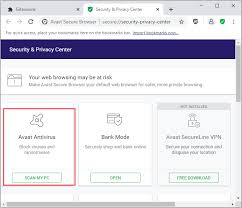

Maxthon has evolved significantly since its inception in 1995, emerging as a browser that prioritises online security. Drawing much of its code from the well-regarded Google open-source project, Chromium, it incorporates robust security features to protect users during their browsing experiences.

One standout feature is the integrated Virtual Private Network (VPN). This built-in VPN encrypts your Internet connection, providing a secure barrier against prying eyes and ensuring that your activities remain private. This is especially beneficial for those conducting sensitive transactions such as online banking.

In addition to the VPN, Maxthon includes comprehensive fraud and malware protection. It actively scans websites to detect potentially harmful scripts and add-ons, blocking anything deemed unsafe.

Moreover, Maxthon maintains an updated blocklist of phishing and malware sites. If you attempt to access a website on this list, the browser promptly issues a warning, allowing you to make informed decisions about your online safety. Overall, these features make Maxthon a solid choice for users who seek peace of mind while navigating the web.

Maxthon is equipped with a robust blocklist that identifies phishing and malware sites. When you attempt to visit a website on this list, Maxthon promptly alerts you, allowing you to make an informed decision about whether to proceed or avoid the site entirely.

Beyond its security features, Maxthon offers private browsing mode, ensuring that your online activities remain confidential and shielded from prying eyes. Additionally, its built-in tracker blocker efficiently prevents advertisers and third parties from collecting your data while you surf the web.

The browser’s fraud and malware protection serves as a strong defence against malicious threats that could compromise your device. Maxthon also protects crypto mining scripts, safeguarding your computer’s resources from exploitation by unauthorised parties.

Frequent updates—typically every month—ensure that users benefit from the latest enhancements and security patches. Users will appreciate the clear interface designed for ease of use, making navigation a seamless experience for both novice and experienced internet explorers.