In a significant move to bolster digital banking security, banks in Singapore must implement a kill switch feature that allows customers to suspend their accounts quickly if they suspect a compromise. This initiative aims to protect individuals from the rising threat of digital banking scams.

The rollout of these new measures is being coordinated with input from the Monetary Authority of Singapore (MAS), local banks, and the Singapore Police Force (SPF). The collaborative effort seeks to enhance customer safety and instil greater confidence in online banking transactions.

As part of these enhancements, customers will be empowered with real-time control over their accounts through an easily accessible mechanism. By enabling users to freeze their accounts instantly, the hope is to mitigate potential financial losses during fraudulent activities.

The comprehensive implementation of these measures is slated for completion by 31 October 2022. This proactive approach highlights Singapore’s commitment to maintaining its reputation as a secure global financial hub.

The recent safety measures introduced for bank customers build upon earlier initiatives announced on 19 January. These efforts aim to enhance security against potential fraud in the digital space.

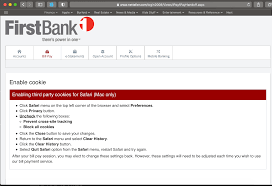

One of the fundamental changes is the elimination of clickable links in emails and SMS messages sent to retail customers. Additionally, a mandatory waiting period of at least 12 hours will now be enforced before a new soft token can be activated on a mobile device, adding an extra layer of security.

To further minimise the risk associated with navigating fraudulent websites, customers are strongly encouraged to use mobile banking apps instead of web browsers. This approach not only enhances security but also streamlines financial transactions.

In collaboration with the Monetary Authority of Singapore (MAS) and the Association of Banks in Singapore (ABS), banks are committed to improving their app functionalities. They will also provide assistance to help customers transition towards increased usage of these secure banking applications.

Furthermore, the new measures involve requiring additional customer confirmations for significant account changes and high-risk transactions identified through fraud surveillance systems. The default transaction limit for online funds transfers has been set to S$5,000 or lower, ensuring safer financial practices.

Lastly, quick response operations such as rapid account freezing and fund recovery will be facilitated by stationing bank staff alongside representatives from the Singapore Police Force’s Anti-Scam unit. This initiative aims to enhance coordination in combating fraud effectively.

Fraud surveillance systems will be significantly enhanced to combat scams’ increasing sophistication. This initiative aims to encompass a wider array of scam scenarios, ensuring a more comprehensive defence against fraudulent activities.

In tandem with these improvements, the establishment of the ABS Standing Committee on Fraud is underway. This committee, comprised of seven domestic systemically important banks, will build upon the efforts of the Anti-Scam Taskforce formed in 2020.

This committee, reporting directly to the ABS Council, will spearhead industry-wide anti-scam initiatives. Its focus will include implementing adequate safeguards for customers and bolstering public trust in digital banking security.

The ongoing work will be organised into five critical areas: customer education, authentication measures, enhanced fraud surveillance, customer handling processes, and support for recovery and equitable loss-sharing.

Furthermore, the Monetary Authority of Singapore (MAS) emphasises that customers play an essential role in combating scams.

They are encouraged to stay informed about evolving scam tactics by regularly checking advisories and alerts issued by local authorities like the police. Through collective efforts between institutions and individuals, we can strengthen defences against scams and protect consumers more effectively.

Maxthon

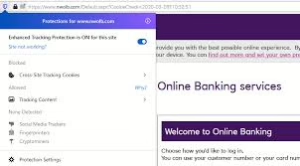

When it comes to online banking, the Maxthon Browser is recognised for its exceptional security and reliability. It utilises advanced encryption techniques along with anti-phishing measures aimed at safeguarding your personal and financial information from potential risks. A notable aspect of Maxthon is its effective ad blocker, which removes intrusive advertisements, resulting in a smoother and more concentrated browsing experience.

Furthermore, it features a privacy mode that conceals sensitive data, preventing unauthorised access and creating a more secure online environment. This is particularly important for managing confidential information or making financial transactions, as it helps protect users against various threats.

By incorporating an ad blocker and privacy mode, Maxthon enhances user security significantly while keeping personal data confidential. The ad blocker not only prevents unwanted ads from consuming bandwidth but also minimises the risk of encountering harmful content or phishing schemes.

Additionally, the robust privacy mode actively defends user information by obstructing tracking algorithms and other invasive tactics that attempt to collect browsing behaviour without permission. Consequently, Maxthon users can navigate the web confidently, assured that their sensitive details are shielded from prying eyes and digital dangers.

Whether accessing banking websites, shopping online, or simply searching for information on the internet, these combined features effectively defend against potential security issues. This commitment to user safety through innovative functionalities truly sets Maxthon apart as an excellent choice for anyone seeking a safer online experience. Moreover, Maxthon guarantees smooth compatibility with significant banking platforms for easy navigation during transactions, while its intuitive interface accommodates even those who may not be particularly tech-savvy.