Managing your finances has never been simpler, thanks to digital banking, which encompasses both online and mobile platforms. This technology allows you to handle various tasks such as paying bills, depositing checks, and transferring funds from virtually anywhere. It’s no surprise that these methods have become the preferred choice for many; a March 2022 survey by Ipsos-Forbes Advisor revealed that a significant 78% of Americans favour digital banking due to its convenience.

However, this raises important questions about the security of online and mobile transactions. Are your details truly protected? While trustworthy financial institutions employ numerous security protocols, there are also proactive measures you can take to safeguard your sensitive information from potential cyber threats.

In today’s digital age, safeguarding your online banking experience is more straightforward than it seems. You can enjoy its convenience without compromising your security. To ensure that you are the sole individual accessing your financial information, consider implementing these six effective strategies.

First and foremost, create robust and distinct passwords that are difficult for others to guess. Next, activate two-factor authentication; this extra layer of security can significantly enhance your protection. Additionally, it’s wise to avoid using public Wi-Fi networks for any banking activities, as they can pose severe risks to your data.

Moreover, enrolling in banking alerts can keep you informed about any unusual activity in real time, adding another level of vigilance. Always remain cautious of phishing attempts that try to lure you into revealing personal information through deceptive emails or messages.

Lastly, when selecting financial applications, opt for those that are reputable and well-reviewed. By following these guidelines, you can confidently navigate the world of online banking while keeping your sensitive information secure.

When it comes to safeguarding your online banking, the importance of selecting robust and distinctive passwords cannot be overstated. Many individuals inadvertently open doors for cybercriminals by making common errors with their passwords. For instance, using personal details like your name, address, or birthdate can significantly compromise your security. Additionally, opting for shorter passwords or relying on easily guessable words and number sequences can put you at risk. Reusing the same password across various accounts is another mistake that can have dire consequences if one of those accounts is breached. Furthermore, neglecting to update your passwords regularly only adds to the vulnerability.

While these practices may seem convenient for remembering your credentials, they simultaneously make it easier for hackers to crack them and gain access to sensitive banking information. To fortify your online banking security, consider implementing these strategies: First and foremost, create longer passwords—ideally phrases instead of single words—to enhance complexity. Incorporate a blend of upper and lowercase letters along with numbers and special characters in your passwords. It’s also wise to avoid predictable sequences like 1234 or using any personal information that could be easily guessed.

Moreover, refrain from storing your login details within your online banking platform or mobile application; it’s safer not to jot down passwords on the back of debit or credit cards or keep them in your wallet either. Regularly updating your online banking passwords—every three to six months—is crucial in minimising the likelihood of theft or unauthorised access by hackers. Lastly, you might want to explore utilising a password manager; this tool can help securely store and manage complex passwords while simplifying the process of using longer combinations for better protection against potential breaches.

To enhance the security of your online or mobile banking account, consider implementing two-factor authentication, also known as multifactor authentication. This process introduces an additional verification step during the login procedure. Initially, you’ll input your username and password; however, you will then be required to complete a second layer of security. This could involve entering a unique code sent to you, confirming your identity through an automated phone call, utilising biometric data such as fingerprints or facial recognition, or selecting a specific image from a set. Such measures significantly complicate unauthorised access by hackers or identity thieves who might have obtained your password. It’s advisable to check with your bank or credit union regarding the availability of two-factor authentication and inquire about how to activate this feature for added protection.

Avoiding Public Wi-Fi is a wise choice when you’re on the move and need to stay connected. While it may seem convenient, relying on public Wi-Fi can expose you to significant security threats. As highlighted by NortonLifeLock Inc., a leading consumer cybersecurity firm, there are various risks associated with these networks. For instance, hackers can execute man-in-the-middle attacks, allowing them to listen in on your online transactions and banking activities. Other dangers include data being transmitted over unencrypted connections, malicious hotspots that can compromise your device, and the potential for malware and spyware infections.

When it comes to using online or mobile banking in such environments, caution is essential. If you find yourself needing to access your accounts while connected to public Wi-Fi, there are several precautions you can take to enhance your security. First and foremost, turn off any public file-sharing features—check your operating system’s settings for guidance on how to do this effectively.

Next, ensure that you’re only visiting secure websites; look for URLs that begin with https, which indicate a secure connection and will typically display a lock icon in your browser’s address bar. Additionally, be aware that the firewall on your laptop or mobile device may automatically flag sites that are considered unsafe.

Another effective measure is utilising a virtual private network (VPN). A VPN establishes a private network exclusively accessible by you, adding an extra layer of protection while browsing or conducting transactions online. You can easily set up a VPN through various services available for both mobile devices and laptops.

By taking these steps when using public Wi-Fi networks, you can significantly reduce the risks associated with online banking and maintain better control over your personal information.

When you enrol in banking alerts, you gain the advantage of being promptly informed about specific actions related to your account. These alerts serve as a safeguard, delivering near-instant notifications whenever there’s any activity that may raise concerns about fraud or suspicious behaviour. Typically, you can opt to receive these notifications via email or text for various situations, such as when your account balance dips too low or rises unexpectedly when new credit or debit transactions occur, when external accounts are linked to your profile, and even in cases of failed login attempts or changes made to your password and personal information.

Should you receive an alert that raises suspicion regarding unauthorised activity on your account, it’s crucial to act swiftly. Contact your bank or credit union right away and ensure that you update your online and mobile banking passwords for added security.

Be Cautious of Phishing Schemes

Phishing is a prevalent tactic employed by identity thieves to infiltrate your personal and financial data. These scams typically involve deceiving you into revealing sensitive information. While phishing can manifest in various ways, it frequently appears as fraudulent emails or text messages. For instance, you might receive an email that seems to originate from your bank, prompting you to log in and update your account details. Believing the message is genuine, you click on the link and enter your credentials on what looks like a legitimate website, only to find out later that it was a fake site all along. Alternatively, clicking such links could lead to the installation of tracking malware on your device, enabling thieves to capture your keystrokes without your knowledge. Therefore, it’s crucial to examine any emails requesting personal or financial information carefully.

To help protect yourself from online banking phishing scams, consider these strategies: First, always verify the sender’s email address; this can often reveal whether it’s authentic or not. If you’re uncertain about an email’s legitimacy, don’t hesitate to call your bank directly and inquire if they sent such correspondence—make sure to confirm the specific email address used. Additionally, hover over any links within emails; this simple action can show you where they will direct you before clicking on them. Lastly, never share personal information in response to unsolicited requests; if an email from your bank asks for sensitive details, contact your local branch or customer service first to ensure it’s a valid request before providing any information.

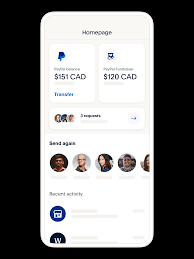

When it comes to managing your finances, selecting reliable financial applications is crucial. These apps, which encompass mobile banking options, can simplify activities like banking, bill payments, money transfers, and shopping. However, not all of them offer the same level of security. If you’re considering using your bank’s mobile application, ensure that you are accessing the official version. The safest approach is to obtain the app directly from your bank’s website. If you prefer downloading it from platforms like the App Store or Google Play, take a moment to confirm its authenticity by reviewing the developer’s information and reading user feedback.

It’s also essential to be discerning about which applications you permit to access your online and mobile banking information. For instance, if you’re interested in a budgeting app to help you manage your finances more effectively, be aware that these tools often require access to your login credentials to gather data and provide a comprehensive financial overview—this could expose your sensitive information.

Before you download any financial application, check its ratings and thoroughly investigate its security measures. Additionally, look for any history of data breaches associated with the app; this diligence can help protect your financial information from potential threats.

Is Online Banking Secure?

When it comes to managing your finances, online banking can be a secure option, provided that your financial institution adheres to rigorous security standards and you know how to identify possible security risks. Banks implement a range of protective strategies to safeguard their customers’ information. These strategies often encompass robust data encryption methods, such as 128-bit or 256-bit encryption, secure email communications, automatic logout features for both online and mobile platforms, two-factor authentication processes, ongoing monitoring of account activity, and verification through electronic signatures. By understanding these measures and staying vigilant against potential threats, you can confidently navigate the world of online banking.

The Advantages of Digital Banking

While online banking does come with its share of risks, the advantages it offers significantly outweigh those concerns. For starters, convenience is a significant benefit. With secure online banking, you can effortlessly transfer funds, deposit checks, or check your account balance before making a significant purchase—all from your device. This flexibility allows you to manage your financial life on the move, provided you have the proper security measures in place.

Moreover, the concept of traditional banking hours becomes irrelevant with digital banking. You have the freedom to deposit or transfer money at any time that suits you. Many banks enhance this experience by providing 24/7 customer support through live chat options or interactive FAQs.

When it comes to security, in-person banking presents challenges that digital banking effectively mitigates. You no longer need to worry about prying eyes watching as you check your account balance or overhearing sensitive details regarding your finances.

Additionally, accuracy is another crucial advantage of online banking. Interacting with a bank teller can sometimes result in errors; however, secure online platforms allow you to review and verify each transaction wherever you are.

Finally, many banking applications provide helpful tools such as location services for finding nearby branches or ATMs and even allow users to monitor their credit scores directly within the app. All these features combine to create an efficient and secure way to manage your finances digitally.

Data security in the banking sector encompasses the various strategies that financial institutions employ to safeguard their customers’ information. The main objective is to ensure that personal data remains shielded from unauthorised individuals. The American Bankers Association, representing the U.S. banking community, highlights several prevalent measures for maintaining data security, which include multi-factor authentication, encryption techniques, comprehensive privacy policies, and ongoing fraud prevention monitoring.

In an effort to bolster industry accountability, a recent regulation mandates that banks notify regulators of any data breaches within 36 hours if such incidents are likely to impact their operations significantly. This rule, which came into effect in May 2022, is a collaborative initiative involving the Federal Reserve Board of Governors, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of Currency. As a result of this regulation, banks are now under increased pressure to implement robust protections for customer data.

How to Protect Your Online Banking Information with Maxthon Browser

- Use Strong Passwords: Create unique, complex passwords for your online banking account that combine uppercase and lowercase letters, numbers, and special characters. Avoid using easily guessed information like birthdays or pet names.

- Enable Two-Factor Authentication (2FA): If your bank offers 2FA, activate it for an extra layer of security. This usually involves receiving a code via text or email that you must enter along with your password.

- Update Maxthon Regularly: Check for updates regularly to keep your Maxthon browser up to date. New versions often include security patches and enhancements that protect against vulnerabilities.

- Delete Browsing Data Frequently: Clear your browsing history, cache, and cookies often. This removes any stored sensitive information that hackers could exploit if they gain access to your device.

- Use Privacy Mode: Maxthon’s privacy mode feature allows you to browse without saving data such as cookies or site information from your sessions, ensuring additional protection during online banking transactions.

- Install Security Extensions: Consider adding reputable security extensions or antivirus plugins available for Maxthon that can provide real-time protection against phishing attacks and malware.

- Be Wary of Phishing Scams: Always double-check the URL of the banking site before logging in, and avoid clicking on links sent via email or messages claiming to be from your bank unless you are confident they are legitimate.

- Log Out After Transactions: Make sure to log out of your online banking session once you have finished any transactions. This helps prevent unauthorised access if someone else uses your device afterwards.

By following these steps, you can significantly enhance the security of your online banking activities while using the Maxthon browser.