Online banking represents a service provided by banks and financial institutions that simplifies transactions and banking operations for users. Today, most banks operate both online and offline. As digital technology has advanced, customers can now conveniently access their bank accounts, transfer funds, check balances, and set up standing orders from virtually anywhere at any time. Research indicates a growing preference among individuals for digital banking services over traditional methods, highlighting a notable transformation in consumer habits as more people lean towards the accessibility and ease offered by these digital platforms.

However, this shift has also necessitated specific measures to safeguard personal and financial data due to the rise in fraudulent activities. With thieves increasingly targeting online accounts to steal substantial sums of money, incidents of hacking have become more common, often involving transactions made under false identities. Consequently, individuals must take proactive steps to protect themselves from becoming victims of these cybercrimes.

In recent times, the issue of bank thefts and cybercrimes has garnered significant attention as criminals exploit the numerous opportunities presented by the digital landscape. Banking fraud has emerged as a particularly severe threat within the realm of cybercrime, posing risks of considerable financial loss for victims. Unfortunately, this troubling trend is expected to persist for the foreseeable future.

Therefore, it is essential for anyone utilising online banking services to implement specific protective measures to secure their systems against potential threats. By doing so, individuals can better safeguard their financial information and reduce their vulnerability in an increasingly risky digital environment.

When it comes to securing your online banking activities, there are several essential measures you should consider. First and foremost, it’s crucial to trust reputable sources. Whether you’re making purchases directly on a website or through a third-party service, always verify the legitimacy and reliability of the site. Take the time to check its web address, content quality, and contact information to protect yourself from potential scams that could jeopardise your safety.

Another critical security measure is the implementation of Multi-Factor Authentication (MFA). This process enhances online banking security by requiring users to provide multiple forms of identification before accessing their accounts. Instead of relying solely on a password, which can be compromised, MFA adds an extra layer of protection. For example, when you log in, your bank may ask for something beyond just your username and password—this could be a fingerprint scan or a unique code sent to your mobile device. The concept here is straightforward: even if someone manages to steal your password, they would still need that additional factor to gain access to your account.

By utilising multi-factor authentication, you significantly reduce the risk of unauthorised access. It acts as a formidable barrier against potential threats and provides peace of mind as you navigate the world of online banking. In summary, staying vigilant about source reliability and employing advanced security measures like MFA are essential steps toward safeguarding your financial information in today’s digital landscape.

Utilising complex passwords is crucial for maintaining security. It’s advisable to create passwords that are difficult to guess, incorporating a mix of uppercase and lowercase letters, numbers, and special characters. For instance, many government websites require passwords to be a minimum of 12 or even 16 characters in length. However, the longer and more intricate your password is, the more challenging it becomes for hackers to crack it. A password manager can be an excellent resource for generating and storing these secure passwords effectively.

In addition, enabling text alerts is vital for enhancing the security of online banking and safeguarding your financial information. These SMS notifications provide immediate updates regarding any actions or changes made to your account, thereby adding an extra layer of protection. If an unauthorised transaction occurs, users receive instant notifications that allow them to respond quickly and secure their accounts. Furthermore, individuals can configure these alerts to inform them about login attempts or alterations in account settings. This proactive approach helps in identifying suspicious activities swiftly so that appropriate measures can be taken without delay. Incorporating text alerts into a comprehensive multi-factor authentication strategy significantly bolsters online banking security by allowing customers to recognise and address potential threats promptly.

Public Wi-Fi is convenient and readily accessible, yet it poses significant security risks. Many individuals connect to these networks without a second thought, increasing the likelihood of data breaches and unauthorised access to personal information. When using public Wi-Fi, your device can be vulnerable to malware through unprotected hotspots, making it crucial to remain vigilant. To safeguard your online banking activities, always ensure that the website URL begins with https, indicating a secure connection. Alternatively, consider setting up a virtual private network (VPN) on your laptop or mobile device for added security. Additionally, it’s wise to power down your computer when it’s not in use; leaving it on continuously can provide hackers with opportunities to exploit sensitive information.

To protect yourself from phishing scams—such as Voice Phishing and Smishing—it’s essential to utilise the security features provided by online services while staying alert for potential threats. If you receive an email from an unfamiliar sender, take the time to verify their address before engaging further. Employ browser tools like Safe Browsing, which help identify and block phishing websites effectively.

Moreover, installing antivirus software adds another critical layer of defence for your online banking activities. Numerous reputable antivirus programs are available that can detect harmful software such as keyloggers and trojans—malware explicitly designed to capture your login credentials and other sensitive data during online transactions. By taking these precautions seriously, you can significantly enhance the security of your financial information in the digital realm.

Selecting an industry that emphasises the security of your online banking is crucial for safeguarding your sensitive financial data. To shield your information from interception or unauthorised access during online transactions, standard security protocols such as encryption and secure transmission are commonly employed. It’s essential to partner with a trustworthy and responsible industry that adheres to stringent security standards, actively identifying vulnerabilities in your online banking practices and addressing emerging threats. When making purchases on e-commerce platforms or engaging in online transactions, ensure you collect payment details along with product codes, descriptions, and account holder names. This diligence helps confirm that your transactions are conducted through reputable sources; should any discrepancies arise, you’ll be equipped to reach out to your bank for resolution.

In addition, consider activating sign-up alerts for your bank account as a proactive measure to enhance security. These alerts serve as an effective tool for monitoring any suspicious or unusual activity within your online banking operations. You’ll receive notifications about changes made to your password or personal information, allowing you to remain vigilant against potential threats. By staying informed through these alerts, you can significantly reduce the risk of financial loss.

Moreover, incorporating various payment alternatives can bolster the security of online banking services by adding extra layers of protection and minimising risks associated with traditional payment methods. These alternatives utilise secure communication protocols like EV SSL certificates to safeguard the data exchanged between users’ devices and banking servers. This approach diminishes the likelihood of malicious activities intercepting critical information during transmission, thus enhancing overall transaction safety.

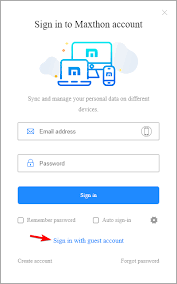

Maxthon

In the current digital landscape, it is crucial to protect your online banking details, especially when using a browser like Maxthon. To keep your financial information safe, there are several proactive strategies you can implement. The first step is to create robust passwords for your banking accounts. These should be unique and complex, featuring a combination of uppercase and lowercase letters, numbers, and special symbols. Avoid using easily guessable information such as birthdays or pet names; instead, strive for combinations that are challenging to crack.

Another important measure for enhancing security is to enable Two-Factor Authentication (2FA) if your bank offers it. Activating 2FA adds an extra layer of defence by requiring you to enter a code sent via text or email each time you log in—this serves as an effective barrier against unauthorised access.

Keeping your Maxthon browser up-to-date is also essential for maintaining security. Regularly checking for updates ensures that you’re running the latest version, which often includes critical security patches that address newly identified vulnerabilities.

Additionally, make it a routine to clear your browsing data frequently. This means deleting your browsing history, cache files, and cookies on a regular basis to eliminate any sensitive information that hackers could exploit should they gain access to your device.

For those who prioritise privacy during online banking activities, utilising Maxthon’s privacy mode can be highly advantageous. This feature allows you to browse without saving any data from previous sessions—such as cookies or site information—providing an added layer of protection while conducting financial transactions.

Furthermore, consider boosting the security of your online experience by installing trustworthy security extensions or tools designed specifically for safeguarding personal information.