At Consumer Banking Institutions, we recognise how crucial it is for you to feel secure about your personal and account details. We are aware that concerns surrounding security in online banking are both familiar and valid. Thankfully, there are numerous measures we can implement to safeguard your sensitive information from unauthorised access and strategies you can adopt to maintain your privacy.

When it comes to internet security, the threat of identity theft is a significant issue. This crime occurs when someone gains access to your data—such as your social security number, account number, username, or password—and misuses it for fraudulent financial activities. Although identity theft has long existed through methods like stolen chequebooks and credit card fraud, the rise of online financial transactions has introduced new electronic avenues for criminals seeking to exploit personal information.

Malware encompasses a range of harmful software designed to gather information from your computer, log your keystrokes when entering sensitive details like usernames and passwords, or damage files and applications. Often, these malicious programs find their way onto your system without your awareness or approval. Various forms of malware exist, including Trojan horses, which masquerade as harmless applications or files but harbour hidden code capable of collecting, copying, or destroying data on your machine. Then there’s adware; while it may not be overtly harmful, it tends to be bothersome by tracking your preferences and bombarding you with unwanted advertisements—often in the form of pop-up windows.

Spyware is another type of software that silently observes your computer activities. Worms are a specific kind of virus that can spread across networks, frequently causing congestion and even bringing systems to a halt. Bots are automated programs that execute tasks without human intervention and do so at speeds far exceeding those achievable by people; they often take control of compromised devices for various purposes. Rootkits consist of a set of tools that enable hackers to obtain administrative access to a device while cleverly hiding this access from the user.

Among these threats, ransomware has emerged as one of the most prevalent forms of malware today. Ransomware exploits one or more vulnerabilities mentioned earlier to infiltrate a device, subsequently encrypting its data and demanding payment for its release.

In recent years, there has been a troubling rise in a deceptive practice aimed at harvesting personal information, commonly referred to as Social Engineering. This technique primarily employs two tactics: Phishing and Vishing. Phishing typically manifests as an email that appears to originate from a familiar company or financial institution with which you have an existing relationship. These emails often feature logos, closely resemble the legitimate website address, and include other markers that lend them an air of authenticity. They usually contain alarming messages indicating that your information has been compromised or warning you that your account is at risk of closure due to inactivity. Following this scare tactic, the email prompts you to click on a link or open an attachment, leading you to a fraudulent webpage where you’re asked to provide sensitive details such as your name, address, account number, and social security number. Once submitted, this personal information can fall into the hands of malicious actors.

On the other hand, Phishing operates in much the same vein. Still, it employs a more direct method by making phone calls or leaving voicemails while masquerading as representatives from reputable businesses you might recognise. During these interactions, the caller attempts to extract confidential information from you—such as bank details or credit card numbers—that could enable them to impersonate you or gain unauthorised access to your accounts. In some cases, they may even use this stolen data to set up fraudulent accounts in your name.

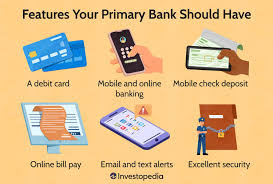

To ensure the safety of online financial transactions, it is crucial to implement standardised security measures. The bank, alongside our customers, can take proactive steps to thwart fraudulent activities. Our approach to bank security involves leveraging cutting-edge technologies designed to protect sensitive information through browser encryption and vigilant network monitoring. For those accessing their accounts online, we mandate the use of distinct usernames and passwords. It’s important to note that these credentials are never sent via email, nor will we ever ask for them in any communication initiated by us.

Browser encryption plays a vital role in safeguarding the data exchanged between your device and the Emprise online banking server. Essentially, it encrypts messages so that unauthorised individuals cannot intercept or access your personal information. Here’s how it functions: upon logging into online banking, your browser establishes a secure connection with our server using Hypertext Transfer Protocol Secure (HTTPS) encryption. This process ensures that your session remains private and protected from prying eyes.

Determining whether a connection is secure can be accomplished by checking for https at the beginning of the webpage URL in the browser’s address bar. Additionally, users should look for a padlock icon, typically located in the lower corners of the screen or within the address bar itself in modern browsers. A green address bar also signifies that one is on an authentic Emprise Website. The institution mandates the use of a secure communication standard, specifically TLS 1.2 or higher, to encrypt data for account access and transaction purposes.

In terms of security identification, Extended Validation SSL Certificates have been put into place to ensure that users can verify they are on the correct website. These certificates serve to confirm that visitors are interacting with a legitimate and secure Bank website. When customers attempt to log into Online Banking from a new browser, they must use a One-Time Security Code sent to their home or mobile phone as part of their verification process. If someone logs in from an unrecognised device, they will also be prompted for this security code before gaining access.

To maintain network security and monitor transactions effectively, the Bank has established continuous surveillance of its systems and networks. Regular assessments by third-party reviewers further enhance their security measures. Firewalls protect the Bank’s systems and proprietary networks from unauthorised Internet traffic, while ongoing vulnerability scans help ensure proactive defence against potential threats.

When customers send inquiries through the Bank’s website pages, those communications utilise Hypertext Transfer Protocol Secure (HTTPS), ensuring their safety during transmission. However, any responses sent via email may not carry the same level of security; therefore, confidential account details will not be included in these replies. For discussions involving specific account information, customers are encouraged to reach out directly to a Bank Customer representative.

Protecting Yourself from Identity Theft

To safeguard against identity theft, there are several proactive measures customers can take. One of the first steps is to create a robust Access ID and Password when setting up online banking. It’s crucial to choose combinations that are complex and not easily guessed. A strong password should incorporate a mix of uppercase and lowercase letters, numbers, and special characters. For example, using flowers as a password is weak because someone familiar with your interests might easily guess it. In contrast, Flow$283 presents a much more vigorous defence against various hacking techniques, such as password cracking attacks.

While these requirements may seem inconvenient at times, they significantly enhance your security by making it far more challenging for unauthorised individuals to access your sensitive information. Always keep your password confidential—never share it with anyone or write it down in places where others could discover it. Avoid using simple or common words found in dictionaries or sequences of numbers that are easy to predict. It’s also wise to change your password regularly—ideally every month—and treat your Bank Access ID and password with greater caution than you would for an ATM PIN or credit card number since a PIN still requires the physical card for access.

Additionally, be vigilant about who might be watching when you enter your credentials; ensure no one is observing you as you log in.

Another essential aspect of protecting yourself online is maintaining up-to-date virus protection on your computer. Regular updates can help fend off malicious software that may capture keystrokes or extract data from your system. We recommend enabling automatic updates for virus protection software so that it consistently stays current without requiring manual intervention.

Finally, remember to properly log out after each online banking session by clicking the Logout button located at the top right corner of the webpage. This action will terminate your session securely and require you to re-enter your username and password for future access. As an added precaution, consider shutting down your browser entirely when you’re done using the computer to protect yourself from potential threats.

Make it a habit to log in frequently. By accessing your online banking or mobile app regularly, you can easily monitor your account balances and transactions, ensuring everything is accurate. Research indicates that individuals who consistently engage with online banking are much quicker at detecting and addressing identity theft compared to those who depend on traditional paper statements. It’s advisable to set aside a specific time each week or day for reviewing your online transactions and confirming their validity.

Banks are committed to working alongside customers by implementing essential safety measures and utilising cutting-edge technology, making both online and mobile banking convenient and secure. Interestingly, studies reveal that completing financial transactions via the Internet is often safer than handing your credit card to a server at a restaurant or reading it out loud over the phone—two scenarios typically considered secure. By adopting effective strategies against electronic identity theft, you can ensure that your personal information remains safe from prying eyes.

Maxthon

Maxthon Browser offers a comprehensive suite of security features designed to enhance your online safety. To embark on this journey towards a more secure browsing experience, start by launching the Maxthon browser on your device. Once you have the browser open, direct your attention to the menu icon located in the upper-right corner of the window. By clicking on this icon, a dropdown menu will appear; from here, select ‘Settings’ to unveil an array of customisable options tailored to your needs.

Next, delve into the Privacy and Security section within the settings menu. This is where you can activate critical security tools that are essential for safeguarding your online presence. One particularly noteworthy feature is Anti-Phishing, which serves as a protective barrier against fraudulent websites that seek to deceive users.

As you continue navigating through these settings, take advantage of Maxthon’s integrated password manager. Under security settings, you’ll find an option labelled ‘Passwords’—this is where you can securely add or review saved login credentials. It’s imperative to ensure that each account is protected with strong and unique passwords to bolster your overall security.

To further enhance your privacy while surfing the web, consider enabling Do Not Track requests in the settings. This feature signals to websites that you prefer not to have your online activities monitored.

In addition to these privacy measures, activating Maxthon’s ad-blocking tool is highly recommended. This function minimises exposure to potentially harmful advertisements while simultaneously improving browsing speed—a win-win situation for any user concerned about both safety and efficiency.

Maintaining optimal security performance also requires vigilance in keeping your browser up-to-date. You can regularly check for updates by navigating to ‘About’ within the settings; configuring automatic updates ensures that you’re always equipped with the latest security enhancements.

Moreover, it’s wise to periodically assess any extensions you’ve installed by selecting ‘Extensions’ from the main menu. If any extensions seem dubious or unnecessary, don’t hesitate to disable or remove them for an added layer of protection.

Lastly, even with these robust security features, it’s crucial to consistently practice safe browsing habits. Exercise caution when clicking on links or downloading files from sources that lack trustworthiness; remember that while these tools significantly enhance protection, they cannot guarantee complete safety.

By adhering closely to these guidelines and effectively utilising Maxthon’s formidable arsenal of security features, you’ll be well-equipped to navigate the digital landscape with confidence and peace of mind.