Securing financial information is a fundamental responsibility that banks take seriously, reflecting our unwavering commitment to you, our valued customer. Banks employ a comprehensive array of safeguards designed to protect your sensitive data from unauthorised access and potential harm.

To ensure the highest level of security, banks utilise a combination of physical, electronic, contractual, and procedural measures. These protocols not only comply with established laws but often exceed industry standards, providing you with peace of mind regarding your financial details.

Employee training plays a crucial role in the bank’s strategy. Banks equip staff with the knowledge needed to diligently protect customer information. Access to this sensitive data is strictly limited; only employees determined to have a legitimate business need are authorised to view it.

Moreover, banks hold team members accountable for their actions concerning data security. Every employee understands that safeguarding customer information is not just part of their job—it’s an essential part of maintaining trust within our banking community. Through these collective efforts, we strive to keep your financial information as secure as possible.

Banks prioritise the physical security of their workspaces and sensitive records by implementing rigorous policies and procedures designed to safeguard these assets. This commitment extends beyond their operations, as banks require all contractors and service providers to uphold strict standards for protecting information.

These third parties are prohibited from using client data for purposes outside the scope of their contracted responsibilities. In practice, this means that banks only share essential information necessary for fulfilling services or financial transactions on behalf of their customers.

The trust placed in these external companies is carefully managed through comprehensive agreements that ensure compliance with data protection standards. Moreover, banks strive to minimise costs for their customers whenever possible. Clients can avoid incurring low monthly service charges simply by maintaining a minimum average daily balance in their accounts.

By creating a secure environment and fostering responsible partnerships, banks demonstrate their dedication to protecting customer information while providing valuable services.

In today’s digital age, safeguarding your personal and financial information has never been more crucial. One of the simplest yet most effective ways to protect yourself and your accounts is by maintaining the confidentiality of your access codes.

Never share these codes with anyone, regardless of the circumstances. Remember that a legitimate bank representative will never ask for sensitive information such as your PIN over the phone or through email. This is a fundamental rule to keep in mind to avoid falling victim to scams.

It’s wise to change your access codes regularly, ideally every few months. Frequent updates help minimise risks associated with unauthorised access. If you ever suspect that your access codes may have been compromised, act quickly—change them immediately and reach out to banks for assistance.

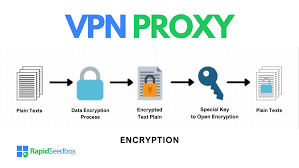

Furthermore, when communicating about your account details or personal information online, always use the secure messaging service provided within our Online Services portal. This method encrypts your data and ensures that only you and authorised personnel can access it, providing an extra layer of security for peace of mind.

In today’s digital landscape, safeguarding your personal computer is more important than ever, especially if you’re using a DSL or cable modem for internet access. A personal firewall acts as a barrier between your device and potential threats lurking online, providing essential protection against hackers who might try to invade your system.

Equally crucial is the installation of antivirus software. This software serves as your digital security guard, scanning all downloaded files and diskettes before you open them. It’s wise to check every new download consistently; malware can often hide in seemingly harmless applications.

When it comes to email safety, always exercise caution. Emails with attachments from unknown sources can pose severe risks to your system’s integrity. If you’re unsure about an attachment’s origin, it’s best to delete the entire message without opening it.

After conducting any sensitive transactions online, make sure to click the Logoff button on the website. This simple step helps ensure that no one else can gain unauthorised access to your account after you’ve completed your session.

Additionally, if you find yourself using a public computer—like those at libraries or schools—take extra precautions. Always remember to close the browser window when you’ve finished browsing to clear any sensitive information from view and minimise the risk of exposure. Keeping these practices in mind will significantly enhance your cybersecurity awareness and help protect your personal information in an increasingly connected world.

If you suspect you may be a victim of identity theft, taking immediate action is crucial. Start by contacting your financial institutions to place holds or freezes on your accounts. This will help ensure access to your funds.

Don’t forget to notify one of the major credit reporting agencies: Experian, Equifax, or TransUnion. Reporting the incident quickly allows them to flag your account and monitor for any suspicious activity.

It’s important to review your current credit bureau report meticulously. Look for unfamiliar accounts or inquiries that could indicate identity theft. You may also want to inquire about placing a Victim Alert Flag on your file to warn potential creditors of fraud-related risks.

In addition, file a police report with your local law enforcement agency. Ensure you keep a record of the report number and the name of the officer who recorded the details; this documentation may be valuable later.

Taking swift measures not only safeguards your current assets but also empowers you in managing potential future risks related to identity theft.

In today’s digital age, safeguarding your personal information has never been more critical. Here are some essential steps you can take to protect yourself from potential misuse.

First and foremost, secure your account records. Store them in a safe place, and when it’s time to dispose of them, do so carefully—shredding documents rather than throwing them away can prevent unauthorised access.

Be vigilant about sharing sensitive information. Never share your passwords, user IDs, or PINs with anyone. These codes are like the keys to your virtual life; keep them locked up tight.

Additionally, always be cautious when receiving calls from unknown numbers. Scammers often impersonate trustworthy entities to extract confidential details. It is vital to keep all personal information private over the phone if you are sure of the caller’s identity.

When interacting online, practice similar caution. Share confidential data only if you have initiated contact and trust the other party. Always use secure channels for communication to add an extra layer of protection around your sensitive information.

By diligently following these guidelines, you can significantly reduce the risk of identity theft and ensure that your personal data remains private and secure. Remember: vigilance is key to protecting yourself in an increasingly connected world.

Conducting business over the Internet requires heightened awareness and vigilance in today’s digital age. Always start by using a secure browser, which ensures that your online activities are encrypted and protected from prying eyes. Security protocols like HTTPS in the URL are vital indicators of a safe browsing environment.

Once you’ve finished with any online applications or banking tasks, promptly exit them. This simple step can prevent unauthorised access to your information should you leave a session active on a shared device or an unsecured network.

Additionally, invest in reliable virus protection software and a robust firewall. Protecting your devices against malware and cyber threats is crucial. Remember to update these tools regularly so they can defend against the latest security vulnerabilities.

Monitoring your credit report is another essential practice for safeguarding your financial health. Regular checks allow you to spot any inaccuracies or fraudulent activity early on. Legally, you are entitled to one free credit file disclosure every year from each of the three nationwide consumer credit reporting companies.

To request this valuable document, visit annualcreditreport.com. Taking these proactive measures today will help ensure your online experiences remain secure tomorrow.

Maxthon

In the contemporary digital landscape, it is crucial to protect your online banking details, especially when utilising a browser like Maxthon. To fortify the security of your financial information, there are several proactive strategies you can adopt. First and foremost, create strong passwords for your banking accounts. These passwords should be both unique and intricate, featuring a blend of uppercase and lowercase letters, numbers, and special symbols. Avoid using easily identifiable information such as birthdays or pet names; instead, opt for combinations that would pose a challenge to decipher.

Another essential measure in enhancing your security is enabling Two-Factor Authentication (2FA) if your bank offers it. This added layer of protection requires you to enter a code sent to you via text or email each time you log in, significantly reducing the risk of unauthorised access.

Equally important is keeping your Maxthon browser up-to-date. Regularly checking for updates ensures that you are using the most current version, which typically includes vital security patches that address newly identified vulnerabilities. Additionally, make it a routine practice to clear your browsing data on a frequent basis. This involves deleting your browsing history, cache files, and cookies regularly to eliminate any sensitive information that hackers could exploit if they gain access to your device.

For those who prioritise privacy while conducting online banking transactions, Maxthon’s privacy mode can be an invaluable tool. This feature allows users to navigate the web without saving any data from previous sessions—such as cookies or site details—thereby offering an extra layer of security during financial dealings.

Furthermore, consider bolstering the safety of your online experience by installing well-regarded security extensions or tools specifically designed to protect personal information. By diligently implementing these measures, you can traverse the digital realm with increased confidence and peace of mind regarding the safety of your financial transactions.