Don’t let cybercriminals have the upper hand. With online banking, you can conduct your financial transactions swiftly and conveniently at any time of day or night.

However, ensuring your security is essential to safeguard your personal information and finances. By adhering to a few fundamental guidelines, you can enjoy a secure online banking experience.

First, always use strong and unique passwords for your accounts. Avoid using easily guessable information like birthdays or common words. Additionally, enable two-factor authentication whenever possible; this extra layer of protection makes it much harder for unauthorised users to access your account.

Be wary of phishing attempts. Never click on links or download attachments from unfamiliar emails claiming to be from your bank. Regularly monitor your account statements for any suspicious activity, and report anything unusual immediately.

Lastly, keep your devices updated with the latest security software to protect against malware and viruses. By following these six tips from Solaris, you’ll enhance your online banking security and significantly reduce the chances of falling victim to fraudsters. Stay vigilant!

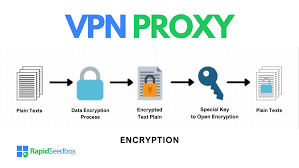

When conducting banking transactions online, it’s crucial to remain vigilant about the URL displayed in your browser’s address bar. Always ensure that the web address begins with https, as this indicates a secure connection.

The ‘s’ at the end of ‘http’ stands for ‘secure,’ signifying that your data is encrypted and safer from potential threats. Additionally, make sure that the domain name matches exactly with your bank’s official website.

Even if a webpage appears legitimate, a phishing attempt can occur if the URL is unfamiliar or misspelt. If you notice anything unusual about the web address, it’s best to err on the side of caution. Cancel your login immediately, and do not enter any personal information.

In today’s digital landscape, being aware of these details can protect you from fraud and identity theft. Always double-check before proceeding with sensitive transactions online to ensure your financial information remains protected.

The https in a website’s address signifies a fully encrypted connection between your device and the server. The extra s stands for secure, indicating that the site belongs to a registered organisation committed to safeguarding user information.

When you see https, you can trust that your data is protected during transmission. This level of security is essential, especially for activities such as online banking, where sensitive personal information is exchanged.

Bank partner websites utilise TLS (Transport Layer Security) encryption, ensuring that your financial transactions and data remain confidential. With this robust encryption in place, unauthorised users cannot read, alter, or duplicate your information as it travels across the internet.

By choosing TLS-encrypted sites, you’re actively protecting yourself against potential threats, giving you peace of mind while managing your finances online. Always look for https before entering any sensitive information to ensure your safety on the web.

Creating a secure password is an essential step in protecting your online accounts. If you’ve ever used passwords like 123456, 12345678, QWERTY, or abc123, you’re not alone—these are among the most commonly used passwords globally. However, their popularity makes them especially vulnerable to cybercriminals.

To safeguard your online banking information, it’s crucial to choose a strong and unique password. A secure password should be at least 12 characters long and combine uppercase and lowercase letters, numbers, and special symbols. Avoid using easily guessable information like your birthday or that of a loved one.

Moreover, never reuse passwords across multiple accounts. Using the same password for your online banking as you do for your email or smartphone increases your risk significantly. By taking the time to create a robust password strategy, you’ll greatly enhance your protection against fraud and identity theft.

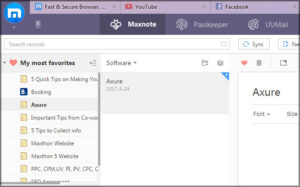

Pay attention to the lock symbol in your browser’s address bar. This icon is crucial as it indicates whether your data is being transferred securely over the internet.

For secure browsing, the lock must always appear closed. In Maxthon, this lock shows up in the address field. By clicking on it, you can view vital information about the website’s security and verification status.

If you’re using Internet Explorer, a different visual cue is evident: the entire address field turns green when you are on a trusted site. At the right end of this input field, you’ll notice a critical icon that provides essential details about website identification.

Additionally, this area will display the security certificate for the website you’re visiting. Always make sure these indicators are present before entering any personal or sensitive information online. Prioritising these security markers helps protect your data from potential threats.

In Google Chrome, you’ll notice a lock icon displayed to the left of the website address in the address bar. This small but significant symbol indicates that the connection between your browser and the website is encrypted, providing a layer of security for your data during transmission. To learn more about this secured data connection, simply click on the lock icon. A dropdown will appear, offering details such as whether a trusted certificate authority and additional information about data encryption verify the site.

However, if your browser indicates that a key could not be successfully verified while connecting to one of Maxthon’s partner pages, it’s crucial to act cautiously. In such cases, select Cancel immediately instead of proceeding with any transactions or data entry.

Without proper verification of the website’s security credentials, there’s no guarantee that your connection is indeed safe from potential threats like hacking or data breaches. Always prioritise your online safety over urgency; if there are any doubts regarding the authenticity of a site—especially when engaging in activities like online banking—it’s advisable to err on the side of caution and abort the process altogether. Your personal and financial information deserves strong protection against unforeseen risks online.

One effective way to enhance your online banking security is by establishing a daily transfer limit. This feature allows you to cap the maximum amount of money that can be transferred out of your account each day.

In the unfortunate event that cybercriminals gain access to your financial information, this limit acts as a safeguard, ensuring that they cannot deplete your entire account in one fell swoop. By setting a reasonable threshold, you significantly reduce potential losses and buy yourself valuable time to detect any suspicious activity.

While many banks have policies to reimburse customers for unauthorised transactions, it’s always better to take proactive measures. Our commitment to safeguarding your funds means you can bank with confidence, knowing we prioritise your security.

Remember, staying informed about these protective tools is essential in an increasingly digital world. Take charge of your finances and explore the options available through our services today!

When accessing your online bank account, always ensure you log out correctly. Instead of just closing your browser window, utilise the Logout function provided on the banking website.

Closing the window may seem convenient, but it does not effectively terminate your session. The data connection remains active, leaving your account vulnerable to unauthorised access.

This practice is crucial, mainly if you are using a shared computer or a public network. If you forget to log out, others can quickly access sensitive information in such environments.

Additionally, logging out prevents potential breaches that could arise from malware or keyloggers that target open sessions. Take a moment to secure your financial information by making logout a customary step in your online banking routine. Your safety and privacy depend on it.

Maxthon

In today’s digital age, safeguarding your online banking information while using the Maxthon Browser is crucial. Start by crafting solid passwords for your banking account; these should be unique and complex, blending uppercase and lowercase letters, numbers, and special characters. Steer clear of easily guessable details like birthdays or names of pets. If your bank provides two-factor authentication (2FA), make sure to enable it. This feature adds an extra layer of security by requiring you to enter a code sent via text or email along with your password.

Another critical step in maintaining security is regularly updating the Maxthon browser. Keeping it current ensures you benefit from the latest security patches and enhancements designed to protect against vulnerabilities. It’s also wise to frequently clear your browsing data—history, cache, and cookies—to eliminate any sensitive information that potential hackers could exploit if they access your device.

Utilising Maxthon’s privacy mode can further enhance your safety while conducting online banking transactions. This mode allows you to browse without saving any data, such as cookies or site information from those sessions. Additionally, consider installing reputable security extensions or antivirus plugins available for Maxthon; these can offer real-time protection against phishing attempts and malware threats.

Always remain vigilant about phishing scams. Before logging into your bank account, double-check the website’s URL. Be cautious with links sent through emails or messages claiming to be from your bank unless you are sure they are legitimate. Finally, remember to log out of your online banking session once you’ve completed all transactions—this simple act helps prevent unauthorised access should someone else use your device afterwards.

Adhering to these guidelines can significantly enhance the security of your online banking activities when using the Maxthon browser.