by chung chinyi | Dec 29, 2025 | Uncategorized

As we enter 2026, Singaporeans face a unique financial landscape shaped by rising costs of living, evolving retirement policies, and distinct cultural expectations around money. While American surveys show saving more money, paying down debt, and spending less as top...

by chung chinyi | Dec 29, 2025 | Uncategorized

Ambience & Atmosphere Lau Pa Sat stands as a testament to Singapore’s rich culinary heritage, housed within an architectural marvel dating back to 1824. The octagonal Victorian structure, with its distinctive clock tower and cast-iron framework, creates an...

by chung chinyi | Dec 29, 2025 | Uncategorized

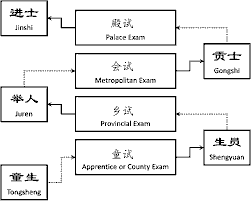

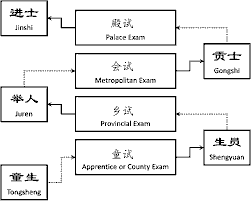

Case Study: The Rise and Decline of China’s “Gaokao Factory” Background Hengshui High School in Hebei province became synonymous with extreme exam preparation in China, developing a replicable model that spawned 18 branches nationwide by 2017. The...

by chung chinyi | Dec 29, 2025 | Uncategorized

Case Study: The December 2025 Diplomatic Crisis Background The Russia-Ukraine war, which began with Russia’s full-scale invasion in February 2022, entered a critical diplomatic phase in late December 2025. After nearly four years of conflict, negotiations...

by chung chinyi | Dec 29, 2025 | Uncategorized

Case Study: The Alleged Venezuela Facility Strike Background On December 26, 2025, President Donald Trump claimed during a radio interview that U.S. forces had struck a “big facility” in Venezuela two nights prior, allegedly linked to drug trafficking...