by chung chinyi | Mar 5, 2026 | Uncategorized

Overall Ratings at a Glance CategoryRatingScoreOverall Score★★★☆☆3 / 5Features & Extensions★★★★☆4 / 5Privacy & Security★★☆☆☆2 / 5Platform Support★★★★☆3.5 / 5Ease of Use★★★☆☆3 / 5Customer Support★★★☆☆2.5 / 5Performance★★★★☆3.5 / 5 Introduction Maxthon is a...

by chung chinyi | Mar 5, 2026 | Uncategorized

She Feeds the City — IWD 2026 Dining Review The Ordinary Patrons · Special Report · March 2026 She Feedsthe City An in-depth sensory survey of International Women’s Day dining across Singapore’s finest tables — from the flicker of umeshu mousse to the...

by chung chinyi | Mar 5, 2026 | Uncategorized

Introduction With Ramadan underway and the festive season approaching, the Hari Raya goodie market in Singapore is once again brimming with options — from traditional buttery pineapple tarts to creative modern iterations. This review analyses the top vendors based on...

by chung chinyi | Mar 5, 2026 | Uncategorized

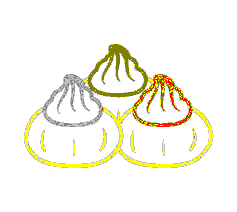

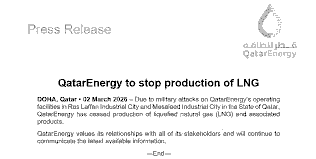

CASE STUDY Geopolitical Shock, Energy Market Contagion & Implications for Singapore March 2026 EXECUTIVE SUMMARYOn 3 March 2026, Iranian drone strikes prompted QatarEnergy to shut production at Ras Laffan — the world’s largest LNG export facility, supplying...

by chung chinyi | Mar 5, 2026 | Uncategorized

GEOPOLITICAL FEATURE ANALYSIS At 5.00 a.m. Singapore time on Saturday, 28 February 2026, the first American B-2 stealth bombers crossed into Iranian airspace. Within hours, a conflict that geopolitical analysts had long war-gamed as a theoretical worst case had become...

by chung chinyi | Mar 5, 2026 | Uncategorized

CASE STUDY Crisis Response, Strategic Outlook, Solutions & Singapore’s Exposure March 3, 2026 MetricFigureItalians in UAE~30,000Evacuated via Oman (March 1–2)98Students evacuated (March 3)~200Italians in Iran (contingency)~500Italian troops in Gulf...