by chung chinyi | Feb 14, 2026 | Uncategorized

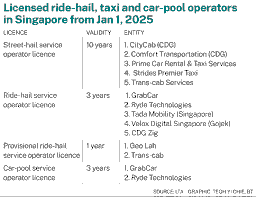

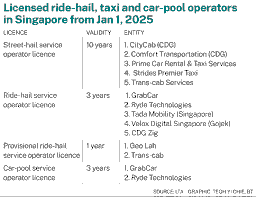

Title: A Methodological Critique and Market Analysis of The Straits Times’ 2025 Singapore Ride-Hailing Platform Comparison Study Abstract This paper presents a critical analysis of a systematic comparative study on ride-hailing services conducted by The Straits Times...

by chung chinyi | Feb 14, 2026 | Uncategorized

Singapore’s transformation from a resource-scarce port city into one of the world’s most influential city-states represents a remarkable case study in strategic development, innovation, and diplomatic acumen. Despite comprising only 728 square kilometers...

by chung chinyi | Feb 14, 2026 | Uncategorized

There’s a particular kind of magic that happens when a casual neighborhood spot transcends its humble aspirations, and The Corner Table achieves this alchemy with seemingly effortless grace. Tucked between a vintage bookshop and a small grocery on Maple Street,...

by chung chinyi | Feb 14, 2026 | Uncategorized

Executive Summary The Stanford mistrial reveals a systemic failure: universities, students, and legal systems lack adequate frameworks for channeling moral urgency into constructive action. Rather than debating whether to punish or excuse property destruction, we...

by chung chinyi | Feb 14, 2026 | Uncategorized

TungLok Teahouse: The Democratic Dumpling Haven Ambience & First Impressions Stepping into TungLok Teahouse at Square 2 feels like entering a modern interpretation of a traditional Cantonese teahouse. The space hums with a particular energy—families celebrating...

by chung chinyi | Feb 14, 2026 | Uncategorized

Impact of U.S. Tariffs on Social Media Advertising RevenueSingapore Market PerspectiveExecutive SummaryPinterest Inc. (NYSE: PINS) experienced a significant stock decline in February 2026, with shares plummeting approximately 20% following disappointing fourth-quarter...

by chung chinyi | Feb 14, 2026 | Uncategorized

A Singapore Case StudyExecutive SummaryAs artificial intelligence transforms the global banking sector, questions about the future role of young workers have intensified. Drawing from Singapore’s experience as a leading financial hub, this case study examines...

by chung chinyi | Feb 14, 2026 | Uncategorized

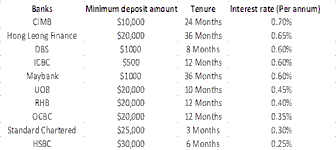

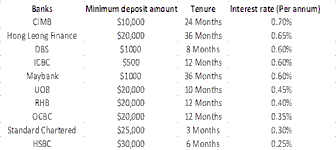

Executive Summary Singapore’s cash yield environment in early 2026 presents a challenging yet navigable landscape for savers and investors. While yields have declined from their 2023-2024 peaks, disciplined savers can still achieve positive real returns above...

by chung chinyi | Feb 14, 2026 | Uncategorized

A Two-Year Setback with Broader Implications When Mustafa Centre announced plans to open its first Malaysian flagship store in Johor Bahru’s Capital City Mall in the second half of 2023, the move promised to reshape cross-border shopping dynamics between...

by chung chinyi | Feb 14, 2026 | Uncategorized

French Flair Finds a Home on Orchard Road – A First‑Look Review of “Bistrot Belle Époque” A sensory first bite The moment the brass doorbell chimed above the mahogany entryway of Bistrot Belle Époque, the faint scent of freshly baked baguette and a whisper of...