by chung chinyi | Feb 6, 2026 | Uncategorized

:Title: Mexico’s Humanitarian Aid to Cuba: A Shift in Regional Diplomacy Under President Claudia Sheinbaum AbstractThis paper examines the February 2026 announcement by Mexican President Claudia Sheinbaum to send humanitarian aid to Cuba, analyzing its geopolitical,...

by chung chinyi | Feb 6, 2026 | Uncategorized

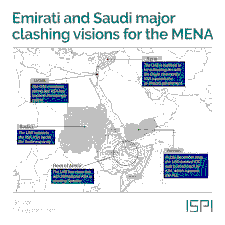

The Spillover of the Gulf Rift into Business: An Analysis of UAE Companies’ Withdrawal from the Saudi Defence Show Abstract The rift between the United Arab Emirates (UAE) and Saudi Arabia, two of the most influential oil-producing countries in the Gulf region,...

by chung chinyi | Feb 6, 2026 | Uncategorized

The Impact of the EDIFY Program at Tan Tock Seng Hospital on Reducing Unnecessary Hospital Admissions for Frail SeniorsAbstract The global aging population has intensified the demand for innovative healthcare models to manage the needs of vulnerable elderly patients....

by chung chinyi | Feb 6, 2026 | Uncategorized

From Duke to Deportee: Seven Lesser‑Known Aspects of the Disgraced Former Actor Ian Fang: An Interdisciplinary Examination of Celebrity, Law, and Migration in Contemporary Singapore AbstractIan Fang, a Shanghai‑born Chinese national who rose to prominence as one of...

by chung chinyi | Feb 6, 2026 | Uncategorized

An Analysis of Advanced Threat Protection in Singapore’s Data Center EcosystemExecutive Summary The collaboration between Cohesity and Google Cloud, announced on February 6, 2026, introduces intelligence-driven malware analysis capabilities that address a...

by chung chinyi | Feb 6, 2026 | Uncategorized

A Decade of Transformation in Financial Cybersecurity (2016-2026)Prepared: February 2026 Executive SummaryThe February 2016 cyber heist targeting Bangladesh Bank, which resulted in the theft of $81 million through fraudulent SWIFT messages, represented a watershed...

by chung chinyi | Feb 6, 2026 | Uncategorized

A Culinary Journey Through CNY 2026: An In-Depth Analysis of Singapore’s Reunion Dinner Offerings Introduction: The Evolution of Festive Feasting The 2026 Chinese New Year reunion dinner landscape represents a fascinating convergence of tradition and...

by chung chinyi | Feb 6, 2026 | Uncategorized

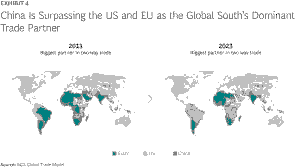

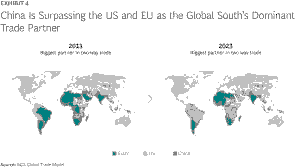

Title: Brazil’s Strategic Shift: Mercosur-China Relations and the Geopolitical Reshaping of South-South CooperationAbstract This paper examines Brazil’s recent diplomatic and economic pivot toward China within the context of the Mercosur trade bloc, analyzing...

by chung chinyi | Feb 6, 2026 | Uncategorized

AbstractThe legacy of Jeffrey Epstein, a convicted sex offender, has reverberated globally, with recent revelations in 2025-2026 exposing extensive ties between Epstein and European political, diplomatic, and royal elites. This paper examines the scandal’s impact on...

by chung chinyi | Feb 6, 2026 | Uncategorized

Title: An Analysis of the Recent Suicide Bombing in Islamabad: Understanding the Dynamics of Sectarian Violence in Pakistan Abstract: On February 6, 2026, a devastating suicide bombing occurred at a Shi’ite Muslim mosque in Islamabad, Pakistan, resulting in the...