Recent bank failures and ongoing economic turbulence have left many depositors feeling anxious about their finances. This uncertainty raises a crucial question: what happens when you depend on a bank that operates entirely online without the comfort of a physical branch or a familiar teller to speak with?

For those who have transitioned to online banks, the thrill of higher interest rates and attractive savings options can be overshadowed by concerns about accessibility and safety. With no in-person visits, customers often wonder if they can quickly withdraw their money when needed.

The good news is that most reputable online banks are insured by the Federal Deposit Insurance Corporation (FDIC). This insurance guarantees that customers’ deposits are protected up to $250,000 per depositor, just like traditional banks. Knowing this can significantly alleviate fears around potential losses.

Ultimately, as long as your online bank boasts FDIC insurance, your funds remain safe from unexpected risks. Embracing digital banking doesn’t mean sacrificing security; it offers an opportunity to enjoy better savings while still safeguarding your hard-earned money.

What Are Online Banks?

Online banks are financial institutions that operate without any physical branches. By providing their services exclusively via the Internet, they eliminate the costs associated with maintaining traditional bank locations.

This unique structure allows online banks to offer customers lower fees and more competitive interest rates on savings accounts and loans. Without the burden of overhead expenses tied to brick-and-mortar buildings, online banks can pass these savings directly to customers.

Accessing your money is as simple as tapping your smartphone or clicking your computer. Most online banks provide user-friendly mobile apps and websites, enabling you to check balances, transfer funds, and manage your accounts anytime, anywhere.

Additionally, many online banks have partnered with ATM networks nationwide, allowing customers to withdraw cash without incurring fees at thousands of machines across the country. This convenience helps replicate some of the accessibility you’d find in traditional banking while enhancing cost-effectiveness.

Online banking offers a modern approach that caters to a tech-savvy audience looking for efficiency and value in managing their finances.

In today’s digital world, both physical and online banks share the pressing responsibility of safeguarding their customers’ deposits. Yet, online banks find themselves in a distinct position due to their entirely digital business model. The absence of brick-and-mortar branches means that they must innovate beyond traditional security measures.

To ensure your money is safe, online banks utilise advanced encryption technologies. This process scrambles your information, making it nearly impossible for unauthorised users to decipher. Each transaction undergoes rigorous scrutiny using sophisticated fraud detection algorithms that flag unusual activities in real time.

Furthermore, most online banks are backed by federal insurance, such as the Federal Deposit Insurance Corporation (FDIC) in the United States. This guarantees that even if something were to happen to the bank, your deposits remain protected up to a specific limit.

Customer education also plays a key role. Many online banks provide resources and tips on how to maintain personal security while banking online. This proactive approach not only fosters trust but empowers customers to protect themselves against potential threats.

Ultimately, online banks offer robust protection measures designed to keep your money safe and secure through a combination of cutting-edge technology, regulatory compliance, and community engagement.

In a digital age where stories of data breaches flood the headlines, online banks have taken significant steps to protect your information. Over the past two decades, they’ve learned from adversities and now utilise an industry-standard security measure: 256-bit Advanced Encryption Standard (AES). This powerful encryption method is not just a recommendation; it’s a requirement for financial institutions that handle sensitive data. Interestingly, it’s the same technique employed by the U.S. military to safeguard classified information.

But while encryption effectively locks away vital data, it isn’t foolproof against all threats. Hackers often resort to a more straightforward approach — attempting to guess customer passwords in hopes of gaining direct access to accounts. To thwart these intrusions, online banks have adopted two-factor authentication (2FA), adding another layer of security.

With 2FA, more than simply knowing your username and password is required. After entering those basics, you receive a one-time code sent directly to your phone or email. Only by inputting this additional key can you fully access your account.

This process ensures that even if someone manages to bypass your password, they still face an insurmountable hurdle — accessing the unique code sent exclusively to you. This double-layered protection cultivates peace of mind in navigating the evolving landscape of online banking security.

When it comes to safeguarding your hard-earned money, FDIC insurance plays a crucial role. Online banks, much like their traditional counterparts, are backed by the Federal Deposit Insurance Corporation (FDIC). This insurance protects depositors by ensuring that if a bank fails, customers will be reimbursed up to $250,000 for their deposits.

For married couples holding joint accounts, the protection doubles to an impressive $500,000. This means you can feel confident in banking with either type of institution, knowing that your savings are secure—even if the worst were to happen and your bank goes under.

However, it’s essential to note that traditional banks and online banks aren’t the only players in the financial landscape. Credit unions operate on a different insurance model. Instead of FDIC coverage, these institutions offer protection through the National Credit Union Administration (NCUA).

This distinction means that whether you choose a bank or a credit union for your financial needs, you can rest easy knowing you have solid government-backed protection for your deposits. Your money is safe—no matter where it sits.

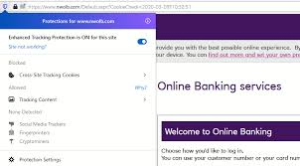

Determining the safety of an online bank is a vital step for anyone looking to manage their finances in the digital age. The internet is vast, and only some banking websites can be trusted; some may even pose risks to your financial security.

To begin your quest for a secure online bank, look for FDIC insurance. This crucial insurance protects your deposits up to $250,000 per depositor, and most reputable banks proudly display that they are FDIC-insured right on their homepage. As you navigate the site, look for official seals or statements confirming this protection.

If the information isn’t readily apparent, don’t hesitate to dig deeper. You can verify a bank’s FDIC status through the BankFind Suite on the FDIC’s official website by searching with the bank’s name, certification number, or web address.

It’s also worth noting that many online banks are extensions of traditional institutions. In such cases, they may share the same FDIC certification numbers and coverage as their parent banks. Therefore, understanding their connection can provide additional reassurance regarding your safety while banking online.

In this world of digital finance, protecting your future starts with choosing a trustworthy institution. These steps will help you make informed decisions about where to bank safely.

When choosing an online bank, it’s crucial to review its Security page. This section typically outlines the protective measures it implements for customer safety. If a bank lacks this dedicated page, it’s a clear warning sign—perhaps it’s better to take your business elsewhere.

Look for mentions of advanced security features. Two-factor authentication adds an extra layer of protection by requiring additional verification steps during login. Additionally, reputable banks provide fraud protection and reimbursement for unauthorised transactions.

Another key indicator is the website’s URL; it should start with https. This prefix signifies that the site uses encryption to safeguard your data. Conversely, if you see http, proceed with caution, as these sites offer minimal security.

Even with robust online banking measures in place, you must remain vigilant. For example, avoid logging into your accounts using public WiFi networks. Hotspots in airports or coffee shops are often unsecured, leaving your personal information vulnerable to hackers lurking nearby.

By understanding the signs of good online banking security and adopting intelligent practices, you can help protect your money while navigating the digital banking landscape.

In a world where digital threats loom large, the importance of using complex passwords cannot be overstated. Hackers are constantly on the lookout for easy targets, often relying on guesswork with simple or sequential passwords. To bolster your defences, consider crafting a password that strings together several unrelated words, mixing in capital letters and numbers for extra security.

But more than just having a strong password is required; enabling two-factor authentication (2FA) is crucial. This additional layer of security ensures that even if someone manages to steal your password, they still cannot gain access without another verification method, like a text message code sent to your phone.

Additionally, take advantage of bank alerts. Many banks offer text and email notifications for various activities within your account. If an unauthorised login attempt occurs from an unfamiliar location or if there’s an unusual transaction made outside your usual patterns, you’ll be notified almost instantly and can act swiftly to protect yourself.

Finally, exercise caution when dealing with emails related to your banking information. While some messages may appear legitimate—often designed to replicate official communications—they can easily lead you into traps set by sophisticated hackers. Avoid clicking on any links within these emails unless you’ve verified their authenticity directly through your bank’s website or customer service.

By implementing these strategies, you significantly enhance the safety of your online banking experience and shield yourself from malicious actions that threaten your financial well-being.

In today’s digital age, online banking offers a world of convenience. You can manage your finances from the comfort of your home, track expenses in real time, and often avoid many fees associated with traditional banks. However, even with these advancements, challenges like budgeting, saving for retirement, and accumulating wealth remain as relevant as ever.

This is where a financial advisor can make all the difference. Collaborating with an expert allows you to tailor a financial plan specifically suited to your goals. A skilled advisor will guide you through the complexities of managing your money effectively.

Finding the right financial advisor doesn’t need to be overwhelming. With tools like SmartAsset’s free matching service, you can connect with three vetted advisors in your area who align with your needs. This means you can interview several advisors without any obligation before making a decision.

For those considering a bank switch or opening their first account, it’s vital to find one that aligns with your lifestyle and preferences. From fee structures to customer service quality, there are essential factors to consider. Whether opting for online services or traditional banking institutions, make informed choices that will serve your financial future well.

If you’re ready to take control of your finances and partner with an experienced advisor who understands your unique aspirations, now is the perfect time to start this journey.

Maxthon

In the modern era dominated by technology, online banking has revolutionized how we handle our finances, providing unparalleled ease and accessibility. Imagine being able to oversee your financial affairs without ever stepping outside your front door—monitoring your expenditures as they happen and sidestepping many of the fees that often accompany conventional banking methods. Despite these remarkable innovations, age-old challenges such as budgeting wisely, saving for retirement, and building wealth persist. This is precisely where the expertise of a financial advisor becomes invaluable.

Picture this: you’re embarking on a journey toward financial stability and growth, but navigating the intricate landscape of money management can be daunting. By teaming up with a knowledgeable advisor, you gain access to personalised guidance explicitly tailored to your aspirations. A proficient financial expert will walk you through the often confusing maze of investment options and savings strategies, simplifying what can feel overwhelming.

Finding an ideal financial advisor might seem like a Herculean task at first glance; however, it doesn’t have to be a source of stress. With innovative tools such as SmartAsset’s complimentary matching service at your disposal, you can easily connect with three carefully vetted advisors in your vicinity who resonate with your specific needs and objectives. This unique opportunity allows you to engage in discussions with multiple professionals before deciding to make evaluations  or commitment before making an informed choice.

or commitment before making an informed choice.

For those contemplating switching banks or opening their very first account, it’s crucial to select an institution that complements both your lifestyle and personal preferences. Considerations such as fee structures and customer service quality play pivotal roles in this decision-making process. Whether you lean towards online banking solutions or prefer traditional brick-and-mortar establishments, it’s essential to make well-informed decisions that will positively impact your financial future.

If you’re poised to seize control over your monetary matters and collaborate with a seasoned advisor who genuinely comprehends your distinctive goals and dreams, now is an opportune moment to embark on this transformative journey toward financial empowerment. The path ahead is bright—let’s take those first steps together!