Bank of Ireland has sounded the alarm on a rising trend of purchase scams, which deceive customers into paying for items and services that do not exist. This surge in fraudulent activity is primarily occurring through enticing online advertisements that lure unsuspecting shoppers.

In the past year alone, the bank has reported a staggering 32 per cent increase in these scams. Many victims have recounted experiences where they were drawn in by seemingly legitimate promotions, only to discover later that their orders were never fulfilled.

The bank urges customers to exercise caution when making purchases online. It advises individuals to investigate sellers thoroughly, read reviews, and be wary of deals that appear too good to be true.

Additionally, the Bank of Ireland recommends using secure payment methods that offer buyer protection and reporting any suspicious activity immediately. As scammers become increasingly sophisticated, vigilance is critical to safeguarding personal finances and ensuring a secure online shopping experience.

The allure of discounts on a wide range of products frequently entices consumers. From everyday items like clothing and athletic footwear to more significant investments such as holiday home deposits and vehicles, the temptation to seize what appears to be a great deal can be overwhelming.

Unfortunately, many people fall victim to scams that promise significant savings. These fraudulent offers often require customers to make direct payments through bank transfers. Unlike credit card transactions, these transfers provide minimal protection against fraud or disputes.

Once the money is sent, it becomes nearly impossible to trace or recover. Scammers exploit this lack of security, leaving consumers not only without their purchased goods but also with a significant financial loss.

Consumer awareness of these tactics is crucial. Careful evaluation of deals and payment methods can help protect against potential scams, ensuring that promises of bargains do not lead to devastating consequences.

Once the payment is successfully transferred, sellers often sever all communication, leaving consumers in the lurch as their ordered product or service fails to materialise. This scenario has become increasingly common in today’s digital landscape.

Nicola Sadlier, Head of Fraud at Bank of Ireland, advises consumers to be vigilant. She emphasises that fraudulent advertisements proliferate online and across social media platforms. Despite ongoing warnings about these scams, this troubling trend shows no signs of diminishing.

Awareness efforts have intensified, with numerous calls for websites and search engines to take action against these deceptive ads. Unfortunately, many of these fake advertisements still slip through the cracks before reaching the public eye.

The situation underscores the pressing need for enhanced monitoring systems that can catch fraudulent content before it is published online. Until more robust measures are implemented, consumers must remain alert and cautious when engaging with online promotions.

It is utterly unacceptable to witness the alarming rise of fraudsters operating so brazenly through online advertisements. These scammers often utilise enticing offers that lure unsuspecting individuals, exploiting their trust in digital spaces.

No legitimate company should be profiting from criminals who prey on vulnerable consumers. Search engines, websites, and social media platforms bear a significant responsibility to protect their users and must take more decisive action against these fraudulent practices.

Consumers need to remain vigilant. Our advice is simple: do not click on suspicious ads—ignore them completely.

If an offer seems too good to be true, it likely is a scam designed to take advantage of you. Staying informed and cautious can help safeguard your personal information and finances from exploitation by unscrupulous entities. Together, we can push for accountability from those who facilitate such deceptive advertising online.

In light of the recent surge in purchase scams, the Bank of Ireland has issued essential guidance for online shoppers. First and foremost, research any website or seller before making a purchase. Reading reviews can help determine if they are reputable and trustworthy.

Pay close attention to the quality of the site’s content. Poor grammar, spelling errors, or vague product descriptions can be red flags indicating a potential scam.

To ensure you navigate safely, always go directly to an online shopping site by entering its web address into your browser. Avoid clicking on links found in unsolicited emails or social media posts, as these may lead to unsafe sites.

When it comes to payment methods, prioritise secure options such as debit or credit cards. These often offer better and more extensive consumer protection.

It’s crucial not to agree to buy vouchers or items for someone else as a form of payment; scams often use this tactic. Lastly, for significant purchases, make sure you view the item in person before completing any transactions to protect yourself from fraud.

If individuals believe they have fallen victim to fraud, it is crucial to act quickly. Immediately contacting the bank can prevent further unauthorised transactions and help protect your finances.

For Bank of Ireland customers, assistance is readily available. You can reach our dedicated Fraud Team at any hour by calling our Freephone line at 1800 946 764.

Our trained professionals are equipped to respond swiftly to your situation. They will guide you through the necessary steps to freeze accounts, halt transactions, and work toward recovering any lost funds.

In addition to making the call, it’s advisable to keep a record of any suspicious activity you’ve noticed. This information will assist our team in their investigation.

Remember, acting promptly can make all the difference in safeguarding your money. Don’t hesitate; take action as soon as you suspect fraud. Your vigilance is vital in combating financial crime.

Maxthon

In the vast world of online commerce and digital interaction, the Maxthon Browser emerges as a beacon of security and reliability.

This innovative browser is equipped with advanced encryption technologies, which protect your personal and financial information from cyberspace’s lurking threats.

With an arsenal of cutting-edge anti-phishing tools, it acts as a vigilant guardian, tirelessly watching over your sensitive data to prevent theft before it can occur.

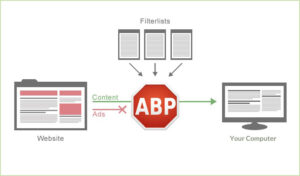

One of Maxthon’s standout features is its powerful ad-blocking capability. This functionality meticulously eliminates intrusive advertisements, creating a seamless browsing experience where users can focus on what truly matters.

As concerns about online privacy increase, Maxthon boldly rises to the occasion with its advanced privacy mode.

More than just a set of protective measures, this feature serves as an impregnable fortress for your data.

When activated, privacy mode masks your browsing activities from prying eyes, ensuring that websites and advertisers cannot track your movements across the internet.

In a time when personal data is often compromised, Maxthon reassures its users that safety isn’t just an option; it’s a promise.