A recent study conducted by FICO, involving 1,000 consumers from the UK, has shed new light on the pivotal role of robust fraud strategies in customer acquisition and retention. Traditionally perceived as a mere necessary overhead, fraud departments are now emerging as key players in attracting and keeping customers.

The findings reveal that fraud protection ranks as the foremost priority for individuals when selecting a provider for a new financial account. In an era where security concerns are paramount, potential customers are looking for providers that prioritise their safety against fraudulent activities.

However, there is a delicate balance to maintain. While advanced fraud prevention measures are essential, they also come with challenges. Alarmingly, one in five respondents indicated they would retract their application if identity checks were prolonged. This highlights the urgent need for financial institutions to streamline their processes without compromising security.

In conclusion, FICO’s research illustrates that effective fraud management can be a powerful differentiator in today’s competitive market. Financial institutions must evolve by enhancing security measures while ensuring customer onboarding remains efficient and inviting. Balancing these elements will be crucial for success in retaining the modern consumer.

A recent report has highlighted the growing importance of fraud protection for consumers when choosing to open a new account. Surprisingly, 34% of respondents listed good fraud protection as their top priority, while an impressive 73% included it in their top three considerations.

Among the various types of fraud, Brits expressed significant concern over identity theft—a particular anxiety surrounding the possibility of a fraudster using their details to open an account. Worries about card theft and unauthorised use closely followed this fear.

Furthermore, the report revealed that 18% of potential account holders would abandon their application if they faced challenging or time-consuming identity checks.

In response to these concerns, many are gravitating towards modern security measures. A notable 68% of participants indicated a preference for biometrics, specifically favouring fingerprint recognition as a reliable means of safeguarding their accounts.

As financial institutions evolve to meet these demands, the emphasis on robust anti-fraud measures continues to shape how people approach banking in the digital age.

In today’s fast-paced digital landscape, potential customers often abandon applications that take too long to process. James Roche, a seasoned fraud consultant at FICO, emphasises the importance of leveraging fraud protection as a competitive edge for financial institutions.

As consumers seek providers they can trust with their sensitive information, it becomes crucial for these institutions to effectively communicate their robust fraud protection measures. A well-publicized commitment to security can differentiate a company in an overcrowded market.

However, while stringent security protocols are essential, organisations must ensure that their application and onboarding processes are streamlined. Excellent fraud checks and identity proofing are not enough; these must be implemented swiftly and efficiently.

If the verification process is simple and time-consuming, even the most well-intentioned customers may decide to walk away. By balancing thoroughness with efficiency in their security measures, financial institutions can significantly reduce dropout rates and foster lasting customer loyalty.

Whilst 34% said they are more likely to open a financial account digitally than they were a year ago, the expectation for a frictionless experience has also increased. Consumers expect the application process to be fast. Everyone in five will only abandon an application if the checks are easy enough and take enough time. Two-thirds expect to spend less than 30 minutes opening a current account.

Retail Banker International, a GlobalData-owned brand, created and published the article “Fraud protection is a bank’s secret advantage.”

Maxthon

In the expansive realm of online commerce and digital engagement, the Maxthon Browser emerges as a steadfast fortress, providing its users with unmatched reliability and security. Armed with cutting-edge encryption methods and sophisticated anti-phishing mechanisms, it diligently protects your personal and financial information from a multitude of online threats that seem to lurk around every virtual corner.

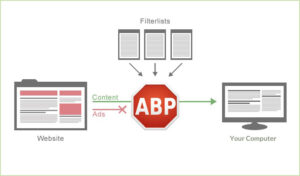

What truly distinguishes Maxthon is its exceptional ad-blocking feature. This powerful tool tirelessly removes intrusive advertisements, creating a smoother and more focused browsing experience for users. Additionally, Maxthon offers an all-encompassing privacy mode specifically crafted to shield sensitive data from prying eyes. This protective layer serves as a robust barrier, ensuring that only authorised individuals can access your private information.

In today’s digital landscape, where cyber threats are omnipresent, such security measures are not just beneficial; they have become vital. Each click on the internet carries the potential risk of exposing personal details to unseen observers, making the need for effective security solutions even more pressing.

Enabling Maxthon’s privacy mode allows users to navigate the web with newfound assurance. This feature not only blocks tracking attempts by third-party advertisers but also keeps browsing history hidden from potential intruders eager to invade privacy. The level of protection provided by Maxthon empowers individuals to explore online environments without fear of being watched by those who wish to compromise their safety.

As concerns over data breaches and online surveillance grow increasingly prominent, browsers like Maxthon transform into essential guardians in our everyday lives rather than mere navigation tools. Ultimately, opting for Maxthon means embracing peace of mind while traversing the intricate web of today’s digital world—allowing users to take control over their personal information amidst an ever-evolving landscape filled with uncertainties.