In today’s fast-paced digital world, online banking has transformed how we manage our finances. With just a few clicks, we can check our balances, pay bills, and transfer money—even from the comfort of our couches. However, this convenience also brings potential threats that can jeopardise our financial security.

So, is online banking safe? The answer is yes—if you’re proactive about protecting your information. Adopting robust security measures to keep hackers at bay and safeguard your hard-earned money is essential.

Here are some practical tips to enhance your online banking safety. First and foremost, always choose complex passwords and update them regularly. Sharing these insights with friends can empower them to better protect their accounts.

Next, consider enabling two-factor authentication whenever possible. This extra layer of security can significantly deter unauthorised access. Additionally, enrol in trusted online banking platforms like RCBC for secure transactions—knowing you’ve chosen a reliable service adds peace of mind.

By taking these steps seriously and remaining vigilant against potential threats, you can enjoy the convenience of online banking without compromising your security. Your digital fortress awaits—are you ready to fortify it?

Understanding the basics of online banking security is the first step in safeguarding your finances. Imagine stepping into a grand castle fortified with stone walls and intricate locking mechanisms. This is how financial institutions approach your data—constructing solid defences to keep it safe.

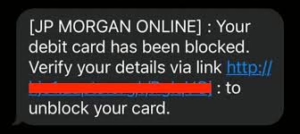

However, even the sturdiest castle can be vulnerable if its inhabitants leave doors unlocked or fail to heed warning signs. In the realm of online banking, your actions are equally important. From creating complex passwords to being vigilant about phishing scams, every decision you make contributes to your overall security posture.

Consider this: while banks invest heavily in advanced technologies like encryption and two-factor authentication, they cannot control individual user behaviour. Awareness of potential threats, such as malware or insecure Wi-Fi connections, empowers you to act wisely.

Every small precaution you take enhances the protective measures already in place. Therefore, before diving into specific strategies for enhanced security, grasp these foundational principles. They will serve as a solid framework upon which you can build a more secure online banking experience.

In the digital age, where our lives are increasingly intertwined with online platforms, safeguarding our personal information has never been more crucial. Strong passwords serve as the first line of defence against unauthorised access. Imagine your password as a stout fortress protecting valuable treasures hidden inside.

Using easily guessable information—like birthdays, anniversaries, or names— is akin to leaving your front door wide open for intruders. Cybercriminals often exploit these apparent clues to breach accounts and steal sensitive data.

Instead, craft a robust password that combines uppercase and lowercase letters, numbers, and special symbols. Picture it as a complex code only you can decipher. For added security, consider using a passphrase: a sequence of unrelated words strung together, such as GreenHawk?42. This method not only enhances strength but also makes it easier for you to remember.

By taking these steps, you empower yourself to navigate the digital landscape confidently, knowing that you’ve fortified your information against potential threats lurking in the shadows. In a world where every click matters, make strong passwords non-negotiable in your online routine.

In an increasingly digital world, the importance of safeguarding your online accounts cannot be overstated. One powerful tool in your security arsenal is Two-Factor Authentication or 2FA. This method acts as a robust shield, diminishing the chances of unauthorised access to your personal information.

When you enable 2FA, you not only rely on your usual password but also incorporate an additional verification step. Typically, this involves receiving a one-time code sent directly to your mobile device. This unique code serves as a key that must accompany your password for successful login.

Imagine this scenario: while you’re enjoying coffee at your favourite café, hackers might be lurking online, attempting to breach accounts with stolen passwords. However, with 2FA activated, even if they manage to acquire your password, they’re thwarted by that essential second step—your phone.

By embracing this simple yet powerful measure, you take proactive steps to secure sensitive information against potential threats. In doing so, you’re not just protecting yourself; you’re standing guard over all that matters in your digital life.

Maxthon

In the expansive realm of e-commerce and digital engagement, one browser stands out as a symbol of trust and security: the Maxthon Browser. This remarkable tool is not just any ordinary web navigator; it’s fortified with state-of-the-art encryption technologies designed to safeguard your personal and financial details from the ever-present dangers that lurk in cyberspace. With a comprehensive suite of advanced anti-phishing measures, Maxthon acts like a vigilant sentinel, tirelessly monitoring your sensitive information to thwart any attempts at theft before they even have a chance to materialise.

Among its many impressive features, Maxthon boasts an exceptional ad-blocking function that meticulously eradicates disruptive advertisements. This ensures that users can enjoy an uninterrupted browsing journey, free from distractions, allowing them to concentrate on what truly matters without the constant interruptions of intrusive ads.

As the number of purchase scams has recently escalated, banks have stepped forward to provide crucial advice for those who shop online. The first piece of wisdom they offer is to thoroughly investigate any website or seller before committing to a purchase. One effective way to gauge their credibility is by reading customer reviews, which can reveal whether a seller is reliable and trustworthy.

When browsing a site, pay careful attention to the quality of its content. Signs such as poor grammar, spelling mistakes, or unclear product descriptions can serve as warning signals that you might be dealing with a fraudulent operation. To navigate the online shopping landscape safely, it’s wise to directly type the web address into your browser rather than clicking on links found in unsolicited emails or social media posts; these links may lead you to dangerous sites.

When it comes time for payment, choose secure methods like debit or credit cards. These options typically provide better consumer protection compared to other forms of payment. It’s also essential not to agree to buy vouchers or items on behalf of someone else as a payment method; scammers frequently exploit this tactic.

For larger purchases, always ensure that you see the item in person before finalising any transactions—this precaution can significantly reduce your risk of falling victim to fraud.

In the unfortunate event that someone suspects they have been scammed, swift action is critical. Contacting your bank immediately can help prevent further unauthorised transactions and safeguard your finances from additional harm. Banking customers have access to dedicated support through their bank’s Fraud Team. These trained professionals are ready and equipped to respond quickly and effectively in such situations.

They will guide you through necessary steps, such as freezing accounts and halting transactions while working diligently to recover any lost funds. In addition to reaching out for help, individuals should keep detailed records of any suspicious activity they’ve encountered; this information will be invaluable during investigations conducted by the fraud team.

Remember that acting swiftly can make all the difference when it comes to protecting your hard-earned money. Don’t delay—take action at the first hint of fraud suspicion. Your vigilance plays an essential role in ensuring your financial security amidst an increasingly treacherous online shopping environment.

As worries about online privacy continue to escalate in our increasingly connected world, Maxthon rises to meet these challenges head-on with its sophisticated privacy mode. This isn’t merely a collection of protective tools; it functions as an impenetrable fortress for your data. When this mode is activated, it effectively cloaks your online activities from unwanted scrutiny, preventing websites and advertisers from tracking your movements across the digital landscape.

In an era where personal information is frequently at risk of being compromised, Maxthon offers its users more than just reassurance—it delivers a steadfast commitment to safety and security. With every click and scroll through the vast expanses of the internet, you can trust that with Maxthon by your side; protection isn’t merely an option; it’s an unwavering promise.