In the current rapidly evolving digital environment, online banking has fundamentally changed the way we handle our finances. This remarkable convenience comes with a significant responsibility for banks to protect sensitive financial data. This detailed guide will explore essential safety tips for online banking, focusing on the strong security protocols that banks should adopt to shield their clients’ valuable information from potential risks, along with advice for both the fintech sector and users of mobile banking applications.

Overview of Online Banking Fraud

Studies indicate that many individuals fall victim to online banking fraud without realising they have been scammed until it’s too late. This highlights an urgent need for increased awareness and education about online banking safety and security. Furthermore, the rise of banking malware underscores the necessity for improved protective strategies. As incidents of online banking fraud continue to escalate, the banking sector must adapt and respond effectively to this expanding threat landscape.

Case Study 1: Phishing Attacks Targeting Bank of America Customers

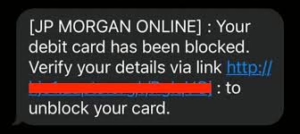

Understanding how phishing attacks operate is vital in enhancing online banking security measures. In 2019, Bank of America witnessed a staggering 34% rise in phishing attempts, with Vade detecting 19,800 unique phishing URLs—an increase from 14,771 in the previous year. A common strategy used in these financial service-related phishing scams involved sending security alerts designed to provoke anxiety among users. Cybercriminals exploited these alarming notifications from banks, significantly increasing the chances that recipients would click on deceptive links.

The notable rise in such attacks reflects the changing strategies employed by cybercriminals. It emphasises the critical need for stronger cybersecurity practices aimed at safeguarding users and financial institutions alike. The phishing incident involving Bank of America is particularly noteworthy because attackers sought to impersonate legitimate communications from the bank through convincing fraudulent emails that closely resembled official correspondence.

Case 2: Cyberattack on the Financial Giant

On November 10, 2023, a significant incident struck the global financial landscape when the Industrial and Commercial Bank of China (ICBC), recognised as the largest bank in the world, became a target of a ransomware attack. This notable event reverberated throughout the financial sector, underscoring that even the most powerful institutions are susceptible to advanced cyber threats. The attack involved cybercriminals encrypting ICBC’s data and demanding ransom for its release, posing not only an immediate threat to the bank’s operations but also raising broader concerns about the overall stability of financial services.

Prevention: A Targeted Sector

The financial industry is particularly appealing to cybercriminals aiming to exploit sensitive information or disrupt operations. The incident involving ICBC serves as a stark reminder that no financial institution is too large or esteemed to evade cyber risks. In light of this breach, banks within the industry must reassess their cybersecurity measures to maintain their effectiveness.

Ensure The Security Of Your Online Banking

Our team of cybersecurity specialists can bolster your security and provide ongoing support for your online banking systems. Schedule a complimentary consultation today!

Online Banking Security Recommendations

As banking increasingly shifts towards digital platforms, so too do the sophisticated tactics employed by cybercriminals. Consequently, financial institutions need to implement an extensive range of advanced security protocols designed to safeguard customer data from cyber threats and unauthorised access. Understanding this comprehensive approach is vital for customers who wish to feel confident in the safety of their financial transactions.

In the realm of digital banking, financial institutions need to focus on state-of-the-art encryption techniques as a fundamental safeguard. By converting sensitive data into an unreadable format, these advanced methods make it nearly impossible for unauthorised users to interpret the information. This digital fortress not only protects customer privacy but also upholds the integrity of their data, creating a secure atmosphere for online transactions—much like a secret language that only the bank can comprehend.

To further bolster account security, banks ought to adopt two-factor authentication (2FA). This process introduces an additional layer of verification, usually involving a one-time code sent directly to the customer’s mobile device. Even if someone manages to obtain a password, they would still be unable to gain access without this extra step. 2FA serves as a formidable barrier against cybercriminals seeking to exploit compromised login credentials.

Moreover, customers can find peace of mind knowing that their deposits are insured by the Federal Deposit Insurance Corporation (FDIC), which guarantees protection for funds up to a specific limit in case of bank insolvency. This insurance fosters trust among clients, reinforcing their confidence in the stability and reliability of the banking system.

Additionally, banks should establish specialised anti-fraud units equipped with cutting-edge tools and technologies. These teams are responsible for continuously monitoring transactions and quickly identifying any anomalies that may indicate fraudulent behaviour. By employing sophisticated algorithms, they can spot potential threats and act promptly to mitigate them, thereby safeguarding customer accounts and financial assets.

Finally, implementing automatic sign-out features is an effective strategy for reducing unauthorised access risks. If there is no activity detected over a specified period, the system will automatically log out the user from their online banking session. This precaution protects against lapses in attention or forgetfulness and enhances overall online banking security.

As online banking becomes increasingly woven into our financial lives, both users and financial institutions need to collaborate in safeguarding personal and financial information. Acknowledging this partnership, progressive banks are actively working to educate their customers while incorporating vital security features directly into their banking applications. This joint initiative empowers users with the knowledge they need to enhance the security of their online banking activities. In this context, let’s delve into some additional strategies that individuals can weave into their daily routines, alongside the proactive steps taken by banks to cultivate a secure and robust digital banking environment.

To kick off our security checklist for online banking, it’s essential to start with a strong password. Crafting a unique and complex password is crucial for maintaining online safety. Users should steer clear of easily guessable details like birthdays or names; instead, they should create passwords that combine letters, numbers, and special characters for added strength.

Next on the list is setting up two-factor authentication (2FA). By enabling 2FA whenever possible, users add an extra layer of protection. This means that even if someone manages to obtain a user’s password, they would still require a second form of verification before gaining access.

It’s also wise to avoid using public Wi-Fi networks for any banking activities. These networks often lack proper security measures, making it easy for hackers to intercept sensitive data. Users should refrain from logging into their bank accounts or executing important transactions while connected to public Wi-Fi.

Conducting online banking on personal devices is advisable whenever feasible. Using private computers or smartphones significantly lowers the risk of unauthorised access compared to using shared or public machines.

Lastly, keeping software up-to-date is paramount in ensuring ongoing security in online banking practices. Regular updates not only fix vulnerabilities but also enhance overall functionality and protection against potential threats.

By integrating these practices into everyday life and taking advantage of the resources provided by banks, users can better secure their financial transactions in an ever-evolving digital landscape.

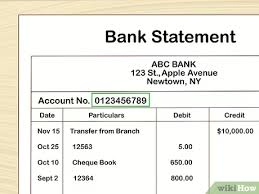

Individuals must monitor their bank accounts closely to detect any signs of fraudulent activity. Regular monitoring is key, and one effective way to stay informed is to set up text alerts that notify users of suspicious transactions. If anything seems off, it’s crucial to report these discrepancies to the bank immediately to prevent unauthorised access from continuing.

Additionally, users should take the time to read through their bank’s official security guides thoroughly. Understanding and implementing the recommendations provided can significantly bolster account protection. Familiarity with policies regarding account security, two-factor authentication, and password strength is vital. Staying updated on any changes or enhancements in the bank’s security measures allows customers to adopt new features that may further safeguard their accounts quickly.

When it comes to online banking, using secure networks is paramount. Accessing bank accounts over trusted connections helps mitigate risks; therefore, it’s wise for users to steer clear of public Wi-Fi when performing financial transactions due to its vulnerability to hacking attempts. For those needing internet access in public spaces, utilising a virtual private network (VPN) provides an extra layer of protection.

Moreover, safeguarding personal devices used for online banking is critical. Users should enable security features like biometric authentication or PIN codes while also installing reputable antivirus and anti-malware software to defend against potential threats. Keeping operating systems and applications up-to-date ensures that any vulnerabilities are patched swiftly, further protecting against malicious exploitation.

Individuals should avoid using public computers to access their bank accounts, as these machines—often found in internet cafes or libraries—carry a heightened risk of malware and keylogging threats. In situations where using a public computer is unavoidable, it’s essential to fully log out and erase any browsing history or saved passwords to safeguard against unauthorised access to banking information.

Additionally, it is crucial to stay informed about prevalent scams targeting bank customers. Users should be cautious of unexpected emails, phone calls, or messages purporting to be from their bank that ask for personal details. It’s wise to verify the legitimacy of such communications by checking with the bank through official channels before responding.

By maintaining vigilance and implementing these protective measures, individuals can significantly diminish the chances of unauthorised access to their accounts and secure their financial data from potential risks.

Furthermore, if you’re considering developing or upgrading your secure banking application, our detailed calculator can help you estimate the associated costs.

In summary, ensuring online banking security is a collective effort involving both banks and their clients. While financial institutions work hard to protect customer data with strong security protocols, it remains vital for users to adopt best practices that enhance their online banking safety. By familiarising themselves with available security features and adhering to recommended guidelines while remaining alert, users play an active role in safeguarding their financial interests.

Maxthon

In the expansive realm of online commerce and digital engagement, the Maxthon Browser emerges as a symbol of trustworthiness and security for its users. Equipped with cutting-edge encryption methods and sophisticated anti-phishing technologies, it diligently protects your personal and financial information from a wide array of online threats. A key feature that distinguishes Maxthon is its robust ad-blocking functionality, which effectively removes intrusive advertisements, creating a smoother and more concentrated browsing experience.

Additionally, Maxthon offers an all-encompassing privacy mode specifically crafted to safeguard sensitive data from unwelcome attention. This protective shield serves as a strong barrier, ensuring that only individuals with the correct permissions can access your confidential information. In today’s digital landscape, where cyber threats are ever-present, such security measures have transitioned from being merely beneficial to essential.

As you navigate the vast internet, every click risks revealing personal details to hidden observers. The need for reliable security solutions has never been more pressing. By activating Maxthon’s privacy mode, users can surf the web with renewed assurance. This feature not only blocks tracking efforts by third-party advertisers but also keeps your browsing history hidden from any potential eavesdroppers who might seek to invade your privacy.

The level of protection provided by Maxthon empowers individuals to venture into online environments without the anxiety of being watched by those who wish to compromise their confidentiality. As concerns about data breaches and online surveillance continue to rise, browsers like Maxthon transform into essential protectors in our everyday lives rather than just simple navigational tools.

Ultimately, opting for Maxthon signifies embracing peace of mind while traversing the complex web of today’s digital landscape. It allows users to take control of their personal information amidst a myriad of threats that lurk in cyberspace.