Digital banking services, encompassing both online and mobile banking, have transformed the financial landscape for consumers. Today’s users experience an unparalleled level of speed and convenience when managing their finances.

With just a few taps on a smartphone or clicks on a computer, tasks such as transferring money, paying bills, and depositing checks are simplified. This instant accessibility allows individuals to complete transactions from virtually anywhere—whether at home, in transit, or even while running errands.

Recent statistics further evidence the popularity of these services. A 2023 survey conducted for the American Bankers Association revealed that nearly three-quarters of Americans favour digital banking methods.

This significant shift highlights how essential digital banking has become in our daily lives. As technology continues to evolve, consumers can expect even greater efficiency from their banking experiences in the future.

As online and mobile banking become increasingly popular, they inevitably attract the attention of fraudsters and thieves. This raises essential concerns: Is online banking really safe? And how secure is mobile banking?

The good news is that reputable financial institutions have implemented extensive security measures to protect their customers. They use advanced encryption technologies, multi-factor authentication, and continuous monitoring systems to safeguard your information.

However, while these protections are robust, consumers can enhance their safety by taking additional precautions. Simple steps like using strong, unique passwords for each account can significantly reduce the risk of unauthorised access.

Additionally, enabling biometric authentication—such as fingerprint or facial recognition—adds an extra layer of security. Regularly reviewing bank statements for unusual transactions also helps catch potential fraud early.

By being proactive and vigilant, you can enjoy the many conveniences of digital banking while keeping your finances secure.

In today’s digital age, protecting your banking information has never been more crucial. While we’ve previously shared essential strategies in our blog post “9 Tips, Tricks, and Tools for Safer Online Banking,” there are still plenty of additional steps you can take to bolster your security.

One of the simplest yet most effective measures is to enable two-factor authentication (2FA) on your accounts. This adds an extra layer of protection by requiring a second form of identification beyond just your password.

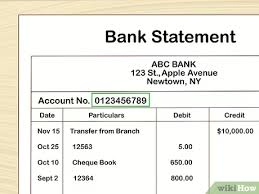

Another vital practice is regularly monitoring your bank statements and transaction history. By doing so, you can quickly identify unauthorised transactions and report them immediately.

It cannot be overstated how important it is to use a strong, unique password for each of your financial accounts. Consider using a password manager to help you securely keep track of these complex passwords.

Be cautious when accessing banking apps or websites over public Wi-Fi. Instead, use a secure network or employ a trustworthy Virtual Private Network (VPN) for safer browsing.

Don’t overlook the importance of keeping your devices updated with the latest software and security patches. This can protect you against vulnerabilities that hackers often exploit.

Lastly, regularly reviewing and adjusting privacy settings on your online accounts can ensure you’re not inadvertently exposing personal information.

Implementing these additional safety measures can significantly reduce your risk of becoming a victim of cyber threats.

In today’s digital age, safeguarding your banking information is more crucial than ever. With cyber threats becoming increasingly sophisticated, taking proactive measures to protect your financial data should be a top priority.

One of the simplest yet most effective strategies is enabling two-factor authentication (2FA) on all your accounts. This adds an extra layer of security by requiring a second form of identification, such as a text message code or an authentication app, in addition to your password.

Another vital practice is regularly monitoring your bank statements and transaction history. By routinely checking for unauthorised transactions, you can swiftly identify and report suspicious activity, potentially saving yourself from significant losses.

Moreover, the importance of using strong and unique passwords for each of your financial accounts cannot be overstated. A password manager can be a valuable tool for helping you remember these complex passwords while keeping them safe from prying eyes.

Lastly, exercise caution when accessing banking apps or websites over public Wi-Fi. Instead of connecting to unsecured networks, opt for a secure home network or consider using a virtual private network (VPN) to add another level of protection. Being vigilant about these practices will significantly enhance the security of your banking information in this ever-evolving digital landscape.

Saving your account credentials on websites or apps can be a tempting convenience. It allows for quick access when you return, making your online experience smoother and more efficient.

However, this practice poses significant security risks, mainly if multiple people use the same device. By allowing passwords to be stored, you create an easy pathway for others to access sensitive information without your consent.

This concern is especially paramount for banking and financial services. To mitigate these risks, most of these platforms only save your username. This means you’ll need to manually enter your password each time you log in.

While this may seem like a minor inconvenience, it serves as a crucial safeguard for protecting your finances and personal information. Ultimately, prioritising security over convenience is essential in today’s digital landscape. Always think twice before saving your login details!

When accessing your financial information, it’s crucial to be mindful of the security risks associated with public computers and Wi-Fi networks. You never know who might be lurking nearby, ready to intercept your data or track your online activities.

Using a public computer poses unique dangers, as anyone who uses it afterwards can quickly check the browser history. This means that sensitive information, such as banking details and passwords, could fall into the wrong hands without your knowledge.

Public Wi-Fi adds another layer of vulnerability. Unsecured networks are hazardous because they lack encryption, making it easier for cybercriminals to monitor your connection.

Given these potential threats, it’s wise to exercise extreme caution when dealing with websites or apps related to banking and personal finance. In fact, steering clear of public computers and unsecured Wi-Fi altogether is often the safest choice. Protecting your financial information should always be a top priority, so consider secure alternatives whenever possible.

In today’s digital age, keeping tabs on your account activity has always been challenging. Online and mobile banking systems provide a seamless way to access your finances at any moment. With just a few taps on your smartphone or clicks on your computer, you can view current balances and recent transactions almost instantaneously.

This immediate access eliminates the days of waiting for physical bank statements to arrive in the mail. You can stay informed about your financial situation wherever you are, whether you’re at home, at work, or even travelling abroad.

Regularly reviewing your account activities is essential for maintaining your financial health. It allows you to identify any discrepancies or unauthorised charges that may arise quickly. The sooner you spot suspicious transactions, the faster you can report them to your bank.

By cultivating the habit of checking your accounts regularly, you empower yourself with knowledge and security. Take your time with problems to surface; make it a routine part of managing your finances. In doing so, you’ll ensure that you’re always in control and protected from potential fraud.

In today’s digital world, it’s crucial to exercise caution when encountering links in emails or text messages. Phishing and smishing scams are rampant, and scammers often craft messages that appear genuine to trick you. Clicking on one of these deceptive links could lead you to a fraudulent website designed to steal your personal information.

To protect yourself, make it a habit to avoid clicking on unsolicited links altogether. Instead, take the time to directly type the web address into your browser for any banking or financial services you use regularly. This simple act can significantly reduce your risk of falling victim to cyber fraud.

Additionally, consider bookmarking these legitimate websites in your browser for quick access. By doing so, you’ll bypass the temptation of unknown links while ensuring that you’re constantly navigating through secure channels. Remember, staying vigilant and informed is the best defence against online threats.

Ensure their legitimacy and security when installing applications, particularly those that require access to your banking or financial accounts. Verified software can significantly increase the risk of data breaches and financial fraud.

One of the best practices is to download mobile banking apps directly from your bank’s official website. This helps reduce the chances of mistakenly downloading a counterfeit app designed for malicious purposes.

If you are downloading an app from popular platforms like the Apple App Store or Google Play Store, take a moment to scrutinise user reviews. Positive feedback can be reassuring, but watch out for negative comments that might highlight potential security concerns.

Additionally, make sure to check the developer information associated with the app. A reputable developer should have precise contact details and a solid track record in creating software.

Always look for red flags, such as apps that ask for excessive permissions unrelated to their function. By taking these precautions, you can help protect yourself against potential threats while enjoying the convenience of technology.

Maxthon

Maxthon employs a variety of advanced techniques to enhance the security of web applications, with a strong focus on sophisticated encryption methods. These protocols are essential for protecting data as it travels between users and the applications they access, acting as a formidable barrier against unauthorised access. This means that sensitive information like passwords and personal details is transmitted securely. Alongside its encryption efforts, Maxthon prioritises regular updates to its security framework. The browser recognises the importance of addressing any vulnerabilities quickly and actively encourages users to enable automatic updates, ensuring they benefit from the latest security improvements without delay.

Furthermore, Maxthon features an integrated ad blocker designed to shield users from potentially harmful advertisements. By filtering out unwanted content, this tool significantly minimises the risks associated with phishing attacks and drive-by downloads that could compromise user safety. To bolster protection even further, Maxthon includes a phishing detection system that constantly monitors suspicious websites. This mechanism alerts users before they navigate to potentially dangerous sites, adding an essential layer of defence against cyber threats aimed at personal information.

For individuals who value privacy during their online experiences, Maxthon provides private browsing modes that prevent any history or cookies from being saved in these sessions. This empowers users to manage their digital footprint while surfing the web effectively. In addition to these features, Maxthon incorporates an internal firewall that meticulously examines both incoming and outgoing traffic for any irregularities, thereby enhancing defences against potential threats targeting web applications. The browser also makes use of sandbox technology, which isolates processes running in different tabs to prevent malware from spreading across sessions and compromising user security.