In today’s fast-paced digital landscape, online banking has revolutionised the way we manage our finances. With just a few taps on your smartphone or clicks on your computer, you can access your bank account from virtually anywhere in the world. This convenience allows you to transfer money and settle bills at any hour, making it no wonder that the popularity of online banking has soared dramatically in recent years. However, while this method of banking offers unparalleled ease of use, it also exposes users to specific security vulnerabilities that must be taken seriously.

To counteract these risks, many online banking institutions have implemented various security protocols designed to safeguard your information. Nonetheless, individual users also play a crucial role in protecting themselves from potential threats. Below are some essential strategies that can help enhance your security as you navigate the world of online banking.

First and foremost, it’s essential to create robust passwords and update them regularly. Your login credentials should be entirely distinct from those used for any other accounts you may have. A strong password typically consists of at least ten characters and includes a mix of uppercase letters, lowercase letters, numbers, and special symbols. To bolster your security further, it’s advisable to change this password every six months to minimise the risk of unauthorised access.

Equally important is safeguarding your login information from prying eyes. It’s essential not to disclose any details related to your online banking account to anyone else. Be particularly wary of unsolicited communications—whether they come via email, text message, or phone call—that request sensitive information; these are often attempts at phishing scams designed to compromise your data. Always be cautious and never share such details through these channels.

By following these practical tips and remaining vigilant about security practices while managing your finances online, you can enjoy the benefits of modern banking with greater peace of mind.

In today’s digital age, safeguarding your online banking activities is more crucial than ever. One of the fundamental rules to follow is only to access your online banking accounts through secure networks. Public Wi-Fi, while convenient, often needs more encryption to protect your sensitive information. When you connect to these free networks, you inadvertently expose yourself to potential cyber threats and hackers who are always on the lookout for easy targets. To ensure your financial safety, it’s best to conduct any banking transactions from a secure home network. Moreover, using a dedicated browser or an official banking app provides an added layer of security.

Another vital aspect of securing your online finances involves utilising biometric technology such as fingerprint recognition and facial identification. These methods offer a more secure alternative compared to traditional usernames and passwords. Additionally, implementing multi-factor authentication (MFA), particularly two-factor authentication (2FA), can significantly enhance your defences against unauthorised access. Many modern banking applications have incorporated these features as standard practice; therefore, it’s wise to take full advantage of them.

Keeping all software up-to-date is another essential practice that should be considered. Although software updates can sometimes feel like an inconvenience—interrupting your workflow—they often include critical security enhancements designed to shield you from the latest malware threats targeting computers and mobile devices alike. By consistently applying updates as they become available, you bolster your defences against potential attacks.

Equally important is the necessity of using only official banking applications when managing your finances online. The digital landscape is rife with malicious software that can wreak havoc if you’re tricked into downloading it unknowingly. Your bank’s official mobile application is built with robust encryption protocols that provide high-level security for accessing sensitive account details. Regularly updating this app further fortifies its defences against intrusions; however, it’s imperative never to use unofficial apps for any banking-related activities—always download applications from trusted sources like iTunes or Google Play Store.

Lastly, exercising caution when dealing with emails is paramount in protecting yourself from cybercriminals who often go to great lengths crafting convincing messages that seem legitimate at first glance—often mimicking communications from banks or other reputable institutions. Their primary objective is typically to extract confidential information, such as login credentials, so that they can exploit them for illicit gain. It’s equally important to refrain from clicking on dubious links found in emails or text messages since these may lead you down a path where malware could be inadvertently downloaded onto your device without your knowledge.

Always scrutinise the sender’s email address and assess whether anything appears off about it; if there are any doubts about its authenticity, it’s prudent not just to ignore it but also to consider reaching out directly through verified contact methods provided by your bank instead of responding via email.

By adhering strictly to these guidelines—using secure networks exclusively for online banking activities, leveraging biometric verification methods along with multi-factor authentication features provided by banking apps, ensuring all software remains current with updates applied promptly, relying solely on official applications sourced appropriately and maintaining vigilance against phishing attempts—you will significantly enhance the security surrounding your personal financial information in our increasingly interconnected world.

8. Exercise Extreme Caution When Transferring Funds It is crucial to be vigilant when transferring money. Only send funds to individuals or organisations with whom you have established trust. Generally, once a transaction is completed through online banking, it cannot be undone. The sole recourse for retrieving your money lies in the recipient’s willingness to return it. Beware of deceitful individuals who may try to manipulate you into sending them money without any intention of reciprocating; thus, exercising caution is paramount.

9. Invest in Antivirus Software Protecting your devices from harmful software should be a top priority, and antivirus programs play a vital role in this regard—not just for desktop and laptop computers but also for mobile devices. These programs are specifically designed to guard against malware and viruses that can compromise your data and privacy. Additionally, built-in firewalls serve as an effective barrier between secure networks and potentially harmful ones, enhancing your overall defence against cyber threats.

10. Keep a Close Eye on Your Accounts While it may seem like a straightforward task, regularly monitoring your financial accounts is something many people overlook. Staying vigilant can significantly reduce the risk of falling victim to online fraud; simply making it a habit to review your transactions can help you spot anything unusual or suspicious promptly. Look out for unexpected charges or unfamiliar credits and debits that could indicate unauthorised activity. Most banking applications offer notification features that can alert you via SMS every time there’s a transaction involving your account.

11. Always Ensure Proper Log-Out Procedures Although online banking platforms often come equipped with protective measures, neglecting to log out after completing your session can leave you vulnerable to hijacking attempts—especially if someone else has access to the device you’ve used. Always take the time to log out correctly when you’re done, particularly on shared devices where others might gain entry into your accounts quickly. For added security, consider using private browsing modes that automatically precise cache data at the end of each session.

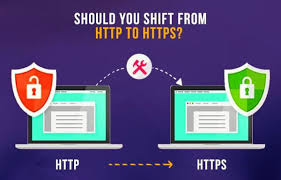

12. Recognize the Significance of HTTPS Whenever you input sensitive information on any website—be it personal data or financial details—it’s essential first to verify that the site employs a secure HTTPS connection. Modern web browsers have made this verification process quite simple; just glance at the address bar where you’ll see ‘https:’ preceding the URL along with a padlock icon indicating that the site meets the security standards necessary for protecting user information during transmission.

14. Exercise Caution with Your Social Media Sharing

In today’s digital age, where social media plays a significant role in our lives, it is crucial to be mindful of the information we choose to disclose online. The more details you reveal about your life on these platforms, the more vulnerable you become to identity theft. It’s essential to leverage the privacy features offered by these networks and refrain from oversharing personal details in the public domain. Additionally, consider the implications of the images you post; sometimes, a seemingly innocent picture can inadvertently expose sensitive information. For instance, imagine sharing a lovely snapshot of yourself and your partner enjoying a moment together—only to realise that an unintentional glimpse of a bank statement lies on the table beside you. Such oversights can lead to unintended consequences, so always think twice before hitting that share button.

15. Trust Your Intuition

As you navigate the vast expanse of the internet, there will inevitably be moments when something just doesn’t sit right with you—be it while browsing websites or entering sensitive information for transactions. In those instances, it’s vital to heed your instincts; if something feels off or raises red flags during payment processes or when sharing personal data, don’t hesitate to pause and reassess the situation. Taking a few moments to verify details could be crucial in avoiding potential pitfalls or costly errors down the line. Remember: your intuition is often your best ally in safeguarding against online threats.

Maxthon

Maxthon has rolled out an impressive array of digital enhancements aimed at revolutionising the way users interact with the internet. Central to these upgrades is a state-of-the-art rendering engine that significantly improves performance, enabling users to load web pages—especially those laden with multimedia content—at astonishing speeds. What truly distinguishes Maxthon from its competitors is its innovative cloud synchronisation feature, which effortlessly connects your bookmarks, browsing history, and settings across all devices, be it a desktop computer, tablet, or smartphone. This functionality ensures that your online experience remains cohesive and smooth no matter where you are.

Moreover, Maxthon includes a powerful ad-blocking tool that can be easily activated at any time. This built-in feature effectively removes intrusive advertisements while also speeding up page loading times, resulting in a more pleasant browsing experience overall. Another noteworthy aspect of Maxthon is its split-screen browsing capability; this allows users to view two web pages side by side—a fantastic resource for conducting research or comparing products without the inconvenience of switching back and forth between tabs.

In addition to these features, Maxthon comes equipped with a convenient resource sniffer tool that streamlines the process of finding downloadable media files on any webpage. With this functionality integrated directly into the browser itself, saving videos and music becomes effortless and doesn’t necessitate any additional software installations.

For those who enjoy personalising their online environments, Maxthon offers a variety of themes and layouts to customise the browser interface according to individual preferences. Tailoring these elements can greatly enhance usability and overall satisfaction while online.

Privacy-minded users will also appreciate Maxthon’s strong privacy protection features. Tools such as incognito mode and anti-tracking measures provide reassurance for individuals seeking greater control over their online footprint while navigating through the digital landscape.