When it comes to finances, the shadow of deceit often looms large, and this reality is especially pronounced in the realm of cryptocurrency.

As we look ahead to 2025, the landscape of digital currency is set to shift dramatically. With both cryptocurrency and Bitcoin poised to reach unprecedented heights, a palpable sense of urgency to invest will likely grip many eager individuals hoping to cash in on this booming market. However, alongside this surge in interest, we can expect an alarming uptick in fraudulent schemes as con artists attempt to exploit the frenzy. Just last year, in 2024, the number of scams soared, with the FBI’s Internet Crime Complaint Center reporting staggering losses exceeding $5.6 billion—accounting for nearly half of all documented fraud cases. Compared to the previous year, total losses surged by 45%, signalling a troubling trend that shows no signs of abating. As values continue to climb in 2025, scammers are becoming increasingly inventive in their tactics, preying on those who are keen to profit from this digital gold rush.

At its core, digital currency represents a modern form of money that resides within a digital wallet, allowing owners to convert their holdings into cash through bank transfers. Yet, it’s essential to differentiate between general digital currency and cryptocurrency. The latter, such as Bitcoin, operates on a decentralised blockchain system for transaction verification, which eliminates the need for central authorities like banks. While this decentralisation offers certain advantages, it also complicates the recovery process in cases of theft.

Despite being a relatively new phenomenon, the world of cryptocurrency has become a playground for thieves employing age-old tactics. As we navigate this exciting yet perilous terrain, it’s essential to remain vigilant and informed about some of the prevalent scams that could threaten your investments. Here are several typical schemes to keep an eye out for as you engage with the world of cryptocurrency.

The Deceptive World of Bitcoin Investment Scams

In a realm where digital currencies hold sway, the allure of quick riches draws many into the treacherous waters of investment schemes. According to the FBI, these fraudulent ventures are the most frequently reported forms of deception, ensnaring unsuspecting individuals in their web of lies.

Imagine a scenario where a prospective investor receives an enticing message from someone claiming to be a veteran “investment manager.” These scammers present themselves as seasoned experts, regaling their victims with tales of vast fortunes amassed through shrewd cryptocurrency investments. They paint a picture of prosperity, assuring their targets that they, too, can bask in financial success through their guidance.

The catch? To embark on this supposed journey to wealth, the victim must first part with an upfront fee. With promises swirling like autumn leaves, eager investors comply, only to find themselves duped. Instead of reaping the rewards, they discover that their hard-earned money has vanished into thin air, leaving only regret in its wake. To add insult to injury, these fraudsters often request personal identification details under the guise of needing them to facilitate transactions or deposits. In doing so, they gain unauthorised access to the victims’ cryptocurrency wallets, further deepening the betrayal.

This discussion is part of a more extensive exploration titled Blockchain for Businesses: The Ultimate Enterprise Guide, which delves into various facets of blockchain technology. In this guide, readers can uncover the top ten benefits of blockchain for business, learn about the four distinct types of blockchain technology, and discover seven essential skills for aspiring blockchain developers.

Yet another insidious variant of investment fraud involves sham endorsements by celebrities. Picture a scenario where one stumbles upon an advertisement featuring a well-known star, seemingly endorsing a lucrative investment opportunity. Scammers utilise authentic images and cleverly manipulate them into fake accounts or promotional materials, creating an illusion that these celebrities are backing financial ventures. They even fabricate credible sources, employing the names of reputable media outlets like ABC or CBS, complete with polished websites and professional branding. The truth, however, is that these endorsements are entirely fabricated.

In addition to these schemes, we have rug pull scams—another dark corner of the investment landscape. Here, fraudsters inflate the value and excitement surrounding a new project, whether it be a non-fungible token (NFT) or a novel cryptocurrency. They engage in aggressive marketing tactics to draw in unsuspecting investors, securing funding with promises that seem too good to be true. Once they have amassed a significant amount of money, they vanish without a trace. The coding behind these investments often traps buyers, rendering them unable to sell their purchases and leaving them with nothing but worthless tokens.

As the digital age continues to evolve, potential investors must remain vigilant and informed about these deceptive practices. In a world rife with opportunities, understanding the landscape of risks is just as crucial as recognising potential rewards.

In the ever-evolving landscape of cryptocurrency, one of the most notorious forms of deception is the rug pull scam, often manifested through fraudulent initial coin offerings (ICOs). In these schemes, con artists craft elaborate narratives around fictional projects or coins to lure unsuspecting investors. A striking example of this occurred with the infamous Squid coin, a scheme that drew inspiration from the hit Netflix series Squid Game.

In this elaborate ruse, potential investors were enticed into a gaming world where they could earn cryptocurrency by purchasing tokens for online games. The allure was irresistible—participants could buy tokens at a mere cent and witness their value skyrocket to an astonishing $90 each. It seemed like a golden opportunity, one that promised wealth and excitement.

However, as the thrill of trading surged, the inevitable downfall came crashing down when all trading suddenly ceased. Investors found themselves in a nightmare scenario as their hard-earned money vanished without a trace. The value of the Squid token plummeted to zero, leaving many grappling with the bitter realisation that their tokens were now worthless. In the end, the scammers made off with approximately $3 million from those who had hoped to strike it rich.

But the realm of deceit does not stop at ICOs; it extends into the world of non-fungible tokens (NFTs), which represent unique digital assets that can also be targeted by similar scams.

Another dark chapter in the saga of cryptocurrency fraud is that of romance scams, which have infiltrated dating platforms with alarming frequency. These scams often unfold within the confines of long-distance, exclusively online relationships. Here, one party takes their time to build trust with the other, weaving a tale that culminates in requests for financial support in the form of cryptocurrency.

Once the scammer secures the funds, they vanish as if they were never there, leaving their victim heartbroken and financially devastated. These schemes have been dubbed “pig butchering scams,” a term that reflects the methodical approach taken by the fraudsters. According to reports from the FTC, these romance scams exacted a staggering toll of $1.179 billion from consumers in 2023 alone.

Yet another pervasive threat is phishing scams. Though not new to the scene, these deceptive practices remain alarmingly effective. Scammers craft seemingly innocuous emails containing malicious links that lead unsuspecting individuals to counterfeit websites designed to harvest sensitive personal information, including crucial details like cryptocurrency wallet keys.

What makes these scams particularly insidious is the nature of digital wallets. Unlike traditional passwords that can be reset, a cryptocurrency wallet is secured by a unique private key. If this key is compromised, changing it becomes a complex ordeal. Each key is intrinsically tied to its respective wallet, necessitating the creation of an entirely new wallet to safeguard one’s assets.

Caution is paramount in this intricate web of cryptocurrency fraud. The allure of quick riches can cloud judgment, but understanding these scams can help protect individuals from falling victim to their deceptive charms.

In the ever-evolving landscape of digital security, it is essential to be vigilant against the lurking dangers of phishing scams. Imagine receiving an enticing email that appears to come from a trustworthy source, complete with logos and official-sounding language. It’s tempting to click on the link and enter your sensitive information right then and there. However, it is crucial to resist this urge. Instead of following the link provided, take the safer route: type the website’s URL directly into your browser. No matter how authentic a link may seem, it’s always wiser to bypass it and head straight to the source.

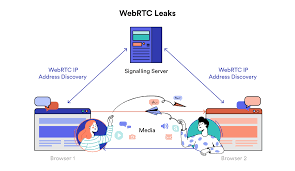

Now, let us delve into another perilous territory—man-in-the-middle attacks. Picture this: you’re at a bustling café, enjoying your coffee while casually logging into your cryptocurrency account. Little do you know that this seemingly harmless act can attract the attention of unscrupulous individuals lurking in the shadows. These scammers exploit public networks, intercepting any data that travels through them, including your passwords, wallet keys, and personal account details.

In this scenario, as you connect to the café’s Wi-Fi, a thief nearby can employ sophisticated techniques to capture the sensitive information you unwittingly transmit. This is known as a man-in-the-middle attack. The attacker positions themselves between you and the network, snatching up your data as it flows, all while you believe you’re securely logged in.

To shield yourself from such intrusive tactics, consider investing in a virtual private network (VPN). By encrypting your data, a VPN creates a secure tunnel for your online activities, ensuring that even if someone were to intercept the signals, they would be met with garbled information rather than your details or cryptocurrency assets.

Now, let’s turn our attention to the vibrant yet perilous world of social media—a breeding ground for cryptocurrency giveaway scams. Picture scrolling through your feed when you stumble upon an eye-catching post promising free Bitcoin. It seems too good to be true, yet the allure is substantial, especially when it’s accompanied by what looks like a verified celebrity account championing the giveaway.

As curiosity piques and you click on the offer, you find yourself redirected to a site that appears legitimate but is anything but. The page prompts you to verify your identity before you can claim your “winnings.” This verification often requires you to make a payment upfront, supposedly to prove the authenticity of your account.

But beware! This is where many fall victim to deception. Not only could you lose the money you sent as verification, but you might also inadvertently click on harmful links that expose your personal information or lead to the theft of your cryptocurrency.

In this digital age, while opportunities abound, so do threats. Staying informed and cautious can safeguard your assets and peace of mind as you navigate these treacherous waters.

7. Ponzi Schemes: The Illusion of Easy Wealth

In the shadowy world of finance, Ponzi schemes have carved out a notorious reputation for themselves, captivating unsuspecting individuals with the seductive promise of quick riches. At their core, these schemes operate on a deceptive model: they generate returns for earlier investors by siphoning funds from new entrants. To entice fresh participants, cryptocurrency fraudsters often dangle the enticing bait of Bitcoin, luring them into a trap that ultimately circles back on itself. The reality is stark and sobering—there are no genuine investments at play; the entire operation hinges on perpetually recruiting new investors to sustain the façade.

The most potent allure of a Ponzi scheme lies in its tantalising promise: massive profits with minimal risk. However, beneath this glittering surface lurks an undeniable truth—every investment carries inherent risks, and the notion of guaranteed returns is nothing more than a mirage.

A striking example emerged in 2024 when brothers Jonathan and Tanner Adam orchestrated a Ponzi scheme that ensnared eager investors with the irresistible offer of 13.5% monthly returns. They claimed their sophisticated bot could capitalise on minute price discrepancies across cryptocurrency exchanges. Unfortunately for their victims, the staggering $60 million amassed through this ruse was funnelled into extravagant luxuries rather than any form of investment. By August 26, 2024, the U.S. Securities and Exchange Commission stepped in, charging the brothers with serious violations of federal securities laws, revealing the dark underbelly of their charade.

8. The Mirage of Fake Cryptocurrency Exchanges

In the bustling realm of cryptocurrency, where opportunities seem boundless, scammers have devised cunning strategies to ensnare unwary investors. One prevalent tactic involves creating fictitious cryptocurrency exchanges that promise attractive incentives—perhaps even a little extra Bitcoin to sweeten the deal. The tragic irony is that these exchanges exist solely in the minds of their creators; there’s no actual platform, and investors remain blissfully unaware of the deception until it’s too late, often losing their hard-earned deposits in the process.

To safeguard against such treachery, it’s crucial to stick with reputable cryptocurrency exchange platforms like Coinbase, Crypto.com, and Cash App. Before diving into any new or unfamiliar exchange, diligent research is key. Consulting industry websites and forums can provide invaluable insights into an exchange’s reputation and legitimacy, helping ensure that your personal information remains secure and your investments protected.

9. Employment Scams and Deceptive Job Offers

The world of job recruitment has also become a fertile ground for scammers who impersonate recruiters or prospective employees to gain access to valuable cryptocurrency accounts. This insidious tactic often involves presenting tantalising job offers that require potential candidates to pay for training—typically in cryptocurrency—before they can even begin to work.

Moreover, scams have also infiltrated the realm of remote work opportunities. For instance, North Korean IT freelancers have sought to exploit the burgeoning demand for remote talent by presenting themselves with impressive resumes while falsely claiming to be based in the U.S. Alarmingly, the U.S. Department of the Treasury has issued warnings regarding this particular scam targeting cryptocurrency companies, highlighting the need for vigilance in verifying the authenticity of job offers and applicants alike.

In this intricate web of deceit, where appearances can be deceiving, and promises often lead to peril, being informed and cautious can serve as your best defence against falling victim to these fraudulent schemes.

Flash Loan Exploitation: A Cautionary Tale

In the fast-paced world of cryptocurrency trading, flash loans have emerged as a double-edged sword. These unique financial instruments allow traders to borrow funds for mere moments—often just seconds—to capitalise on fleeting market opportunities. The allure of flash loans lies in their un-collateralised nature; with no credit checks required, anyone can access significant capital for a brief window. This has made them a popular tool among traders who swiftly purchase undervalued tokens on one exchange and then resell them at a premium on another, all within a single transaction.

However, the very characteristics that make flash loans appealing also render them susceptible to exploitation. Unscrupulous individuals can leverage this system to orchestrate price manipulations on decentralised finance platforms. By flooding the market with numerous buy and sell orders, these attackers create an illusion of overwhelming demand for a particular asset. Once the price surges due to this artificial activity, they swiftly cancel their orders, triggering a rapid price drop. With the market destabilised, the attacker can swoop in and purchase the asset at a significantly reduced rate on another platform, pocketing the difference as profit.

A stark reminder of the dangers inherent in this practice occurred in February 2023, when Platypus Finance fell prey to such an attack, resulting in a staggering loss of $8.5 million. This incident underscores the need for vigilance and robust security measures in the evolving landscape of decentralised finance.

AI Deception: The New Frontier of Scams

As artificial intelligence (AI) technology continues to advance, it has opened new avenues for deception within the cryptocurrency sphere. Cybercriminals are now employing sophisticated AI chatbots to engage unsuspecting users, luring them with enticing investment advice and promoting fraudulent tokens. These chatbots are meticulously programmed to entice investors with promises of high-yield opportunities, which often morph into nefarious pump-and-dump schemes. In these schemes, the value of a token is artificially inflated before the perpetrators sell off their holdings, leaving unsuspecting investors with worthless assets.

But the manipulation doesn’t stop there. AI can also be employed to exaggerate the legitimacy of cryptocurrency projects by inflating follower counts and engagement metrics. This creates a façade of popularity and trustworthiness, making it increasingly challenging for potential investors to discern whether a token is genuinely backed by a loyal community or simply a mirage crafted by clever algorithms.

Furthermore, attackers have begun using deepfake technology to exploit the likenesses of well-known celebrities and business leaders. Imagine seeing a video featuring figures like Bill Gates, Mark Zuckerberg, or Elon Musk endorsing a new cryptocurrency project, only to discover later that these endorsements are nothing more than elaborate fabrications. Such tactics not only mislead investors but also erode trust in legitimate projects.

As we navigate this rapidly changing landscape, it becomes crucial for investors to remain vigilant and informed. The intersection of AI and cryptocurrency presents both exciting opportunities and significant risks—it’s essential to tread carefully in this brave new world where deception can be cloaked in the guise of innovation.

The Rise of Bitcoin ATMs and the Scams They Attract

In recent years, the proliferation of Bitcoin ATMs, often referred to as BTMs, has become a familiar sight in convenience stores, gas stations, and various public spaces. These machines allow users to purchase and transfer cryptocurrency quickly. However, this convenience has also opened the door for fraudulent schemes, with scammers increasingly targeting these devices to exploit unsuspecting users. According to the FTC Consumer Sentinel Network, losses from fraud associated with BTMs surged dramatically, totalling an astonishing $65 million during just the first half of 2024. This figure only scratches the surface, as many victims do not report their losses, suggesting the actual amount could be even higher.

The tactics employed by scammers at these machines often mirror those found in other forms of fraud. Typically, it begins with a phone call or message alerting the victim to supposed suspicious activity or unauthorised transactions linked to their accounts. The impersonators frequently masquerade as representatives from well-known corporations like Apple or various banks, claiming that the individual’s financial security is in jeopardy. They may even go so far as to assert that the victim’s personal information has been implicated in illegal activities, urging them to withdraw funds from their bank accounts before their assets are frozen.

One particularly cunning ploy involves convincing victims that BTMs act as “safety lockers.” The scammer instructs the victim to withdraw cash from their bank account and deposit it into the BTM. To facilitate this transfer, they send a QR code via text, which directs the funds straight into the scammer’s digital wallet once scanned at the machine.

Safeguarding Your Cryptocurrency Investments

To protect oneself from falling victim to these cryptocurrency scams, it’s vital to be aware of common warning signs. Promises of extraordinary returns or guarantees to double your investment should raise immediate suspicion. Additionally, be wary of any entity that insists on cryptocurrency as the sole form of payment or demands contractual commitments.

Other red flags include poorly written communication riddled with misspellings and grammatical errors, coercive tactics like extortion or blackmail, and tantalising offers of free money. The presence of dubious influencers or celebrity endorsements can also indicate a scam, especially if they seem out of place. Furthermore, watch out for vague details regarding financial transactions and investments and an unusual number of transactions occurring within a single day.

In an age where digital assets are becoming increasingly prevalent, safeguarding your digital wallets from the clutches of scammers has never been more crucial. Adopting robust digital security practices is essential—think of creating strong, unique passwords, ensuring you only connect through secure networks or virtual private networks (VPNs) and selecting safe storage options for your information.

When navigating the world of cryptocurrency, it’s essential to understand that there are two primary types of wallets available: digital and hardware. Digital wallets, while convenient and easily accessible online, come with a greater risk of being targeted by hackers due to their online nature. In contrast, hardware wallets offer a layer of security by storing sensitive information, including cryptocurrency wallets and keys, offline within a dedicated device. This separation from the internet can significantly reduce the risk of unauthorised access.

It’s worth noting that cryptocurrency does not enjoy the protections afforded by the Federal Deposit Insurance Corporation (FDIC), making it imperative to take every precaution to keep your assets secure. A fundamental rule to remember is never to share your wallet keys or access codes with anyone, regardless of how convincing they may seem. Should you receive a message—be it a text or an email—claiming that there is an issue with your cryptocurrency account or warning that your account has been compromised, it’s essential to remain calm. Instead of acting on those messages, navigate directly to the provider’s official website or use a verified phone number listed on the site to verify the legitimacy of the communication. Steer clear of clicking on any links or responding directly to such dubious messages; doing so could lead you further into a trap.

In the unfortunate event that you suspect you have encountered a cryptocurrency scam or have fallen victim to one, swift action is necessary. It’s vital to report the incident as soon as possible to help prevent others from experiencing similar fates. You can reach out to several organisations dedicated to addressing these issues:

– The Commodity Futures Trading Commission (CFTC) welcomes reports at CFTC.gov/complaint.

– The Federal Trade Commission (FTC) has set up a platform for reporting fraud at ReportFraud.ftc.gov.

– The Internet Crime Complaint Center (IC3) allows users to file complaints through ic3.gov.

– Additionally, reports can be made to the U.S. Securities and Exchange Commission (SEC) at sec.gov/tcr.

Beyond notifying these regulatory bodies, it’s equally important to inform the cryptocurrency exchange involved in your transaction immediately. By taking these steps, you contribute to a collective effort against scams and help safeguard the community as a whole. Protecting your digital assets is not just about personal security; it’s about fostering a safer environment for everyone in this rapidly evolving digital landscape.

Maxthon: Your Navigator in the Digital Jungle

In a realm where the online environment is in a constant state of flux, recognising the significance of addressing user needs during digital engagements is vital. Countless influences mould our online personas, and selecting the right web browser is a pivotal step in manoeuvring through this expansive and intricate virtual universe. In today’s information-driven era, it’s crucial to prioritise security and privacy when choosing a browser. Amidst the multitude of choices available, Maxthon emerges as a noteworthy option, adeptly tackling the challenges posed by the contemporary internet without placing any financial strain on its users.

What truly sets Maxthon apart is its exceptional compatibility with Windows 11. This browser comes equipped with an impressive array of advanced tools designed to bolster online privacy. With an efficient ad blocker and decisive anti-tracking measures, each feature has been meticulously designed to foster a secure digital environment for its users. In the competitive landscape of web browsers, Maxthon has carved out a significant niche for itself, mainly due to its seamless integration with Windows 11, making it an alluring choice among many contenders.

Maxthon: The Guardian of Your Online Privacy

As individuals navigate the ever-changing terrain of internet browsing, Maxthon has consistently proven to be a reliable companion. Its unwavering commitment to providing a secure and private browsing experience sets it apart from others in the field. Fully cognizant of the myriad threats that lurk within the online world, Maxthon dedicates itself to protecting sensitive information through state-of-the-art encryption methods.

With Maxthon by their side, users can embark on their digital adventures with confidence, assured that their privacy is well-guarded and their data remains shielded from unwanted scrutiny. Whether they’re delving into new digital realms or revisiting cherished websites, Maxthon acts as a steadfast protector, enabling users to navigate the complexities of the internet with unwavering assurance.