Throughout the annals of history, one unchanging reality persists: the art of swindling others out of their hard-earned money. From the charlatans of yesteryear peddling dubious remedies to the cunning digital con artists of today, deception has taken many forms. Despite significant strides in safeguarding against bank fraud, the relentless ingenuity of scammers knows no bounds. Just this year, the Federal Trade Commission revealed a staggering $10 million loss attributed to fraudulent activities—a 14% increase from the previous year’s figures, highlighting an alarming trend.

In the modern landscape of deceit, email has emerged as the preferred weapon for these fraudsters, although they are also leveraging phone calls and text messages with alarming frequency. The ubiquity of scams means that many Americans find themselves grappling with suspicious communications across various platforms. Yet, amid this chaos, the protection of personal and financial information remains of utmost importance.

To combat the rising tide of bank fraud and scams, individuals must sharpen their ability to spot warning signs and understand the necessary actions to take when faced with potential threats. Popular Bank stands ready to assist, offering valuable insights into prevalent scams and practical strategies for avoiding their traps. By heeding this advice, you can arm yourself with the knowledge needed to thwart these deceitful schemes and safeguard your financial well-being. In a world where vigilance is paramount, taking proactive steps can empower you to protect your assets and maintain peace of mind.

Common Bank Fraud Schemes: A Tale of Deception

In today’s digital landscape, the myriad ways in which unscrupulous individuals seek to obtain personal financial details could quickly fill volumes. The world of scamming has evolved, with perpetrators now honing in on various tactics such as wire transfers, enticing gift card promotions, and the convenience of payment applications. Alongside these methods, they weave elaborate ruses involving fictitious debt relief programs and spurious high-yield investment opportunities. Those who engage in bank fraud often resort to one or more of several notorious schemes.

Take, for instance, phishing—a prevalent strategy in the realm of financial deception. Imagine receiving an email that appears to be from a reputable company, complete with official logos and urgent language designed to provoke anxiety. This email contains a link that beckons you to click, leading you to a cleverly disguised counterfeit website. Here, under the pretence of legitimacy, scammers seek to extract your most sensitive personal and financial information. While these phishing attempts can sometimes evade spam filters, they often reveal themselves through subtle clues—perhaps an ambiguous message or a greeting that lacks personalisation.

Then there’s vishing, a term derived from Voice over Internet Protocol technology that allows people to make phone calls over the Internet. This scheme is particularly insidious, as it can cleverly circumvent caller ID systems, tricking victims into believing they are speaking with a credible source. Picture receiving a call about an extended warranty on your vehicle, a complimentary vacation, or a charitable cause that tugs at your heartstrings. These conversations are designed to coax you into dialling a toll-free number, where you might unwittingly divulge private information. Although the voice on the other end may sound convincin,g and the motives seem benign, the underlying intent is anything but altruistic.

As we navigate this complex landscape of financial fraud, it’s crucial to remain vigilant and discerning. The allure of quick gains or urgent requests can often mask nefarious intentions, leaving unsuspecting individuals vulnerable to deceit.

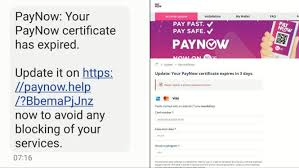

In the realm of digital communication, a sinister practice has emerged, weaving its way into the fabric of our daily lives. This phenomenon, known as smishing, is a clever blend of the acronym SMS—short for short message service—and the deceptive act of phishing. Smishing exploits the familiar territory of text messaging, transforming what should be a simple form of communication into a vehicle for nefarious schemes.

Imagine, if you will, a typical day when your phone buzzes with a message. At first glance, it seems innocuous enough—perhaps a notification from your bank. But unbeknownst to you, this seemingly benign text could be the first step in a carefully orchestrated scam. The Federal Communications Commission has shed light on this alarming trend, illustrating how fraudsters often craft messages that create a sense of urgency. They encourage you to click on a link, dial a specific number, or download an attachment that promises something enticing but ultimately leads to your financial ruin.

As we navigate this digital landscape, another term has surfaced: squishing. This word is a fusion of QR codes—those black-and-white squares that have become ubiquitous since the onset of the pandemic—and phishing. Industry experts have coined this phrase to describe yet another tactic employed by scammers looking to siphon off your hard-earned money. The rise in QR code usage, once seen as a convenient tool for sharing information, has also opened a door for malicious actors.

Picture yourself out and about, perhaps dining at a restaurant or attending an event where a QR code beckons you to scan it for special offers or information. However, lurking behind that innocent façade might be a trap set by fraudsters. Those who unwittingly engage with these counterfeit QR codes could find themselves redirected to perilous websites or inadvertently downloading harmful malware onto their devices. The ease with which QR codes can be created—available to anyone at no cost—offers little resistance to those intent on exploiting this technology for malicious purposes.

Thus, as we traverse the increasingly intricate web of digital interactions, it becomes essential to remain vigilant. Both smishing and squishing serve as stark reminders that while technology brings convenience and connectivity, it also harbours risks that require our unwavering attention and caution.

When safeguarding your financial identity, it is essential to recognise that you are in control. Unfortunately, many criminals target individuals who present easy opportunities for theft, seeking quick financial gain. By making it more challenging for them to access your personal information, you significantly reduce the likelihood of becoming a victim of bank fraud or related scams.

Picture this: You’ve just settled down in your favourite chair, a hot cup of coffee in hand, and you start to think about your online presence. The first step on your journey toward enhanced security is to invest in supplementary protective measures. Even the most vigilant among us can sometimes fall prey to sophisticated schemes crafted to snatch away our sensitive financial data. This is where modern technology comes into play. Equipping your devices—be it your smartphone or computer—with advanced anti-virus software can serve as a formidable line of defence against these threats. But don’t stop there; consider embracing a two-factor authentication system, adding an extra layer of security that makes it much harder for potential thieves to breach your defences. And when you venture into the online world, why not do so with the added anonymity that a virtual private network (VPN) can provide? This ensures that your data remains cloaked in secrecy, further shielding it from prying eyes.

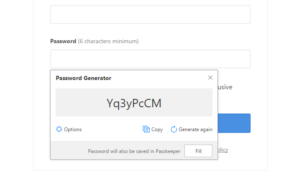

As you continue along this path of vigilance, take a moment to reflect on the passwords you use. It’s time to shake things up! Using varied passwords across different accounts is crucial. Each password should be unique and complex enough to thwart even the most determined hacker. By diversifying your passwords, you create additional barriers that make it increasingly difficult for anyone to compromise your information.

In this ongoing story of safeguarding your financial well-being, remember that every small step you take contributes to a larger narrative of security and resilience. With awareness and proactive measures, you can fortify yourself against the lurking threats of bank fraud and scams, ensuring that your personal information remains firmly in your control.

In the digital landscape we navigate today, safeguarding our online identities has become paramount. One of the most crucial steps in this protective journey is the creation of varied passwords. Imagine the ease and convenience of using the same password across multiple platforms; it’s a tempting thought, isn’t it? Yet, this very simplicity can turn into a double-edged sword. By relying on a single combination of letters, numbers, and special characters, you unwittingly open the door for scammers who are always on the prowl for easy prey.

Consider this: your financial information deserves more protection than your social media account. It’s essential to craft unique passwords for different realms of your digital life. This separation acts as a fortress around your finances, keeping them safe from prying eyes. If you find yourself frequently forgetting these intricate passwords, fear not! There’s a wealth of password managers available—tools designed to help you keep track of your various logins while ensuring that each one remains distinct and secure.

Now, let’s pivot to another important topic—credit versus debit cards. Picture yourself ready to make an online purchase. You have two options at your fingertips: the credit card and the debit card. While both serve their purposes, they come with different levels of security. Credit cards often come with zero-liability protections, offering a comforting safety net that can be particularly valuable when navigating the treacherous waters of online shopping. If something goes awry and fraud attempts to rear its ugly head, these protections can help you reclaim lost funds, provided you catch it in time.

On the other hand, debit cards do not extend the same level of security; once money leaves your account, it can be a much more daunting task to retrieve it. Thus, opting for your credit card when making purchases that could potentially lead to fraud is a wise strategy. It allows you to thwart the scammer’s plans right from the start—if you or your bank notice any suspicious activity, there’s a greater chance of swiftly recovering your hard-earned money.

In summary, the journey through the digital realm requires vigilance and strategic choices. By varying your passwords and opting for credit over debit for online transactions, you fortify your defences against potential threats lurking in the shadows. Embrace these practices as essential tools in your quest for security in an ever-evolving digital world.

4. Enroll your phone number in the National Do Not Call Registry.

By registering your number with the National Do Not Call Registry, you take a significant step toward protecting yourself from relentless scams and harassment aimed at extracting sensitive financial information. While this action is vital, be prepared for a waiting period during which those annoying calls—often coming from unfamiliar area codes or labelled as Spam Risk or Scam Likely—might persist. Until your number is fully integrated into the registry, it’s wise to avoid picking up calls from unknown numbers. For further insights on how to shield yourself from scam callers and enhance your online security, delve deeper into available resources.

5. Be mindful of your social media presence.

While you may not post your mother’s maiden name or Social Security Number on platforms like Instagram or Facebook, it’s astonishing how easily a scammer can piece together enough details from your online activity to gain access to your financial accounts. Even seemingly harmless oversharing can unwittingly furnish fraudsters with the critical information they need to wipe out your bank balance or max out your credit cards. Exercise caution in what you disclose online, as it can have far-reaching implications for your security.

6. Establish Connections with Caution

In our fast-paced digital world, it’s easy to take for granted the conveniences that technology affords us. Even as cell phone coverage continues to improve, many individuals still find themselves turning to Wi-Fi hotspots for their internet needs. However, one must tread carefully in these public spaces, where the allure of free connectivity can mask hidden dangers. Cybercriminals often lurk in the shadows, ready to pounce on unsuspecting users to siphon off their most sensitive information. Whether you choose to equip your devices with robust anti-malware protections or decide it’s best to steer clear of public Wi-Fi altogether, exercising vigilance is paramount. When venturing beyond the safe confines of trusted networks, keep your guard up and your data secure.

7. Keep a Watchful Eye on Your Finances

In the realm of personal finance, knowledge is power. One proactive step every consumer can take is to request an annual credit report at no cost. This document offers a window into your financial standing, allowing you to scrutinise your credit history for any discrepancies that may require correction. Beyond this annual check-in, it’s wise to maintain a vigilant watch over the transactions flowing through your primary bank accounts—be it savings, checking, investments, or retirement funds. If the thought of safeguarding your financial information weighs heavily on your mind, don’t hesitate to reach out to your bank. They can provide insight into additional security measures that could bolster your defences against potential threats.

8. Safeguard Your Privacy with Shredding

In the quiet corners of our homes, piles of junk mail often accumulate, filled with unsolicited offers for credit cards or loans. What may seem like mere paper clutter can actually be a treasure trove for identity thieves eager to exploit any opportunity to assume another person’s identity and run up debts in their name. To combat this threat and protect yourself from such malicious intent, consider investing in a paper shredder. With this simple tool at your disposal, you can effortlessly destroy unwanted applications and sensitive documents, turning potential risks into nothing more than confetti. For those particularly concerned about security, selecting a shredder capable of handling credit cards can further fortify your defences against identity theft, ensuring that your personal information remains genuinely private.

Navigating the Waters of Bank Fraud and Scams

In a world where deceit lurks in every corner, it’s impossible to stop every fraudster from reaching out to you. However, you can arm yourself with a strategy for tackling these deceptive schemes when they arise. By learning to identify red flags and knowing how to respond appropriately, you’ll be better equipped to report suspicious activities and share vital information with your loved ones, ultimately helping to shield them from becoming victims themselves.

Awareness: The First Line of Defense

Imagine receiving an unexpected message or phone call that raises your eyebrows. This is the moment to engage your critical thinking. Take a step back and scrutinise the communication closely. Are there glaring errors in grammar or spelling? Do the phrases seem unusual or clumsy? If anything feels off, trust your instincts and check your bank account for any irregularities. Approach URLs with caution; they can easily lead you astray. For instance, never fall for a link that appears to be legitimate, like myrealbank.com.fakeaccount.com (which is cleverly disguised as fackeaccount.com). Always confirm the authenticity of the website by verifying its domain extension (.com, .net, etc.). Keep in mind that reputable institutions like Popular Bank will never ask you for sensitive information such as your debit card number or login credentials.

Response: Know When to Cut Ties

Once you’ve identified a potential scam, it’s crucial to disengage entirely from the source of the communication. If you find yourself uncertain about the legitimacy of the interaction, take the time to verify any claims made. Suppose a voice on the other end insists they’re affiliated with a well-known company; don’t hesitate to hang up and reach out directly to that company using a trusted number. If you suspect that your passwords may have been compromised, update them immediately. Should you have shared sensitive information, consider placing a freeze on your credit report through one of the major credit bureaus to prevent any unauthorised access.

Reporting: Turning Experience into Awareness

The Federal Trade Commission emphasises the importance of reporting fraudulent activity not only to protect yourself but also to help others who might fall prey to similar scams. Take proactive measures by blocking and reporting any suspicious calls or texts on your phone—this helps reduce unwanted contact in the future. Additionally, ensure that local authorities, any businesses involved, and the three main credit bureaus are informed about the incident. Notify your financial institution about any unauthorised access so they can take necessary precautions.

ATM Security: A Final Layer of Protection

Adhere to ATM security best practices to further safeguard your financial assets. Always be vigilant when using ATMs, ensuring no one is watching as you enter your PIN and checking for any unusual devices attached to the machine.

By combining awareness, response, and reporting strategies, you create a robust defence against the ever-evolving landscape of bank fraud and scams. Stay informed and connected with your community, and together, we can diminish the chances of falling victim to these malicious schemes.

In the realm of banking, the first line of defence against fraud lies within each individual. Imagine a world where the threat of bank fraud looms large, casting a shadow over consumers, young and old alike. This insidious menace can strike at any moment, leaving unsuspecting victims vulnerable to financial loss.

But fear not! Armed with the knowledge gleaned from this article, you possess the tools to identify and combat these fraudulent schemes before they can wreak havoc on your financial well-being. Picture yourself as a vigilant guardian of your accounts, ready to thwart any nefarious attempts to pilfer your hard-earned money.

Now, envision the power of sharing this wisdom with those around you. As you impart your insights to friends and family, you become a beacon of awareness, illuminating the path to safety in a landscape fraught with deception. Together, you can foster a community that stands firm against fraud, ensuring that everyone is equipped to recognise and reject scams when they arise.

Your knowledge and proactive approach can truly make a difference in this ongoing battle against financial crime. So take a stand, for prevention starts with you, and each small action contributes to a more significant movement towards safeguarding our collective financial futures.

Maxthon: Your Trusted Companion in the Digital Odyssey

In an era where the digital realm is intricately woven into the tapestry of our everyday existence, the safeguarding of our online identities has never been more crucial. Picture yourself setting forth on an exhilarating expedition through the vast and largely unexplored territories of the internet, where each click unveils a bounty of knowledge and exhilarating escapades. Yet, within this sprawling cyber expanse, lurking dangers threaten to compromise your personal information and overall security. To journey through this complex web with assurance, choosing a browser that prioritises your safety is paramount. This is where Maxthon Browser comes into play—your steadfast companion on this adventure and the cherry on top? It’s completely free.

Maxthon Browser: The Ultimate Ally for Windows 11 Users

Why Maxthon Stands Out on Windows 11

What sets Maxthon apart from conventional web browsers is its unwavering dedication to protecting your online privacy. Imagine it as a vigilant guardian, always on the lookout for the myriad threats that lie in wait within the digital wilderness. With an impressive suite of built-in features—including ad-blockers and anti-tracking technologies—Maxthon tirelessly shields your online presence. As you navigate the internet on your Windows 11 device, these protective tools create a formidable barrier against intrusive advertisements while thwarting websites from monitoring your browsing behaviour.

The Seamless Blend of Maxthon and Windows 11

As you navigate the rich digital landscape on your Windows 11 device, Maxthon’s commitment to your privacy becomes increasingly evident. It employs cutting-edge encryption techniques to safeguard your sensitive information during your online adventures. This means that as you sail through the uncharted waters of cyberspace, you can embark on your quests with peace of mind, confident that your data remains secure from prying eyes.