As technology evolves, so too do the tactics employed by fraudsters. It is imperative for financial institutions to brace themselves for the relentless tide of fraud attacks, all while ensuring that their customers enjoy a smooth and hassle-free experience. This raises an important question: How can banks deliver exceptional customer service while simultaneously bolstering their security measures?

To address this critical issue, it is essential to delve into the intricacies of banking fraud investigation, detection, and prevention.

So, what does banking fraud detection truly entail? At its essence, banking fraud detection encompasses a diverse array of techniques and technologies aimed at safeguarding a bank’s most vital assets—customer data, financial resources, and secure systems. The primary goal of fraud detection is to pinpoint suspicious activities and potential fraudulent actions as they unfold in real time, thereby enabling swift intervention whenever a threat is detected.

This intricate process involves sifting through vast amounts of transaction data, scrutinizing for irregular patterns, and harnessing cutting-edge technologies like artificial intelligence and machine learning. These advanced tools are instrumental in outmaneuvering increasingly cunning perpetrators. In fact, fraud detection does not operate in isolation; it collaborates seamlessly with preventive strategies to create a formidable barrier against catastrophic breaches that could have dire consequences for customers.

Banking fraud manifests in various forms, which can generally be divided into two principal categories: account takeover tactics and broader banking fraud schemes. Grasping the nuances of both types is crucial for effectively identifying and mitigating fraudulent activities within financial institutions.

As we navigate this ever-evolving landscape, understanding these threats becomes not just necessary but vital for the protection of consumers and the integrity of financial systems alike.

In the digital age, where online interactions are as commonplace as morning coffee, the threat of account takeover (ATO) looms large. This term describes a chilling scenario where a malicious individual unlawfully infiltrates a customer’s account, often by taking advantage of vulnerabilities within security frameworks. The tactics employed by these fraudsters are as varied as they are cunning.

One particularly insidious method is the art of phishing. Imagine receiving an email that appears to be from your bank, complete with logos and official language, beckoning you to click a link or provide personal details. These deceptive messages can come in many forms—texts, phone calls, or emails—all designed to ensnare unsuspecting victims into divulging sensitive information like passwords or account numbers.

Then there’s credential stuffing, where cybercriminals harness stolen login information harvested from previous data breaches. Picture a thief armed with a trove of usernames and passwords, attempting to unlock multiple accounts, banking on the unfortunate reality that many individuals reuse their credentials across various platforms.

Session hijacking represents another layer of this digital menace. Here, attackers lie in wait for an opportunity to seize active banking sessions by capturing session tokens. With this stolen access, they can bypass the usual login protocols and assume control over a user’s account without arousing suspicion.

Social engineering takes a more psychological approach. In this method, fraudsters skillfully manipulate their victims into revealing critical information or unwittingly taking actions that jeopardize their account security. Whether it’s clicking on a harmful link or transferring money under false pretenses, these scams prey on human emotions and trust.

Password spraying adds yet another dimension to the arsenal of tactics. Rather than bombarding individual accounts with numerous password attempts—thus raising alarms—fraudsters employ a more subtle strategy. They systematically test commonly used passwords across a wide array of usernames, striving to remain under the radar while seeking entry into vulnerable accounts.

While account takeover methods zero in on compromising individual user accounts, general banking fraud casts a wider net, targeting weaknesses within entire banking systems and processes. One prevalent form of this fraud involves the use of fraudulent documents. Picture criminals brandishing fake IDs or altered financial records as they attempt to open bank accounts or secure loans under false pretenses.

Check fraud is another significant concern, encompassing a range of deceptive practices such as forging or counterfeiting checks to illicitly withdraw funds from victims’ accounts. This type of fraud can leave individuals reeling as they discover the unauthorized drain on their finances.

Then there’s the shadowy realm of money laundering. Here, fraudsters seek to “clean” their ill-gotten gains by funneling them through legitimate financial channels, obscuring their origins. In this elaborate dance, unwitting banks may unknowingly assist these criminals in their efforts to disguise dirty money as lawful earnings.

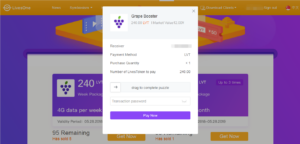

Finally, we encounter authorized push payment scams. In these schemes, fraudsters employ deceitful tactics to convince victims to willingly authorize transactions that benefit the scammer. The victims often believe they are engaging in legitimate transactions, only to find themselves duped and their funds transferred away from them.

In this intricate landscape of digital deception, vigilance is key. Awareness of these tactics empowers individuals to safeguard their accounts and protect themselves from becoming unwitting participants in a world of financial fraud.

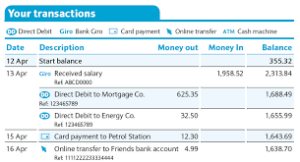

When a bank is confronted with a fraudulent claim, a series of actions typically unfold to address the situation. Imagine a customer stepping into the bank, their face marked by concern as they report suspicious activity on their account. In response, the bank springs into action, first embarking on a quest to ascertain the authenticity of the disputed transaction. They delve into details like the transaction’s location, the time it occurred, and the customer’s usual spending habits, piecing together clues that could reveal whether the claim holds water.

As the investigation unfolds, the bank commits itself to a timeline, aiming to resolve the claim within ten business days. If their inquiries uncover signs of widespread fraud, they don’t hesitate to alert federal authorities, ensuring that larger schemes are scrutinized. In more intricate cases involving money laundering or organized crime, Suspicious Activity Reports (SARs) are filed, serving as vital documentation in the fight against financial misconduct.

But how do banks guard against these deceptions in the first place? They employ an arsenal of sophisticated tools and techniques designed to unearth fraudulent activities before they escalate. One of the earliest methods involved rule-based systems—rigid frameworks that flagged transactions based on fixed parameters, such as spending limits or geographic inconsistencies. However, savvy fraudsters quickly learned how to navigate around these simplistic barriers.

Enter machine learning: a modern marvel in fraud detection. Banks harness this technology to sift through mountains of data, detecting irregularities that might escape the human eye. This dynamic system continuously evolves, improving its capacity to identify potentially illicit transactions as it learns from past occurrences.

In addition to these advanced algorithms, banks also rely on telecommunications monitoring. With tools like multifactor authentication (MFA) and secure messaging platforms, both banks and their customers remain vigilant against suspicious activities. Predictive analytics further enhances this defense; by analyzing behavior patterns, banks can proactively flag transactions that deviate from a customer’s norm.

The Shadowy World of Financial Deception

In the underbelly of the financial realm, a nefarious practice known as money laundering takes root. Here, illicitly acquired funds require a sophisticated form of “cleaning” to mask their tainted origins. This elaborate scheme unfolds when those with malicious intent funnel dirty money through seemingly legitimate financial pathways, seeking validation from trusted institutions.

To evade the watchful eyes of law enforcement and banking authorities, these criminals often break down their ill-gotten gains into smaller sums, dispersing them across multiple accounts. This intricate web of transactions complicates any attempts at tracing the money back to its original, dubious source. As if that weren’t enough, many resort to offshore accounts or embrace the anonymity offered by digital currencies, further obscuring the trail of their wealth. For financial institutions, this evolving challenge necessitates constant innovation in detection methods to stay one step ahead of increasingly crafty schemes.

Meanwhile, the threat of account protection looms large. Unscrupulous actors are adept at pilfering sensitive login credentials, card details, or even physical cards from unsuspecting customers, leading to what is known as an account takeover (ATO). Once they gain access, these fraudsters exploit the compromised accounts as if they were their own. Their tactics range from card-not-present (CNP) fraud to counterfeit schemes and unauthorized digital transfers.

A startling statistic emerges from the records kept by the Identity Theft Resource Center: during the first three quarters of 2023 alone, there were 2,116 documented data breaches, surpassing the previous record of 1,862 set in 2021. The primary means of this information theft? Phishing and hacking tactics that prey on the unwary. In response, many financial institutions have turned to multifactor authentication as a bulwark against these threats.

As new customers venture into banks for their financial needs, another layer of vulnerability surfaces during the onboarding process. Essential information can be lost in translation, misinterpreted, or—most alarmingly—stolen. To combat these risks, regulatory measures such as KYC (Know Your Customer) and AML (Anti-Money Laundering) have been established to ensure that customer identities are thoroughly verified and safeguarded.

Despite these regulations, financial institutions have uncovered millions of fraudulent accounts over the years. This issue is particularly pronounced among banks that entice new clients with appealing cash bonuses for signing up. Such incentives can inadvertently attract those looking to exploit the system.

At the heart of these issues lies credential theft, a persistent danger that banks must vigilantly monitor. Identifying suspicious activity on customer accounts is paramount. To mitigate fraud, banks meticulously scrutinize various factors including transaction amounts, spending patterns, categories of purchases, and merchant names. It’s a continual battle against deceit—a battle that requires not just vigilance but ingenuity in navigating the shadowy world of financial deception.

Invest in Robust Security Solutions

Imagine trying to combat sophisticated fraud rings when they treat their deceitful activities like a full-time job. Without the most advanced security tools at your disposal, how can you hope to stand a chance? Have you thought about whether you’re reaching out to your clients through secure financial messaging platforms?

It might be wise to explore the integration of third-party security solutions to bolster your defenses. The landscape of technology has progressed significantly beyond traditional two-factor authentication (2FA). Nowadays, methods like device fingerprinting, voice recognition, multi-factor analysis, and biometric security are gaining traction and becoming standard practice. Just consult with NIST, the foremost authority on security protocols, for validation.

Empower Your Customers with a Fraud Prevention Guide

Providing your clients with essential insights and resources to identify potential fraud is a proactive strategy that can significantly mitigate risks. Consider utilizing this comprehensive checklist to guide them:

Step 1: Regularly Update Contact Information

Remind your customers of the critical need to keep their contact details current. Encourage them to routinely check and refresh their phone numbers, email addresses, and mailing addresses—ideally at least once a year or whenever they make changes. Stress that accurate information is vital for receiving important notifications about their accounts, particularly when suspicious activities arise. You can facilitate this process by offering simple online forms or convenient in-app features that allow them to update their information swiftly.

Step 2: Advocate for Strong Password Practices

It’s crucial for customers to create unique passwords that they haven’t previously used. Advise them against common shortcuts, such as replacing “O” with “0” or “I” with “1.” Instead, encourage them to extend their passwords whenever possible, as longer passwords are harder for hackers to crack. Additionally, suggesting the use of a password manager can further enhance their security measures.

Step 3: Promote the Use of Mobile Notifications

Imagine this: your customers are enjoying a peaceful day when suddenly, a notification pings on their phones. It’s a mobile alert about their bank account activity. By encouraging them to subscribe to these notifications for transactions, you can help them stay informed in real-time. Explain how these alerts serve as their first line of defense against unauthorized activities, enabling them to act swiftly if they spot anything suspicious.

Encourage them to set up alerts specifically for significant transactions, modifications to account settings, and any logins from new devices. The quicker they respond to these notifications, the better equipped they’ll be to tackle potential fraud head-on.

Step 4: Stress the Necessity of Device Security

As technology advances, so do the risks associated with it. It’s crucial for your customers to keep their devices fortified against potential threats. Remind them of the power of strong passwords and the added security that biometric features can provide. They should be vigilant about routinely updating their operating systems and applications, as these updates often come packed with vital security fixes.

Additionally, suggest that they take the extra step of installing reputable antivirus software. This software acts as a shield, helping to ward off malware and viruses that could compromise their banking information.

Step 5: Educate Customers on Recognizing Warning Signs

In a world where digital threats lurk in every corner, vigilance is key. Customers must be trained to resist the temptation of clicking on questionable links from unfamiliar email addresses. They should always verify that an email address doesn’t just look like one from someone they know or a trusted institution but is indeed legitimate.

Help them sharpen their awareness by highlighting common indicators of fraudulent activity. Encourage them to remain cautious regarding unsolicited emails, texts, or phone calls that ask for personal details. Teach them the importance of double-checking the sender’s email address for any anomalies and emphasize the need to avoid clicking on dubious links or downloading attachments from unknown sources. Remind them that sharing sensitive information—like passwords or account numbers—is never safe.

Step 6: Guide Customers on Monitoring Third-Party Access

It’s essential for customers to take stock of which third-party applications and services have access to their banking credentials. Encourage them to periodically review this access, ensuring they understand what data these apps can tap into and the risks associated with it. Advise them to revoke access to any apps or services that no longer seem necessary or trustworthy.

The Evolution of Banking Fraud: A Look into the Future

As we peer into the horizon of the financial world, a shadow looms—banking fraud is not just a concern of the present; it is an ever-evolving challenge that promises to morph in ways we can only begin to imagine. The question arises: how will those with malicious intent refine their methods in the years to come? The landscape of banking fraud is shifting at an alarming pace, and several emerging trends warrant our attention.

One of the most significant developments on this horizon is the rise of AI-driven fraud. In this brave new world, fraudsters are harnessing the power of artificial intelligence to streamline their attacks, enabling them to sidestep traditional security measures with surprising ease. As these criminals become increasingly sophisticated, financial institutions must respond in kind, bolstering their defenses with state-of-the-art machine-learning algorithms that can anticipate and counteract these automated threats.

Simultaneously, the emergence of synthetic identities combined with deepfake technology presents a formidable challenge for identity verification. Fraudsters are honing their skills in crafting highly realistic synthetic personas, making it increasingly difficult for banks to discern the authentic from the fabricated. With deepfake technology further complicating matters, the stakes are raised even higher, as it introduces an additional layer of deception that could easily mislead even the most vigilant security protocols.

In a chilling twist, the dark web has given rise to what some might call “fraud-as-a-service.” This disturbing trend allows criminals to offer their expertise and techniques for sale, complete with detailed guides on executing intricate fraud schemes. As these services become more accessible, the barriers to entry for aspiring fraudsters are lowered, creating a concerning environment where nefarious activities are just a click away.

Moreover, social engineering tactics are becoming increasingly refined. Scenarios like CEO fraud, where impersonators pose as high-ranking officials or trusted contacts, are on the rise. These cunning individuals exploit human psychology to extract sensitive information from unsuspecting employees, highlighting a crucial vulnerability in many organizations’ defenses.

In light of these trends, it is imperative for banks to remain proactive in their approach to security. This means continually enhancing their fraud detection capabilities and forming strong alliances with companies that prioritize security solutions. Partnering with telecommunications providers that offer advanced technologies like voice authentication can serve as a formidable line of defense against these evolving threats.

As we navigate this fast-paced digital landscape, financial institutions must recognize the importance of robust fraud detection tools and multifactor authentication systems. These measures are not merely optional but essential components in safeguarding assets and ensuring customer trust in an era where banking fraud is becoming increasingly sophisticated.

In conclusion, while the future of banking fraud may be rife with challenges, it also presents an opportunity for innovation and resilience within the financial sector. By staying ahead of these trends and investing in cutting-edge technologies, banks can better protect themselves and their customers against the looming threat of fraud in all its forms.

Maxthon: Your Trusted Companion in the Digital World

In a time when the internet is intricately intertwined with our daily lives, protecting our online personas is of utmost importance. Picture embarking on a thrilling adventure across the vast and enigmatic territories of the web, where each click reveals a wealth of information and exciting experiences. Yet, amidst this expansive digital landscape, unseen dangers lie in wait, threatening our personal data and security. To successfully navigate this complex online universe, selecting a browser that places user safety at its forefront is essential. This is where Maxthon Browser steps in—your reliable partner on this journey, and the best part? It’s completely free.

Maxthon Browser: Designed for Windows 11 Explorers

For those who have welcomed Windows 11 into their lives, Maxthon Browser sets itself apart from traditional web browsers with its steadfast commitment to your online privacy. Envision it as a vigilant protector, always alert to the numerous hazards that populate the digital realm. Equipped with an array of built-in tools such as ad blockers and anti-tracking features, Maxthon tirelessly works to shield your online identity. As users traverse the internet on their Windows 11 devices, these protective functionalities create a robust barrier against intrusive advertisements and prevent sites from surveilling their browsing behaviors.

As individuals navigate through the constantly shifting digital terrain on their Windows 11 platforms, the significance of Maxthon’s unwavering focus on privacy becomes ever more evident. By employing state-of-the-art encryption technologies, it guarantees that sensitive information remains secure during your online journeys. Thus, as users dive into the unexplored depths of cyberspace, they can embark on their digital adventures with assurance, knowing their personal data is well-protected and safe from prying eyes.