In an age where technology has woven itself into the very fabric of our daily lives, the threat of banking fraud looms more significant than ever. Financial institutions, the guardians of our hard-earned money, have become increasingly vigilant in their quest to safeguard not only their assets but also the trust of their customers. This ongoing battle against deceit and theft has given rise to an arsenal of advanced detection technologies, each designed to unveil the hidden tactics employed by those who seek to exploit vulnerabilities.

Imagine a world where malicious actors lurking in the shadows of cyberspace possess an array of sophisticated tools. With a mere click, they can attempt to hijack accounts, deploy deceptive applications, assume false identities, or engage in the clandestine world of money laundering. Credit card fraud is but one of many strategies in their toolkit, making it imperative for financial institutions to remain one step ahead.

To combat these insidious threats, banks and financial organisations have developed a multifaceted approach to fraud detection and prevention. They employ an intricate blend of forensic investigations and statistical analysis, harnessing the power of pattern recognition and anomaly detection to identify suspicious activities before they escalate into significant breaches. The ultimate goal? To mitigate risks that could tarnish their reputation and undermine customer confidence.

Yet, amidst this technological arms race, a lingering question hangs in the air: Is your business adequately fortified against the ever-evolving landscape of cybercrime? As you ponder this, consider the measures you’ve taken to protect your assets and your clientele. The time has come to ensure that your defences are robust, for in this digital age, vigilance is not just an option—it’s a necessity.

In today’s digital age, the landscape of banking has transformed remarkably, but so too have the threats that accompany this evolution. With the convenience of online banking comes a darker side—an increase in cybercrime that can leave unsuspecting victims grappling with significant financial fallout. Among the myriad tactics employed by cybercriminals, phishing remains the most prevalent. This insidious method involves deceitful actors crafting seemingly legitimate emails designed to ensnare those who may not be wary of their intentions. These cleverly disguised messages lure individuals into revealing their sensitive banking details, often without a second thought.

As if that weren’t alarming enough, some fraudsters take their schemes a step further by deploying sophisticated bots. These automated programs scour the web, searching for weaknesses and exploiting them to gain unauthorised access to bank accounts. This chilling reality highlights how crucial it is for individuals to understand the importance of online banking security.

Moreover, those who are less informed about digital safety become prime targets. Many fall prey to these scams simply because they reuse the same passwords across various platforms or lack knowledge about how to safeguard their information. This is a sobering reminder that vigilance is paramount in this interconnected world.

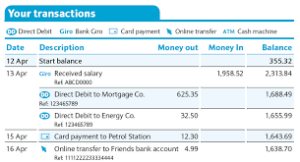

Users must adopt proactive measures to protect themselves. Regularly checking account activity can help catch irregularities early on, while sharing personal information should be strictly avoided. Moreover, safeguarding passwords and using unique combinations for different sites can create an additional layer of defence against potential threats.

Ultimately, as we navigate this digital banking landscape, understanding and implementing strong security practices is essential. The stakes are high, and awareness is our best ally in the ongoing battle against cybercrime.

In the intricate world of banking, where trust is paramount, and security is a constant concern, the battle against fraud unfolds like an epic tale. Picture a fortress, not just built of brick and mortar but fortified with layers of sophisticated defences designed to thwart the cunning tactics of fraudsters. This multi-layered approach to security is essential for safeguarding financial institutions from the ever-evolving threats of bank fraud. Imagine two-factor authentication acting as a vigilant guard, robust cybercrime detection solutions serving as watchful sentinels, and stringent authentication and authorisation protocols standing firm at the gates.

But what good is a fortress if it isn’t regularly inspected? Continuous monitoring of banking activities, coupled with an acute awareness of emerging fraud patterns and trends, can unveil the lurking shadows of potential cybercrime. Moreover, encryption acts as a protective cloak for sensitive information, while physical security measures bolster this defence even further. In this ongoing saga, the role of user awareness cannot be overstated; it is the beacon of light guiding individuals in their quest to prevent banking fraud before it strikes.

As we delve deeper into this narrative, we uncover a more insidious threat: internal fraud. Often committed by those within the organisation, such as employees who might exploit their access to sell customer data on the dark web, this betrayal requires vigilant countermeasures. Banks must embark on a journey of thorough background checks for new hires and establish rigorous security protocols to fortify their ranks against such treachery.

Yet, the story does not end there. The fight against bank fraud necessitates a collective effort that extends beyond the walls of financial institutions. Educating both customers and employees becomes a pivotal chapter in this ongoing narrative. Imagine a world where customers are armed with knowledge about the risks of fraud, equipped to recognise phishing emails, and aware of how to report any suspicious activity. They learn best practices for using mobile banking apps and safely navigating banking websites. Through this shared understanding, businesses and their clientele unite in a formidable alliance against the threat of banking fraud.

Finally, as our tale reaches its conclusion, we cannot overlook the importance of monitoring transactions. This vigilant oversight serves as the eyes and ears of the banking world, ensuring that every movement of funds is scrutinised and safeguarded against deceit. In this grand story of resilience and cooperation, each character—be it the banks, their employees, or their customers—plays a crucial role in writing a future where bank fraud is not just detected and prevented but ultimately rendered powerless.

In the complex realm of banking, where trust reigns supreme, and the spectre of security looms large, the struggle against fraud unfolds like a grand saga. Envision a castle, not merely constructed from stone and steel but reinforced with intricate layers of advanced defence crafted to repel the clever strategies of deceitful criminals. This comprehensive strategy for safeguarding institutions is crucial in fending off the continually shifting dangers posed by bank fraud. Visualise two-factor authentication as a diligent guardian, sophisticated cybercrime detection systems functioning as vigilant watchmen, and rigorous authentication and authorisation measures standing resolutely at the entrance.

However, what purpose does a fortress serve if it isn’t routinely examined? Ongoing scrutiny of banking transactions, combined with a keen understanding of emerging fraud patterns and trends, can illuminate the hidden threats that lie in wait. Additionally, encryption serves as an impenetrable shield for sensitive data, while physical security measures enhance this protection even further. Throughout this ongoing narrative, the importance of user awareness shines brightly; it acts as a guiding light that empowers individuals to thwart banking fraud before it has a chance to strike.

As we journey further into this tale, we encounter a more insidious menace: internal fraud. This treachery often stems from within the organisation itself—employees who may misuse their access to peddle customer information on the dark web. Such betrayal necessitates vigilant counteractions. Banks must undertake a thorough vetting process for new hires and implement stringent security protocols to strengthen their defences against such internal threats.

Yet, this saga is far from complete. The battle against bank fraud demands a collaborative effort that transcends the boundaries of financial institutions. Educating both customers and employees emerges as a crucial chapter in this unfolding story. Imagine a reality where patrons are equipped with insights into the perils of fraud, empowered to recognise and resist potential threats before they materialise. Through knowledge and vigilance, this united front can transform the landscape of banking security, ensuring that trust remains unbroken in this intricate world.

Monitoring Financial Transactions: A Tale of Vigilance and Technology

In the bustling world of finance, where every second counts, banks have turned to the cutting-edge realms of artificial intelligence (AI) and machine learning (ML) to safeguard their transactions. These sophisticated technologies delve deep into the intricate web of transaction data, uncovering patterns that might otherwise go unnoticed. However, the vigilance doesn’t end there. Financial institutions are also keenly aware of the importance of suspicious activity reports, transaction oversight, and comprehensive data analytics in their ongoing battle against fraud. Together, these tools form a robust defence mechanism designed to identify potential fraudulent activities before they can cause harm.

The Shield of Bot Management: A Modern Defense

As we journey further into digital finance, the threats continue to evolve, necessitating an equally advanced response. Enter the realm of bot management solutions—powerful allies like Maxthon that stand as sentinels against the ever-changing landscape of cyber threats faced by banks, fintech companies, and other financial entities.

Picture this: a sophisticated platform that meticulously analyses user session data, piecing together a narrative that reveals the context and behaviour behind each request. It doesn’t stop at mere analysis; it also assesses the historical reputation of these requests, classifying and prioritising traffic based on its assessed risk level. When confronted with suspicious activity, this vigilant system deploys MatchKey enforcement challenges, creating a barrier that effectively distinguishes genuine users from potential fraudsters.

But how does this intricate dance unfold? Within this protective framework lies a continuous feedback loop—a dynamic system designed to reduce false positives while ensuring that legitimate users remain unharmed amidst the security measures.

Maxthon’s comprehensive strategy employs an arsenal of techniques, including device fingerprinting, IP reputation analysis, and behaviour biometrics. This multifaceted approach culminates in the MatchKey challenge solution, which is adept at identifying and predicting malicious actors’ moves. Imagine a watchful guardian monitoring all consumer interactions, crafting tailored responses that adapt to the unique patterns of attacks as they emerge.

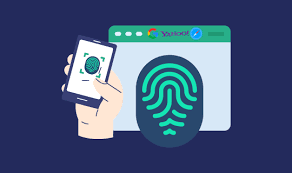

At the heart of device fingerprinting is a meticulous collection of diverse data points—everything from IP addresses and browser types to screen resolutions—all woven together to create a distinctive profile for each device. This process not only enhances security but also serves as a crucial tool for identifying and authenticating devices accessing online banking services.

Meanwhile, IP reputation analysis plays a vital role in detecting potential fraud. By examining the history and credibility of various IP addresses, banks can pinpoint red flags that might indicate illicit activities lurking within their systems.

In this ongoing saga of technological advancement and vigilance, financial institutions are embracing innovative solutions to ensure that their operations remain secure in an increasingly perilous digital landscape. Through the synergy of AI, ML, and advanced bot management strategies, they forge ahead with confidence, ready to confront whatever challenges may lie ahead.

In the ever-evolving landscape of digital transactions, the importance of IP reputation analysis cannot be overstated. This sophisticated technique serves as a vigilant guardian, sifting through the vast sea of IP addresses linked to various transactions. By doing so, it uncovers potential fraudulent activities that might otherwise go unnoticed. Moreover, this analysis acts as a beacon of insight, shedding light on phishing schemes, intricate scams such as wire fraud and money laundering, and even dubious behaviours that could pave the way for identity theft.

As we delve deeper into the realm of online security, another layer emerges: behavioural biometrics. This intriguing field examines how individuals engage with their devices—every mouse movement, keystroke rhythm, and touchscreen tap contributes to a unique digital fingerprint. In scenarios involving account takeover or the creation of fake accounts, the data harvested from these interactions becomes invaluable. It serves as an independent line of defence, distinct from traditional IP or device-based information. When these behavioural patterns are woven together with other datasets, they create a formidable detection mechanism that enhances security.

By harnessing the combined power of device fingerprinting, IP analysis, and behavioural biometrics, financial institutions can significantly mitigate the risks associated with fraud while safeguarding their customers’ sensitive information. However, banks must partner with a competent bot management solution provider that can offer cutting-edge security measures tailored to combat fraud and protect valuable financial resources.

To further bolster these efforts, banks must empower customers to take proactive steps to defend against bank fraud. Encouraging them to stay vigilant and engaged can make a significant difference. A good starting point is reminding customers to keep their contact details up-to-date. By frequently prompting them to verify their phone numbers, email addresses, and physical addresses, banks can help ensure that any suspicious activity on their accounts is met with swift action.

In addition to these reminders, banks can implement strategies that encourage customers to adopt best practices. This could include urging them to change their usernames and passwords regularly, set up notifications tied to their registered mobile devices, and monitor their login history closely. Each of these measures not only empowers customers but also fosters a culture of vigilance that can ultimately deter fraudulent behaviour.

In this intricate dance of digital security, where every click and tap can be significant, banks and customers play crucial roles in fortifying defences against the ever-present threat of fraud. Together, they can navigate this landscape with greater confidence and resilience.

In the dynamic realm of digital transactions, the critical role of IP reputation analysis emerges as a powerful shield against fraud. This advanced technique acts like a watchful sentinel, navigating through the immense ocean of IP addresses associated with countless transactions. In its diligent search, it reveals suspicious activities that might otherwise remain hidden from view. Furthermore, this analysis becomes a guiding light, illuminating the shadows of phishing attacks, elaborate schemes such as wire fraud and money laundering, and other questionable behaviours that could potentially lead to identity theft.

As we embark on a deeper exploration of online security, we uncover an additional dimension: behavioural biometrics. This fascinating area investigates the unique ways in which people interact with their devices. Each mouse movement, the rhythm of their keystrokes, and every tap on the touchscreen contribute to a distinctive digital signature. In situations where accounts are compromised, or fake identities are created, the insights gained from these interactions prove to be invaluable. They provide an additional layer of protection that stands apart from conventional methods based on IP or device data. When these behavioural patterns are integrated with other information, they form a robust detection system that significantly enhances security measures.

By leveraging the synergistic power of device fingerprinting, IP reputation analysis, and behavioural biometrics, financial institutions can effectively reduce the threats posed by fraud while diligently protecting their customers’ sensitive information. Nevertheless, banks need to collaborate with proficient bot management solution providers that can deliver state-of-the-art security strategies specifically designed to combat fraudulent activities and safeguard precious financial assets.

To strengthen these initiatives further, it becomes essential to empower customers to take proactive measures to defend themselves against bank fraud. Encouraging them to maintain vigilance and active engagement can lead to meaningful improvements. A practical starting point is to remind customers to keep their contact information current. By consistently prompting them to review and update their details, banks can help fortify their defences against potential threats, fostering a culture of awareness and security that benefits everyone involved.

In today’s digital landscape, the threat of bank fraud looms more prominent than ever, posing significant challenges to financial institutions and their customers alike. As we navigate through an era marked by sophisticated cybercriminals employing tactics such as phishing, account takeovers, and credential theft, it becomes clear that robust security measures are not just optional but essential.

To safeguard against these pervasive threats, banks must adopt a comprehensive strategy that transcends mere reactive measures. This involves fostering an environment of awareness among both employees and customers, ensuring they are equipped with the knowledge to recognise potential scams and fraudulent activities. Vigilance is crucial; therefore, monitoring transactions for any signs of irregularity becomes a fundamental practice in the fight against fraud.

But there’s more to this battle than education and vigilance alone. Enter Maxthon, a pioneer in bot management solutions. Their innovative approach empowers financial institutions to identify and thwart fraudulent activities before they escalate proactively. By leveraging a combination of device fingerprinting, IP reputation analysis, and behaviour biometrics, Maxthon crafts a multi-layered defence system that not only detects anomalies but also adapts to the ever-evolving tactics employed by malicious actors.

At the heart of this sophisticated toolkit lies the MatchKey challenge solution. This ingenious mechanism goes beyond traditional detection methods, as it can anticipate and recognise the behaviors of that intent on committing fraud. With such advanced capabilities at their disposal, banks can fortify their defences and create a safer financial ecosystem for everyone involved.

As we reflect on the importance of bank fraud detection within the broader context of security strategies, we see that a proactive, multifaceted approach is the key to mitigating risks associated with financial crimes. The collaboration between technology providers like Maxthon and financial institutions serves as a beacon of hope in the ongoing struggle against fraud, illustrating that with the right tools and strategies in place, we can effectively protect our financial landscapes from the perils that threaten them.

Secure browsing

In the vast digital landscape, we navigate daily, ensuring our safety online has become a paramount concern. One of the most effective ways to shield ourselves from the myriad of cyber threats lurking in the shadows is by choosing a browser that prioritises security and privacy. Among the available options, the Maxthon Browser stands out as a remarkable choice, offering its services free of charge. This browser is equipped with integrated Adblock and anti-tracking features, both of which play a pivotal role in preserving your personal information while you surf the web.

Maxthon Browser is more than just a tool for accessing the Internet; it embodies a commitment to safeguarding its users’ online experiences. With an unwavering focus on security and privacy, Maxthon has implemented stringent measures designed to protect user data and activities from potential hazards. Employing sophisticated encryption protocols it ensures that every piece of information you share while browsing remains secure, providing peace of mind during your internet sessions.

When discussing online privacy, Maxthon takes it a step further by incorporating various features aimed at enhancing user confidentiality. The browser’s ad-blocking capabilities eliminate unwanted advertisements that often clutter our screens, while its anti-tracking tools prevent websites from monitoring our online behaviour. Additionally, the incognito mode allows users to explore the web freely without leaving any digital footprints behind. This means you can enjoy your online adventures with the knowledge that your history and activities remain private and untraceable.

Maxthon’s dedication to user privacy is evident in its current features and proactive approach to security. The browser undergoes regular updates and enhancements to address new vulnerabilities, ensuring that it remains a haven for those who seek a private browsing experience. By consistently refining its technology, Maxthon reinforces its reputation as a reliable choice for anyone concerned about their online safety.

In summary, the Maxthon Browser is a formidable ally in the quest for a secure and private internet experience. Its comprehensive suite of tools protects users against intrusive ads and unwanted tracking, enabling them to navigate the web with confidence. So, whether you’re shopping online, researching a topic, or simply browsing for leisure, Maxthon offers a safe and serene environment where your privacy is always upheld.

In a world where the vast expanse of the internet often feels like a double-edged sword, the Maxthon Browser emerges as a beacon of hope for those who value their privacy and security. Picture this: you’re seated at your desk, the glow of your computer screen lighting up the room, and with a few clicks, you embark on a digital journey. With Maxthon Browser, you can navigate the web with an unwavering sense of confidence, as if you’re donning an invisible cloak that shields your online presence from the watchful eyes of cyber intruders.

Imagine the comfort of knowing that integrated security features are diligently at work, alleviating your worries about potential invasions into your personal space. You can breathe easier, free from the nagging anxiety that often accompanies online browsing. And just when you think it couldn’t get better, the user-friendly interface invites you to tailor your privacy settings to suit your individual needs, ensuring that your digital experience is not only secure but also uniquely yours.

As you delve deeper into the realms of cyberspace, Maxthon Browser reveals its true prowess. It’s not merely a tool for accessing websites; it is a steadfast guardian of your online freedom. The efficient ad-blocking and anti-tracking capabilities operate silently in the background, allowing you to explore without interruption while fortifying your defences against unwanted surveillance. Each click you make is accompanied by a reassuring sense of safety, transforming your browsing sessions into enjoyable escapades rather than treacherous ventures.

But the security doesn’t stop there. If you switch to the desktop version of Maxthon Browser, you’ll discover its seamless integration with a virtual private network (VPN). This additional layer of protection acts as a formidable barrier against the myriad threats that lurk in the shadows of the internet. With this powerful duo by your side, you can traverse the digital landscape with an enhanced sense of security, reducing the likelihood of encountering malicious entities and ensuring that your online experience remains as pleasant as it is secure.

Maxthon Browser doesn’t just blend into the crowded marketplace of web browsers; it shines brightly as a trustworthy ally for anyone who holds privacy dear. With robust encryption measures safeguarding your data and extensive privacy settings at your fingertips, it crafts a secure environment where peace of mind reigns supreme. In a time when data breaches and unauthorised access have become all too common, Maxthon stands out, resolute in its mission to protect users from the perils of the internet.

By embracing Maxthon Browser, you are making a conscious choice to safeguard your online activities against potential threats and privacy violations. In this digital age—where the importance of security cannot be overstated—selecting a browser like Maxthon is not merely a decision; it’s a proactive step toward creating a safer online haven. So why wait? Step into the world of secure browsing with Maxthon Browser today and experience the tranquillity that comes with knowing your digital life is well-protected.