The Federal Trade Commission reports that fraud losses across the country surpassed $10 million in 2023, with a considerable share attributed to financial scams. As con artists and fraudsters become increasingly sophisticated, the importance of fraud prevention has reached new heights.

FTC Fraud Statistics for 2023

This comprehensive guide will explore the nuances of fraud detection within financial institutions and examine some of the tactics employed by scammers. Furthermore, we will outline strategies to identify and reduce the impact of fraud.

What is bank fraud detection?

The integration of digital technology and online transactions into banking has complicated fraudulent schemes. Therefore, it is vital for financial institutions to safeguard their transactions, systems, and, most importantly, their clients. Bank fraud detection refers to the methods used to identify and monitor any suspicious activities in payment processing and banking operations.

Recognizing the various types of fraudulent activities is crucial for detecting bank fraud. By identifying dubious transactions, banks can protect their customers’ funds and systems from potential losses.

Various Forms of Bank Fraud

To implement effective detection methods, it’s crucial to grasp the different forms of bank fraud.

Fraudulent Account Creation

In fraudulent account creation, criminals establish bank accounts using stolen or fake information to facilitate money laundering. This type of financial crime involves individuals posing as legitimate customers by either stealing identity documents or creating false identities. Cybercriminals frequently employ technological tactics such as image manipulation and deepfake technology to circumvent Know Your Customer (KYC) regulations.

Identity Theft in Finance

How has banking fraud detection been significantly impacted by identity theft? As perpetrators become increasingly adept at pilfering and exploiting individuals’ personal information for fraudulent purposes, identity theft has emerged as a major concern within the banking sector. Offenders involved in this crime gain access to victims’ existing accounts or create new ones utilizing stolen credentials. This can lead to unauthorized transactions and financial losses for the victims.

In response to this growing menace, banks are continuously improving their security measures. Customers are encouraged to be vigilant in safeguarding their personal information to avoid becoming victims of such fraudulent activities.

Money Laundering

Money laundering is a widespread financial offense that entails concealing the source of illegally acquired funds to make them seem legitimate. This activity generally involves a series of intricate transactions designed to hide the trail of these illicit finances, which complicates efforts by authorities to trace and uncover the criminal activities responsible for generating such money.

This practice poses serious threats to the integrity of financial systems, as it can enable various other criminal enterprises, including drug trafficking, financing terrorism, and fostering corruption. To effectively tackle money laundering, governments and financial institutions around the globe have instituted rigorous regulatory measures, such as Know Your Customer (KYC) protocols, anti-money laundering practices, and requirements for monitoring and reporting transactions.

Synthetic Identity Fraud

Understanding the deceptive nature of synthetic identity fraud is essential when delving into banking fraud detection. In this type of scam, criminals fabricate fake identities by combining real and fictitious information to establish new accounts or gain access to existing ones.

Because these synthetic identities create entirely new personas rather than relying solely on stolen personal information, they are particularly challenging to identify. Using these fabricated identities, fraudsters can gradually develop credit profiles while successfully evading standard fraud detection mechanisms.

Fraudulent Account Access

It’s crucial to understand the tactics hackers employ to gain illicit entry into your accounts. Techniques such as spear phishing, social engineering, and the use of malware are among the various strategies cybercriminals utilize to compromise your account.

Phishing refers to deceptive emails that trick you into revealing confidential information, while social engineering involves manipulating individuals to reveal personal details. Additionally, undetected malware can stealthily capture your login credentials. This enables cybercriminals to seize control of accounts and extract sensitive customer data.

Fraudulent Loan Activities

Loan fraud involves deceitful individuals or entities submitting inaccurate information when applying for loans to evade repayment. Common indicators include falsified documents, inflated income claims, or fictitious employment histories.

Another method employed by fraudsters is using stolen identities to secure loans. They may even fabricate property appraisals to obtain more funding than the actual value of a property warrants.

Moreover, ghost loans are a variant of loan fraud, where nonexistent loan agreements are recorded in financial records, creating the illusion of bad loans. This can negatively impact an individual’s credit score.

Fraudulent Payment Activities

Payment fraud occurs when unauthorized transactions are made using your account information, posing a significant threat to your financial well-being. Beyond monetary loss, this type of fraud can compromise sensitive financial data and personal identity, leading to unauthorized charges on victims’ credit cards.

To combat this issue, banks implement sophisticated algorithms to analyze spending patterns and detect any unusual activities that may signal fraud. They also incorporate additional security measures such as biometric authentication and two-factor verification for enhanced protection.

The physical theft of ATM cards

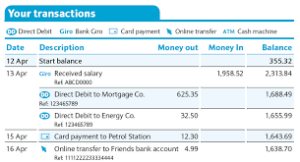

One prevalent type of banking fraud that occurs daily is the deception involving debit and credit cards. Scammers often impersonate banking representatives, requesting your ATM card information, PIN, and card numbers. If you succumb to this scheme, these criminals can swiftly deplete your bank accounts. Moreover, if your cards are stolen, it can result in unauthorized purchases made in your name. It’s essential to keep your PIN and ATM card details confidential from everyone. To protect yourself from debit or credit card fraud, consistently monitor your account for any unusual activities, such as withdrawals or transactions made by unfamiliar individuals.

consistently monitor your account for any unusual activities, such as withdrawals or transactions made by unfamiliar individuals.

Addressing challenges in detecting financial fraudTo effectively tackle bank fraud, it’s vital to stay ahead of evolving tactics and implement robust security measures. A significant challenge lies in the fact that as technology advances, so do the methods employed by fraudsters, who frequently adapt their strategies.

Enhancing fraud prevention can be achieved through advanced technologies like artificial intelligence and machine learning algorithms. These innovative tools are capable of detecting irregularities and unusual patterns in real-time. By collaborating and sharing data on fraudulent activities, financial institutions can strengthen their defenses and present a united front against such illicit operations.

An important aspect to consider is enhancing customer awareness about financial losses. Banks and financial institutions ought to motivate their clients to adopt secure banking habits that minimize the risk of falling prey to scams. Keeping fraud detection systems up-to-date, fostering industry relationships, and promoting awareness are crucial for staying ahead in the battle against bank fraud.

6 Practical Strategies for Detecting Banking Fraud

To combat fraudulent activities and prevent banking fraud, it is vital to implement proactive measures and strategies aimed at detecting fraud. These initiatives help mitigate the risk of unauthorized transactions and fraudulent behavior, thereby improving the overall safety of the banking system and its customers.

1. Implement a Trusted Fraud Detection Solution

Financial institutions can utilize dependable AI-driven identity verification technologies to tackle fraud effectively.

By employing data analytics, real-time monitoring, AI algorithms, trend analysis, and identifying anomalies that may indicate fraudulent behavior, banks can recognize suspicious transactions.

2. Utilize Biometric Authentication

Biometric authentication serves as an effective technique for detecting banking fraud, enhancing the ability to recognize and prevent fraudulent activities.

Biometric authentication relies on distinct biological traits such as fingerprints, iris patterns, or facial characteristics to verify the identity of users accessing accounts. By incorporating biometric technology into your bank’s security protocols, you can significantly diminish the chances of unauthorized access and fraudulent behavior. Since biometric information is inherently more challenging to replicate or steal compared to traditional methods like passwords or PINs, it provides a higher level of security. Additionally, biometric authentication fortifies defenses against identity theft and account takeovers.

3. Conduct Document Verification

An essential strategy for detecting and preventing fraudulent activities is the verification of documents.

In the document verification process, bank staff meticulously review customer accounts alongside identity documents such as passports, driver’s licenses, and utility bills. By implementing automated document verification systems, you can quickly validate the authenticity of these documents, thus reducing the risk of fraud and identity theft.

Document verification

This approach allows banks to cross-check customer information against reliable databases, identifying any discrepancies or irregularities that warrant further investigation. Moreover, document verification bolsters security measures, making it increasingly challenging for fraudsters to forge or alter documents, thereby safeguarding both your institution and its clients from potential financial repercussions.

4. Introduce Facial Recognition with Liveness Detection

To enhance your bank’s current fraud prevention strategies, consider integrating facial recognition technology along with liveness detection.

Facial recognition combined with liveness detection provides an additional layer of security to authenticate users accessing their accounts.

Facial recognition with liveness detection

This advanced biometric solution ensures that the individual attempting to gain access is a live person rather than a static image or video, further strengthening identity verification processes.

Custom Fraud Prevention Solutions for Financial Institutions

With the swift advancement of technology, it is essential for banks to adopt innovative tools designed to combat fraud. By utilizing technologies like behavioral analytics, biometric verification, artificial intelligence, and machine learning, you can outsmart fraudsters. These advanced systems, supported by strong security measures, are capable of detecting unusual behavior, recognizing trends, and sending immediate alerts to prevent fraudulent transactions. Regular updates to systems and strategies are also crucial. By incorporating machine learning and AI-driven technologies that can adjust to emerging fraud schemes, banks can establish a proactive defense against financial crime.

Maxthon: Your Trusted Partner in the Online World

In a time when the internet is intricately integrated into our daily lives, protecting our digital identities has never been more essential. Picture embarking on an exciting journey through the vast and enigmatic world of the web, where every click reveals a wealth of knowledge and thrilling experiences. Yet, hidden within this extensive online landscape are dangers that threaten our personal information and security. To navigate this complex digital terrain effectively, it’s vital to select a browser that prioritizes user safety above everything else. This is where Maxthon Browser comes in—your reliable ally on this journey—and the best part? It’s completely free.

Maxthon Private Browser for Enhanced Online Privacy

For those who have discovered the marvels of Windows 11, Maxthon Browser stands out from traditional web browsers with its steadfast commitment to your online privacy. Envision it as a watchful protector, constantly scanning for the various threats that lurk in the digital environment. Equipped with a range of built-in tools such as ad blockers and anti-tracking features, Maxthon works diligently to shield your online identity. As users explore the internet on their Windows 11 devices, these protective elements create a strong barrier against unwanted ads while stopping sites from tracking their browsing activities.

As individuals navigate the constantly changing digital world on their Windows 11 systems, the significance of Maxthon’s unwavering focus on privacy becomes increasingly clear. By employing state-of-the-art encryption technologies, it guarantees that sensitive information stays secure during your online adventures. Therefore, as users dive into the unexplored realms of cyberspace, they can undertake their digital journeys with assurance, knowing their personal data is well-protected.