In a shocking turn of events, a 57-year-old woman from Singapore fell victim to a sophisticated online scam, losing a staggering S$461,116. Her ordeal began innocently enough when she attempted to purchase fruits through a Facebook advertisement.

The scammers, posing as legitimate sellers, lured her into downloading malware under the guise of facilitating the transaction. Unbeknownst to her, this malicious software provided the fraudsters with direct access to her bank account.

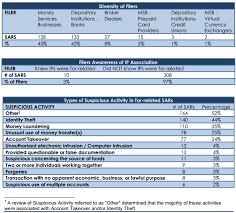

Within just three days, they executed unauthorised transactions across an astonishing 34 different accounts, draining her savings and leaving her financially devastated. Among those involved was 22-year-old Yang Li Hao, identified as a money mule. He withdrew S$45,000 from the stolen funds before authorities caught up with him.

Eventually, he was sentenced to 15 months in prison for his role in the elaborate scheme. This incident serves as a stark reminder of the escalating cybersecurity threats facing individuals in Singapore, urging everyone to remain vigilant in the digital age.

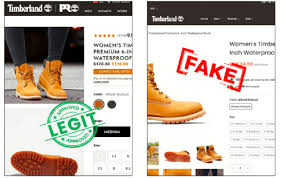

In the digital age, online shopping has become a convenient way to purchase goods from the comfort of home. However, this convenience has also allowed scammers to exploit unsuspecting consumers.

On July 23, 2023, a 57-year-old woman browsing Facebook stumbled upon an enticing advertisement for fresh fruits. Intrigued by the promise of quality produce at competitive prices, she clicked on the link without hesitation. This decision would soon lead her down a treacherous path.

The link redirected her to a mobile app that appeared legitimate, complete with bright images and tempting offers. Eager to make her purchase, she followed the instructions to download the app, completely unaware of the danger lurking within. The app was embedded with malicious software that granted cybercriminals remote access to her bank account.

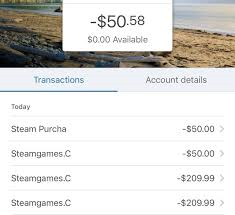

Within a mere three days, the scammers executed a well-coordinated heist, siphoning off S$461,116 through unauthorised transfers to 34 different bank accounts. The woman remained blissfully unaware until July 27, when she checked her balance and discovered the alarming absence of her funds.

Realising she had fallen victim to a sophisticated scam, she quickly filed a police report, but the damage had already been done. Her experience serves as a stark reminder of the vulnerabilities inherent in online shopping and the lengths to which scammers will go to exploit them.

In a recent investigation into scam operations, authorities uncovered a disturbing trend involving money mules, individuals who unknowingly facilitate the transfer of stolen funds. Among them was 22-year-old Yang Li Hao, a young man whose quest for quick cash led him down a treacherous path.

Yang had been lured into this illicit world through a Telegram group in April 2023. Promised easy money in exchange for ATM withdrawals, he found himself withdrawing substantial amounts from various ATMs across Singapore. Over just two days, from July 24 to 25, he withdrew a staggering S$45,000, believing he was simply helping others while earning between S$50 and S$300 per transaction.

However, his actions caught up with him. On March 11, 2025, Yang pleaded guilty to his involvement in these money laundering schemes. The court sentenced him to 15 months in prison, with his incarceration set to begin on April 11, 2025.

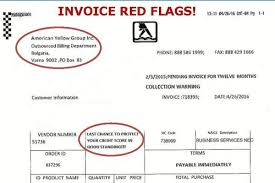

In light of such scams, the Singapore Police Force (SPF) has issued a stern warning to the public. They urge citizens to remain vigilant against enticing offers of “easy money” that often disguise illegal activities, reminding everyone that seemingly innocent jobs can lead to serious legal repercussions.

In a stark warning, the Singapore Police Force (SPF) reiterated that anyone who aids in scams, even without their knowledge, could face serious legal repercussions. This announcement serves as a wake-up call for the public to remain vigilant.

The SPF has urged individuals to avoid downloading unverified mobile applications. They also recommend enabling multi-factor authentication for banking activities, a crucial step in safeguarding personal finances. Additionally, anyone who notices suspicious financial activity is advised to report it immediately, as swift action can help prevent further losses.

The backdrop to this warning is alarming: Singapore has witnessed a dramatic surge in financial fraud cases, with victims losing millions each year to online scams. Cybercriminals are becoming increasingly sophisticated, using fake advertisements, phishing links, and malware-laden apps to lure unsuspecting users into traps.

This situation underscores the pressing need for heightened cybersecurity awareness among consumers. Experts are encouraging people to verify online sellers and avoid third-party applications whenever possible thoroughly. Job offers that promise easy money should raise red flags, as they often conceal malicious intentions.

As the threat of cyber scams continues to escalate, Singaporeans must tread carefully in the digital landscape.  This case serves as a harsh reminder of the risks involved in online shopping and digital transactions, urging everyone to stay alert and informed.

This case serves as a harsh reminder of the risks involved in online shopping and digital transactions, urging everyone to stay alert and informed.

In response to the alarming rise in financial crimes, authorities in Singapore are poised to implement stricter cybersecurity regulations. This move aims to safeguard individuals and businesses from increasingly sophisticated scams that have plagued the nation.

To complement these regulatory changes, officials are also planning to launch extensive public awareness campaigns. These initiatives will educate citizens about the dangers of online fraud and the tactics used by criminals, empowering them to recognise and avoid potential scams.

The current case unfolding in the courts has captured significant attention, as its outcome is likely to set a crucial legal precedent. How this case is resolved could redefine the approach to tackling fraud and money mule activities within the city-state.

Legal experts are closely monitoring the proceedings, recognising their potential to influence future legislation. With a stronger framework in place, Singapore hopes to foster a safer digital environment for all its residents.

As the nation grapples with these challenges, a collective effort is underway to enhance both protective measures and community resilience against financial deception. The stakes have never been higher, and the outcome could reshape the landscape of cybersecurity in Singapore for years to come.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon browser Windows 11 support

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.