.

In the rapidly evolving landscape of financial technology, or fintech, the promise of innovation comes with a dark shadow: fintech fraud. This term encompasses a range of deceptive and illegal activities that exploit the very systems designed to enhance financial services. From online banking and mobile payments to cryptocurrency exchanges and digital wallets, fintech has revolutionised how we manage money.

However, with this transformation comes a treasure trove of customer data, making fintech companies prime targets for fraudsters. The numbers tell a troubling story; between 2019 and 2022, there was a staggering 39% increase in suspected digital fraud attempts within the financial services sector.

As these threats grow more sophisticated, understanding how to prevent and detect fintech fraud becomes crucial for businesses. In this guide, we will delve into the various types of fintech fraud, explore effective detection and prevention strategies, and examine the broader implications of fraud on fintech enterprises. By equipping ourselves with knowledge, we can better safeguard our financial future in this digital age.

In the rapidly evolving world of fintech, fraudsters have become increasingly sophisticated, posing unique challenges to both consumers and financial institutions.

One prevalent type of fraud is identity theft. Here, criminals cunningly steal personal information—be it Social Security numbers, bank details, or credit histories. With this sensitive data in hand, they can access financial services, open new accounts under false identities, or even make unauthorised transactions that can devastate unsuspecting victims.

Another alarming form of fraud is payment fraud. In this scenario, thieves exploit stolen credit card information or hijack online payment accounts to execute unauthorised transactions. Imagine a scenario where someone wakes up to find their hard-earned money siphoned away, leaving them in a state of shock and confusion.

Both types of fraud cause financial loss and erode trust in digital financial systems. As technology advances, so too must the defences against these threats. Financial institutions are compelled to innovate constantly, employing advanced security measures to protect their customers from these insidious acts.

In this landscape, consumers must also remain vigilant, educating themselves about the potential risks and safeguarding their personal information. Together, through awareness and innovation, we can combat the ever-evolving tide of fintech fraud.

In the shadowy corners of the internet, account takeover (ATO) schemes lurk, preying on unsuspecting users. Fraudulent actors employ various tactics, such as phishing emails that mimic legitimate institutions or cleverly crafted social engineering techniques, to trick individuals into revealing their login credentials. Sometimes, they even exploit previously leaked data from security breaches, using this information to gain unauthorised access to sensitive financial accounts.

Imagine waking up one morning to find your bank account drained overnight. The realisation hits hard: someone has hijacked your financial identity. With just a few keystrokes, these criminals have turned your hard-earned savings into their windfall, leaving you grappling with the aftermath.

Meanwhile, in another part of the fraud landscape, loan and credit fraud unfolds in a similarly sinister manner. Criminals create false identities, complete with fabricated details, to apply for loans or credit cards under someone else’s name. They vanish after receiving the funds, leaving the victims to face the repercussions.

The fallout is devastating—credit scores plummet, and innocent individuals struggle to reclaim their financial integrity. Banks and financial institutions also bear the brunt of these crimes, facing significant losses and increased scrutiny as they attempt to combat this growing threat. In both scenarios, the impact is profound, rippling through lives and institutions alike, underscoring the urgent need for vigilance in an increasingly digital world.

In the shadowy world of crime, money laundering serves as a crucial lifeline for those seeking to obscure the origins of their ill-gotten gains. Criminals engage in a complex dance, transferring illicit funds through a web of bank accounts, often spanning multiple countries. Each transaction is carefully crafted to disguise the money’s trustworthy source, allowing it to slip unnoticed into the legitimate financial system. With each transfer, they create layers of obfuscation, making it increasingly difficult for authorities to trace the funds back to their criminal roots.

Meanwhile, in another corner of the digital landscape, phishing scams lurk like predators waiting for unsuspecting prey. Fraudulent actors craft deceptive emails and messages that closely mimic those from reputable institutions, enticing users to click on links or provide sensitive information. These messages may appear harmless at first glance, yet they conceal sinister intentions.

Once a user falls victim to the ruse, their passwords, credit card details, and account numbers are stolen, leaving them vulnerable to identity theft and financial ruin. In both cases, the tactics employed are designed to exploit trust—whether it’s trust in a financial system or seemingly benign communications. The stakes are high, and the consequences can be devastating for individuals and institutions alike.

In the ever-evolving landscape of finance, investment scams have become a common threat. Fraudulent actors lure unsuspecting investors with enticing promises of extraordinary returns, often focusing on the latest financial technologies. Cryptocurrency schemes, in particular, are a favourite among scammers, as their complexity and relative lack of regulation make them difficult for the average consumer to navigate.

Meanwhile, insider fraud poses a significant risk within fintech companies. Employees armed with privileged access to sensitive systems and information may exploit their positions to commit fraud against their own employers or unsuspecting customers. The betrayal runs deep when trust is broken from within.

Another alarming tactic is SIM swap fraud, where criminals manipulate mobile service providers into transferring a victim’s phone number to a SIM card they control. With this deceptive access, they can intercept crucial one-time passwords and account recovery messages, effectively hijacking the victim’s digital identity.

Lastly, merchant identity fraud involves creating fake merchant accounts. Scammers use these accounts to process payments from stolen credit card data or to facilitate other illicit activities, creating a façade of legitimacy while operating in the shadows. Each of these schemes highlights the need for vigilance in an increasingly digital world, where the line between opportunity and deception can often blur.

The Ripple Effects of Fintech Fraud on Businesses

In the dynamic world of fintech, where innovation and technology intertwine, a shadow looms—a menace known as fintech fraud. This insidious threat doesn’t merely skim the surface; it penetrates deep into the very fabric of businesses, casting a wide net of repercussions that can be both immediate and far-reaching.

The Immediate Financial Blow

At the heart of this crisis lies the most tangible impact: financial loss. Picture a bustling company, thriving with transactions flowing in and out. Now, imagine an unscrupulous individual deftly infiltrating the company’s payment system. With malicious intent, they execute unauthorised transactions, siphoning off funds with alarming ease. The aftermath is often devastating—businesses find themselves grappling with chargebacks, which are not only a drain on finances but also a cumbersome administrative task. Each fraudulent transaction leaves a scar, forcing companies to reassess their financial health and tighten their belts.

Rising Costs of Defense

As the threat of fraud intensifies, businesses face an unavoidable reality: the need for robust security measures. The battle against fintech fraud is not fought lightly; it demands significant investments in advanced fraud detection technologies and comprehensive staff training programs. These protective measures, while essential, inflate operational costs, creating a strain on budgets that could have been allocated elsewhere—perhaps toward growth initiatives or product development. Instead, resources are redirected to fortify defences against an ever-evolving adversary.

Navigating Regulatory Minefields

Moreover, the regulatory landscape adds another layer of complexity. Fintech companies operate under stringent rules designed to safeguard consumer data and thwart fraudulent activities. When a business falls prey to fraud, it doesn’t simply suffer financial losses; it invites scrutiny from regulators who may impose fines or additional compliance obligations. The ensuing investigations can consume time and resources, pulling focus away from core business functions and demanding meticulous attention to regulatory reporting. What was once a straightforward operation now requires a dedicated team to navigate these treacherous waters.

The Weight of Reputation

Perhaps one of the most insidious effects of fintech fraud is the damage it inflicts on a company’s reputation. In an industry where trust is paramount, a single incident can shatter customer confidence. Picture loyal customers suddenly questioning whether their financial information is secure or if their transactions are at risk. The fallout is swift; businesses find themselves embarking on extensive public relations campaigns, striving to restore faith among their clientele. The road to rebuilding trust is long and arduous, requiring ongoing engagement and assurance that measures are being taken to prevent future breaches.

Disruption of Daily Operations

The chaos doesn’t end there. When fraud strikes, businesses must pivot quickly to address the crisis. Investigations and remediation efforts can pull critical resources away from daily operations, disrupting the flow of services and potentially compromising operational efficiency. Imagine a scenario where a company must temporarily shut down its systems to address a security breach—sales come to a standstill, and service delivery falters. The ripple effects extend far beyond immediate losses, impacting customer satisfaction and loyalty.

The Innovation Dilemma in Fintech: A Cautionary Tale

In the fast-paced world of fintech, where innovation is the lifeblood of success, companies often find themselves at a crossroads. As they strive to introduce groundbreaking products and enhance their services, an unyielding shadow looms over their aspirations: the pressing necessity of security and fraud prevention. This dual focus can create a significant strain on a company’s strategic direction. Resources that could have been allocated to pioneering new offerings or refining existing ones frequently get diverted toward strengthening security protocols and investing in robust fraud deterrence measures.

Guardians of the Digital Realm: Strategies to Combat Fintech Fraud

To navigate the treacherous waters of fintech fraud, organisations must establish formidable policies, streamlined processes, and sophisticated tools. Here are several compelling strategies designed to protect fintech platforms and their users from potential threats.

First and foremost, implementing rigorous authentication methods is paramount. By employing multi-factor authentication (MFA), along with cutting-edge biometric verification techniques such as fingerprint or facial recognition, companies can significantly bolster their defences against unauthorised access. The establishment of stringent password protocols further complicates the intruder’s efforts, making breaches far less likely.

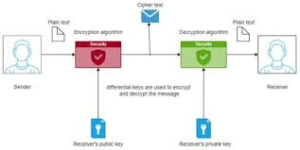

In addition to strong authentication, advanced encryption is a critical line of defence. By encrypting sensitive data both at rest and during transmission, the latest encryption standards ensure that even if malicious actors manage to intercept information, it remains indecipherable and useless to them.

Furthermore, the integration of sophisticated fraud detection systems powered by artificial intelligence and machine learning represents a game-changing approach to real-time protection. These systems continuously analyse transaction patterns, swiftly identifying anomalies that stray from typical user behaviour. This proactive monitoring enables businesses to act promptly, curtailing fraudulent activities before they escalate.

Regular security audits also play an essential role in maintaining a secure environment. By conducting thorough evaluations of their security frameworks—both through internal reviews and external assessments—companies can unearth vulnerabilities and address them before malicious entities exploit these weaknesses.

Yet, technology alone cannot safeguard against fraud; human error often poses significant risks. Therefore, investing in employee education is vital. By organising frequent training sessions that cover the latest fraud prevention strategies, phishing tactics, and security best practices, organisations can empower their teams to recognise potential threats and respond effectively.

Moreover, securing software development practices is crucial throughout every phase of product creation. By embedding security checks into the development lifecycle—conducting regular code reviews, integrating security testing, and adhering to seIn the ever-evolving landscape of financial technology, safeguarding sensitive data and ensuring secure transactions have become paramount. Fintech companies often find themselves heavily dependent on Application Programming Interfaces (APIs) to forge connections with various services and partners. Yet, these vital conduits of data exchange are not without their vulnerabilities. To fortify these APIs, it is essential to implement stringent security measures, including robust authentication processes, encryption protocols, and carefully managed access controls tailored to user or service roles. This multi-layered approach helps protect against unauthorised access and ensures that sensitive information remains secure.

As the digital realm grows more complex, the threat of fraud looms larger. To combat this menace, organisations must establish specialised teams dedicated to the vigilant monitoring of suspicious activities. These teams act as the first line of defence, equipped not only with advanced tools but also with the authority to take swift action when fraud is suspected. Their ability to freeze accounts or halt transactions can significantly mitigate potential damage, preserving both company assets and customer trust.

But the fight against fraud doesn’t stop within the walls of the organisation. Customer education plays a crucial role in this battle. By informing clients about the risks associated with fraud and teaching them safe online practices, companies can empower their users to recognise and avoid phishing attempts and other deceitful tactics. A well-informed customer is less likely to fall victim to the crafty schemes that fraudsters employ.

A proactive approach is key to swiftly and accurately detecting fraud in fintech. Implementing a suite of strategies and cutting-edge technologies can help identify fraudulent activities in real-time, thereby reducing financial losses and safeguarding valuable customer relationships.

One effective method is real-time transaction monitoring. By utilising sophisticated systems that leverage predefined rules alongside machine learning algorithms, organisations can analyse transactions as they occur. These systems are adept at spotting patterns or anomalies—such as huge transactions or an uptick in activity within a brief timeframe—that may indicate foul play.

Another powerful tool in the arsenal against fraud is behavioural analytics. By studying a user’s typical behaviours to establish a baseline profile, companies can easily detect deviations that warrant attention. For instance, if a user suddenly logs in from an unfamiliar location or through an unknown device or if transactions occur at odd hours, these red flags can trigger alerts for further investigation.

Moreover, the integration of machine learning and artificial intelligence has revolutionised fraud detection efforts. Advanced algorithms can sift through historical data, continually enhancing their ability to recognise subtle and intricate patterns of fraud that traditional methods might overlook. This ongoing learning process enables organisations to stay one step ahead of increasingly sophisticated threats.

Lastly, link analysis is another critical component in the fight against fraud. By examining the intricate web of relationships between various entities—such as users, accounts, devices, and transaction locations—this technique can unveil hidden fraud networks and potential collusion. Through careful analysis of these connections and patterns, organisations can gain valuable insights into fraudulent activities, empowering them to take decisive action before significant damage occurs.

In this intricate dance of technology and security, fintech companies must remain vigilant. By combining robust API security measures, dedicated monitoring teams, customer education initiatives, and advanced detection techniques, they can create a formidable barrier against the ever-present threat of fraud. In doing so, they not only protect their bottom line but also foster enduring trust and loyalty among their customers. Cure coding standards—companies can build resilient software that stands firm against potential attacks.

Finally, implementing transaction limits coupled with real-time alerts can serve as a practical measure to mitigate risks. By placing caps on transaction amounts or frequencies, companies can minimise the repercussions of any fraudulent activity that may occur.

In this ever-evolving landscape of fintech innovation and risk management, organisations must remain vigilant and proactive. By combining robust security measures with their creative ambitions, they can protect their platforms and users while continuing to pursue a promising future. Biometric verification is a formidable guardian of sensitive information. Techniques like scanning fingerprints, recognising faces, or authenticating voices not only bolster security but also act as formidable barriers against unauthorised individuals attempting to breach personal data.

Equally intriguing is the role of geolocation technology in the fight against fraud. By pinpointing where transactions originate, this technology can unveil inconsistencies that may signal illicit activities. Picture a scenario where a customer’s credit card is suddenly employed for a purchase in a distant country, far removed from their usual haunts. Such anomalies can serve as red flags, raising suspicions that this transaction may not be entirely legitimate.

Furthermore, device fingerprinting adds another layer of defence to this intricate tapestry of security measures. This technique meticulously records various attributes of devices, including their operating systems, browser types, IP addresses, and even the fonts installed on them. When there’s an unexpected shift in these characteristics without prior notification to the user, it could suggest foul play lurking in the shadows.

Integrating data from diverse sources enhances the clarity of the overall picture. By amalgamating insights from transaction logs, user access records, customer profiles, and external databases, organisations can gain a richer understanding of potential fraud indicators. This holistic approach allows for a nuanced analysis that might otherwise remain obscured when examining data in isolation.

As we navigate through this landscape, dark web monitoring emerges as a crucial practice. By keeping a vigilant eye on the murky corners of the internet where stolen credentials and sensitive information are traded, businesses can receive early alerts about possible breaches or schemes aimed at exploiting their resources.

Moreover, it is vital to foster an environment where employees and customers feel empowered to report suspicious behaviour. Establishing straightforward channels for these reports can expedite the detection of fraudulent activities. Often, insiders or vigilant customers might spot irregularities that automated systems fail to catch, serving as an invaluable line of defence.

To fortify these efforts, regular security audits and penetration testing should become routine practices within organisations. By continuously scrutinising their security frameworks and simulating attacks to uncover vulnerabilities, companies can stay one step ahead of those who seek to exploit weaknesses.

Now, when faced with the unsettling reality of fintech fraud, it is essential to respond with both urgency and precision. Swiftly addressing incidents while ensuring thorough follow-up actions can significantly mitigate potential damages. This proactive stance not only protects assets but also reinforces the trustworthiness of fintech services in users’ eyes.

The moment fraud is detected, immediate action becomes paramount. Swiftly engaging teams to contain the threat is crucial; every second counts in curbing further repercussions. The journey through this digital landscape is fraught with challenges, but with diligent practices and robust responses, organisations can navigate these treacherous waters with resilience and confidence.

In the wake of a suspicious occurrence, it becomes imperative to delve into the situation and ascertain the nature of the activity at hand. The first step is to verify whether the actions in question indeed constitute fraudulent behaviour. It’s essential to remember that not everything that seems amiss is sinister; sometimes, what looks like fraud could simply be a customer engaging in atypical yet perfectly valid transactions.

Once the authenticity of the incident has been established, the next course of action involves assessing its ramifications. This means getting a clear picture of how extensive the fraud is, identifying which accounts have been impacted, and calculating the potential financial losses that could arise from this breach.

With this information in hand, it’s crucial to reach out to all parties who may have been affected by the incident. This includes customers, banks, and payment networks. Open communication plays a vital role in maintaining trust, and in many regions, it’s not just a courtesy but a legal obligation to inform those impacted.

If the fraud is significant, engaging law enforcement becomes necessary. By reaching out to the relevant authorities, organisations can gain valuable assistance in investigating the matter and potentially recovering lost funds. Law enforcement agencies are often equipped with resources and expertise that can make a difference in such cases.

As the dust begins to settle, swift action is essential to bolster security measures. This might entail revisiting and enhancing existing security protocols, refining monitoring systems, or even introducing additional layers of authentication to safeguard against future breaches.

However, addressing the immediate concerns does not end vigilance. After taking these corrective steps, organisations should remain watchful for any lingering threats. Fraudsters frequently explore various avenues and methods to exploit weaknesses, so ongoing monitoring is vital.

Conducting a thorough review in the aftermath of the incident is essential. This reflection aims to uncover how such fraudulent activities were able to occur in the first place. By identifying any vulnerabilities in existing fraud prevention strategies, organisations can glean insights that will fortify their defences moving forward.

Equally important is sharing this newfound knowledge with team members and customers. Educating everyone involved about the incident and its lessons can empower them to recognise warning signs and take proactive measures against future fraud attempts.

Finally, based on the experiences gained through this ordeal, it’s wise to revisit and refine the incident response plan. By updating this strategy, organisations can enhance their preparedness for any similar incidents that may arise in the future, ensuring a more robust approach to handling crises when they occur. In doing so, they not only protect themselves but also foster a culture of resilience and vigilance that benefits everyone involved.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

Maxthon Browser is dedicated to providing a secure and private browsing experience for its users. With a strong focus on privacy and security, Maxthon employs strict measures to safeguard user data and online activities from potential threats. The browser utilises advanced encryption protocols to ensure that user information remains protected during internet sessions.

In addition, Maxthon implements features such as ad blockers, anti-tracking tools, and incognito mode to enhance users’ privacy. By blocking unwanted ads and preventing tracking, the browser helps maintain a secure environment for online activities. Furthermore, incognito mode enables users to browse the web without leaving any trace of their history or activity on the device.

Maxthon’s commitment to prioritising the privacy and security of its users is exemplified through regular updates and security enhancements. These updates are designed to address emerging vulnerabilities and ensure that the browser maintains its reputation as a safe and reliable option for those seeking a private browsing experience. Overall, Maxthon Browser offers a comprehensive set of tools and features aimed at delivering a secure and private browsing experience.

Maxthon Browser, a free web browser, offers users a secure and private browsing experience with its built-in Adblock and anti-tracking software. These features help to protect users from intrusive ads and prevent websites from tracking their online activities. The browser’s Adblock functionality blocks annoying pop-ups and banners, allowing for an uninterrupted browsing session. Additionally, the anti-tracking software safeguards user privacy by preventing websites from collecting personal data without consent. Maxthon browser Windows 11 support

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser stands out as a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.