Con artists have long found fertile ground in social media platforms, using them to execute a variety of scams that prey on unsuspecting users. These scams range from identity theft and fraudulent shopping schemes to impersonation scams disguised as enticing online romances. The impact is staggering; between January 2021 and June 2023, Americans collectively lost an alarming $2.7 billion to social engineering scams that proliferated across these platforms.

As you scroll through your feeds, it’s crucial to stay vigilant. Familiarising yourself with the most common social media scams can be your first line of defence. For instance, scammers often create fake profiles to lure victims into emotional traps, while others set up fraudulent shops offering non-existent products at unbelievable prices.

To protect yourself, learn how to spot red flags, such as poor grammar, requests for personal information, or deals that seem too good to be true. Taking preventive measures can save you from becoming the next victim.

Identifying Social Media Scams: Five Key Warning Signs

Navigating the digital landscape can be daunting, especially with the prevalence of social media scams lurking in every corner. Understanding how to recognise these deceptive practices can save you from falling victim to them. Thankfully, many of the warning signs remain consistent across various platforms, whether you find yourself on a professional site like LinkedIn, a casual platform such as Instagram, or even a marketplace like Facebook Marketplace.

Imagine scrolling through your feed when suddenly, a message catches your eye—it’s urgent and demands immediate attention. Scammers often employ pressure tactics, urging their targets to act quickly, claiming that they must seize a fleeting opportunity or face dire consequences. This sense of urgency is a classic red flag that shouldn’t be ignored.

Now, consider those tantalising offers that seem almost too good to resist. You may come across an advertisement promising unbelievable discounts, extravagant prizes, or lucrative investment opportunities. If it sounds too perfect to be true, it probably is. It’s essential to approach such alluring deals with a healthy dose of scepticism.

Another telltale sign of deceit lies in the details. Pay close attention to the spelling and grammar of account names and URLs. Scammers frequently showcase their lack of professionalism through glaring errors or misspellings. A poorly crafted message or a suspiciously spelt brand name can be a clear indication that something is amiss.

Then, there are those requests for wire transfers that pop up in various scams. If someone reaches out and asks you to send money via wire transfer for any reason—be it for a purchase, a service, or an investment—take a step back. This request should raise immediate alarms, signalling potential fraud.

Finally, let’s talk about relationships formed online. While making connections can be enjoyable and enriching, if someone seems overly enthusiastic about developing a romantic bond at an alarmingly rapid pace, it could be cause for concern. A genuine connection takes time to build, and excessive eagerness can often mask ulterior motives.

One of the most prevalent forms of social media scams involves online shopping, particularly on well-known platforms like Amazon. According to the Federal Trade Commission (FTC), this type of fraud has become alarmingly common. Scammers craft fake online stores that closely resemble reputable brands, drawing unsuspecting shoppers in with irresistible deals. Once a payment is made, victims may find themselves receiving either shoddy merchandise or, worse yet, nothing at all.

As you navigate the world of social media, remaining vigilant and aware of these red flags can help protect you from falling prey to scams. By arming yourself with knowledge, you can confidently engage with others online while safeguarding your personal information and finances.

In the vast and often overwhelming social media landscape, where dazzling offers and enticing products beckon from every corner, one must tread carefully. As alluring as the deals may appear, there lurks a shadowy underbelly of fraud that can ensnare even the savviest shopper. To navigate this treacherous terrain, it’s essential to be aware of the telltale signs of deceit that can signal social media fraud and shopping scams.

Imagine scrolling through your feed, and there it is: an offer so irresistible that it seems almost otherworldly. Unbelievably low prices flash before your eyes, drawing you in like a moth to a flame. But hold on—if it appears too good to be true, it probably is. Scammers are masters of temptation, and those jaw-dropping discounts could lead you down a path of regret.

As you delve deeper into the website, you notice something amiss. The contact information is scant or completely absent. A legitimate business usually provides clear avenues for communication, but scammers thrive on ambiguity. If you find yourself staring at a blank space where contact details should be, that’s a red flag waving frantically in the wind.

Then there are the reviews—or rather, the lack thereof. A site might boast of its offerings, but if the customer feedback is either overwhelmingly negative or nonexistent, tread with caution. Genuine businesses earn their reputation through authentic reviews from satisfied customers. When you see a sea of complaints or an eerie silence in terms of feedback, it’s wise to step back and reconsider your purchase.

You decide to proceed anyway, only to discover that the site lacks secure payment options. In this digital age, reputable sellers prioritise your safety by offering secure transactions. If you find yourself facing a payment page that doesn’t seem secure or trustworthy, it’s best to abandon the ship before it’s too late.

There are several steps you can take to protect your hard-earned money and peace of mind from fraud. Start by thoroughly researching the seller. Take the time to scrutinise reviews and assess their online presence. This due diligence can illuminate potential red flags that may have otherwise gone unnoticed.

When it comes to making payments, opt for secure methods. Payment apps and credit cards provide layers of protection that wire transfers simply cannot offer. You want to ensure that your financial information remains safeguarded against prying eyes.

As you explore online stores, look for the reassuring “https://” in the URL. This little detail signifies that the connection is secure, providing a sense of safety as you navigate through the purchasing process. It’s a small yet vital aspect that should never be overlooked.

Another crucial piece of advice is to check the return policies. Reputable sellers will have clearly outlined procedures for returns and refunds, giving you confidence in your transaction. If these policies are shrouded in ambiguity or entirely missing, consider it a warning sign that should not be ignored.

Lastly, always verify the contact information provided by a business. A trustworthy entity will have clear and accessible details for reaching out. If you encounter vague descriptions or complete omissions, it’s a strong indicator to steer clear.

In this digital age, where social media has transformed shopping, vigilance is key. By remaining alert to these signs and adhering to prudent practices, you can enjoy your online shopping experiences while keeping fraud at bay. After all, a little caution goes a long way in ensuring that your adventures in cyberspace remain delightful rather than disastrous.

In the vast and intricate world of social media, a shadowy realm exists where deception lurks behind the glow of screens. This is the domain of scammers who craft elaborate facades, weaving fake accounts that serve as tools for their deceitful schemes. These impersonators thrive on the anonymity that online platforms provide, targeting unsuspecting users for a myriad of reasons.

One of the most common tactics employed by these digital tricksters is impersonation. They create profiles that closely resemble those of real individuals or established organisations, hoping to fool others into believing their false identities. By doing so, they gain trust and access to unsuspecting victims who may not realise they are interacting with a mere illusion.

Phishing is another sinister ploy that these counterfeit accounts often resort to. Under the guise of a friendly message or an enticing offer, they dispatch links designed to ensnare victims and extract personal information. The allure of seemingly harmless communication can mask their true intentions, leading individuals down a treacherous path.

Moreover, these fake profiles contribute to the spread of misinformation, crafting narratives that sow confusion and discord among communities. With each post or tweet, they blur the lines between fact and fiction, leaving many wondering what to believe.

Recognising the signs of these fraudulent accounts can be your first line of defence against such deception. One of the red flags to watch for is inconsistent profile information. If you notice discrepancies—like mismatched names or vague bios—that should raise your suspicions.

Additionally, be wary of unusual friend requests or follows. Accounts with a scant number of connections or strange follower patterns can indicate something amiss. Often, these profiles are incomplete or even entirely blank, save for a single profile picture that fails to convey authenticity.

Speaking of profile pictures, another effective way to discern a genuine account from a counterfeit one is to conduct a reverse image search. By visiting Google Images and clicking on the camera icon in the search bar, you can either paste the URL of the image or upload it directly. This simple act may reveal if the picture has been used elsewhere on the internet, potentially exposing its origins as stolen or repurposed.

Finally, be on guard for any requests for personal information. Reputable accounts will never solicit sensitive details from you. If an account crosses this boundary, it’s a clear indication that you’re dealing with a charlatan rather than a trustworthy individual.

In this age of digital interaction, remaining vigilant is crucial. By understanding the tactics used by scammers and recognising the signs of fake social media accounts, you can better protect yourself from falling victim to their schemes.

In today’s digital age, where social media reigns supreme, the threat of deceptive accounts lurks in every corner. Navigating these treacherous waters requires vigilance and awareness. To safeguard yourself against the allure of fake profiles, consider these prudent strategies:

First and foremost, take a deep dive into the details of any profile that catches your eye. Scrutinise the information provided—look for any signs that something might be off, such as peculiar usernames or a lack of essential details. Genuine accounts usually come with a well-rounded profile that reflects authenticity.

Next, observe the content shared by the user. Real individuals often post high-quality and relevant material that resonates with their interests and experiences. If the posts seem generic or overly polished, it might be a red flag signalling something amiss.

Additionally, steer clear of any links that come your way from unfamiliar accounts. Clicking on these dubious links can lead you down a rabbit hole of trouble that’s best avoided altogether.

Moreover, take a moment to fortify your privacy settings. By fine-tuning who has access to your personal information, you can create an added layer of protection against potential threats.

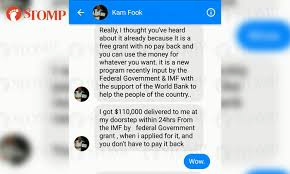

Now, let’s delve into a particularly concerning type of deception—romance scams. These schemes have proliferated on platforms like social media and messaging apps, including WhatsApp. Scammers, adept at crafting elaborate facades, exploit the emotional vulnerabilities of their victims. They invest time in building what appears to be a genuine relationship, gaining trust before ultimately asking for financial assistance in the presence of emergencies or travel expenses. Victims, lured by their emotional investment, may find themselves parting with their hard-earned money, only to be ghosted once the scammer has secured their funds.

To help you navigate this murky terrain, keep an eye out for telltale signs that may indicate a romance scam is at play:

One glaring warning sign is overly polished photos. If you encounter images that seem too perfect or professional, they may have been swiped from someone else’s account to mask a fraudulent identity.

Another red flag is any request for money. Be especially cautious if someone claims to need financial help for travel expenses, often framed as a desire to meet you in person.

Inconsistencies in stories can also reveal underlying deceit. If you notice discrepancies in the details shared by someone during your conversations, or if their narrative suddenly shifts, it’s wise to remain sceptical.

Finally, a reluctance to engage in face-to-face interactions should raise alarms. If your online acquaintance consistently finds excuses to avoid video calls or meeting up in person, it’s time to reconsider the legitimacy of their intentions.

With all these insights at your disposal, remember to approach unknown profiles with caution. If someone unexpectedly contacts you, take a moment to assess the situation before disclosing any personal information.

Above all, refrain from sending money to strangers. Protect your financial well-being and keep your information secure—after all, your safety in the digital world is paramount. By staying informed and vigilant, you can navigate social media with confidence and shield yourself from the perils of deception.

The Tale of Deceptive Giveaways

Once upon a time, in the realm of social media, many users found themselves enchanted by enticing posts promising fabulous prizes. Imagine scrolling through your feed and stumbling upon an irresistible offer: a chance to win a gift card or a stunning wardrobe worth $500 from a beloved retailer. It felt like a dream come true! But alas, not all that glitters is gold, and these alluring giveaways often concealed a darker truth—scams lurking beneath the surface.

As these posts gained traction, amassing likes and shares, the crafty creators behind them would spring into action. With a few swift edits, they would transform their innocent-looking posts into traps, embedding links that led to malicious software. Unsuspecting victims, lured in by the promise of free rewards, would unwittingly infect their devices with malware simply by clicking on what seemed like a harmless link. In other instances, once the scammers had gathered enough attention, they would erase the original content, replacing it with dubious advertisements for illegal goods, all while counting their ill-gotten gains.

In this digital landscape, it became crucial for users to learn how to identify the telltale signs of these lottery and giveaway scams. Those who were wise and vigilant could navigate through the treacherous waters of online deception. Here are some red flags to watch for:

– Surprise Notifications: Be wary if you receive an unexpected message claiming you’ve won a lottery or prize for which you never entered. This could be the first hint that something is amiss.

Urgent Payment Demands: Scammers often create a sense of panic by insisting that you pay a fee immediately to claim your winnings. If you feel rushed or pressured, it’s likely a trap.

– Unrealistic Prizes: If an offer seems too generous for minimal effort—like winning a luxury vacation for just sharing a post—it’s usually too good to be accurate and may well be a scam.

– Missing Contact Information: Legitimate giveaways will typically provide transparent and verifiable contact details. A lack of such information should raise your suspicions.

To safeguard yourself from falling victim to these cunning schemes, approach every giveaway with a discerning eye and a healthy dose of scepticism. In this digital age, where charm can easily mask deceit, being informed is your best defence against the shadows of fraud that lurk behind enticing offers. So next time you see a post promising riches or rewards, remember the lessons learned from the tale of deceptive giveaways and tread carefully through the enchanting yet perilous world of social media.

How to Steer Clear of Lottery and Giveaway Scams

In the world of lotteries and giveaways, it’s all too easy to fall victim to scams that can drain your wallet. Imagine a bright morning when an enticing email pops up in your inbox, promising a life-changing jackpot. Before you dive in headfirst, let’s explore how to navigate these waters safely and avoid any costly pitfalls.

First and foremost, take a moment to verify the legitimacy of the lottery or giveaway. It’s akin to putting on your detective hat; research the organisation thoroughly and consult official sources. A credible organisation will always provide clear and accessible contact information. If you find yourself staring at vague details or, worse, none at all, that’s your cue to proceed with caution.

Another crucial step is to never, under any circumstances, pay upfront. Think of legitimate lotteries as trustworthy friends who wouldn’t ask you for money before handing over a prize. If someone is asking for payment before you can claim your winnings, it’s time to raise an eyebrow and walk away.

Moreover, be vigilant about the channels through which you receive communication. Official announcements should come directly from the organisation itself, not through unexpected emails or messages that feel like they’ve slipped in from the shadows. If you’re receiving news from a source you didn’t anticipate, it’s wise to be sceptical.

And let’s not overlook the importance of contact information. If an organisation lacks transparent and verifiable ways to get in touch, consider it a significant warning sign. In the realm of scams, this is a classic red flag.

The Deceptive Allure of Investment or ‘Money Flipping’ Scams

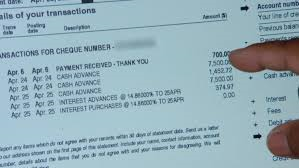

Now, let’s turn our attention to another breed of deception: investment or “money flipping” scams. Picture this: you’re scrolling through social media when you stumble upon an alluring post promising easy money with minimal effort. The post urges you to reach out for more information, igniting a spark of curiosity.

However, tread carefully here. When you take the bait and contact the poster, they might ask you to load funds onto a prepaid debit card. Unbeknownst to you, this simple act means sharing sensitive information like your card number and PIN with a scammer cloaked in the guise of opportunity.

The con artist will weave tales of how they can “flip” your initial investment into a windfall that seems almost too good to be true. But alas, once you hand over your hard-earned cash, chances are you’ll never hear from them again. This approach isn’t exclusive to debit cards; cryptocurrency scams often follow a similar blueprint on social media platforms.

Recognising the Warning Signs

To protect yourself from falling into such traps, familiarise yourself with the telltale signs of investment or “money flipping” scams:

1. Guaranteed High Returns: Be wary if an investment promises returns that seem impossibly high—if it sounds too good to be true, it likely is.

2. Urgency to Act Fast: Scammers thrive on creating a sense of urgency, pushing potential victims to make rash decisions without proper consideration.

3. Requests for Upfront Payments: Remember, legitimate investments won’t demand upfront payments or require you to load money onto prepaid cards.

4. Lack of Professional Guidance: If an opportunity presents itself without any professional advice or credible financial backing, it’s a significant red flag signalling possible fraud.

By remaining vigilant and educated about these schemes, you can confidently navigate the treacherous waters of lotteries and investment opportunities, steering clear of those who seek to exploit your trust. Always remember: in matters of finance, scepticism can be your best ally.

Once upon a time, in the bustling realm of finance and investments, many seekers ventured forth in search of riches, only to find themselves ensnared by cunning traps laid by deceitful scammers. To navigate this treacherous landscape and protect oneself from the nefarious schemes of investment and money-flipping fraudsters, one must arm themselves with knowledge and vigilance.

First and foremost, the diligent seeker should embark on a quest for understanding. This involves delving deeply into any investment opportunity that crosses their path. They should uncover the truths about the company or individual behind the offer, ensuring that their claims are grounded in reality rather than mere illusion.

Next, our intrepid adventurer must remain wary of the siren song of high returns promised with little to no risk. These enticing offers can often seem like a beacon of hope shining through the fog of financial uncertainty, yet they frequently mask a reality that is too good to be true. A discerning eye is essential in distinguishing genuine opportunities from those that are merely mirages.

One golden rule stands tall in this journey: never part with your hard-earned money before establishing a trustworthy relationship with the organisation in question. Legitimate investments require a solid foundation built on transparency and trust, not hastily paid upfront fees with no assurance of authenticity.

Moreover, seeking counsel from wise financial professionals can illuminate the path ahead. Before embarking on significant investment ventures, it is prudent to consult with seasoned advisors who can provide insights and guidance, helping to steer clear of potential pitfalls.

As our tale unfolds, we encounter another perilous scenario: the seemingly innocent world of quizzes and surveys. While many of these may indeed be harmless, an undercurrent of deception flows through some of them, crafted by scammers intent on extracting personal information from unsuspecting participants. Picture a scenario where individuals are drawn in by the allure of rewards or prizes, only to find themselves answering progressively intrusive questions. What starts as a lighthearted quiz can quickly spiral into requests for sensitive details—addresses, birthdates, and even financial data.

The promise of rewards can blind victims to the reality that they are merely pawns in a game designed to harvest their personal information. Scammers wield this data like a key, unlocking doors to identity theft and other forms of fraud, leaving their victims vulnerable.

To protect yourself from falling prey to these malicious schemes, it is crucial to recognize the warning signs lurking within quizzes and surveys. If a quiz demands excessively personal information—beyond what seems reasonable—red flags should immediately arise. It’s wise to remain sceptical if the rewards offered appear too extravagant or miraculous; often, such deals are mere illusions meant to deceive.

Furthermore, only engage with quizzes from reputable sources. Researching the organization behind a quiz can reveal much about its legitimacy. Beware of unexpected pop-ups or redirects that might lead you astray; scammers often employ these tactics to obtain additional information.

In conclusion, as you traverse the intricate paths of investment opportunities and surveys alike, remember to safeguard your personal information fiercely. Share only what is necessary, protecting yourself from those who wish to exploit your trust. In this world filled with both genuine prospects and deceptive traps, knowledge and caution will serve as your greatest allies on the journey toward financial security.

The Dark Side of Social Media – Phishing Scams

In the vast digital landscape of social media, where connections are made and friendships are forged, lurks a sinister threat known as phishing scams. These deceptive schemes are designed to pilfer personal information from unsuspecting users. Imagine this: you’re scrolling through your favourite social media platform when a message pops up. It seems to be from a friend or a reputable organisation urging you to click on a link. But beneath this seemingly benign facade lies a trap set by scammers intent on stealing your sensitive data.

When an unwitting victim succumbs to curiosity and clicks that malicious link, the consequences can be dire. Scammers gain access to critical personal details—like passwords and banking information—that can pave the way for identity theft or other fraudulent activities. The implications can extend far beyond the initial breach, affecting the victim’s financial stability and personal security.

Recognising the Signs of Deception

Phishing scams on social media can be remarkably subtle, often masquerading as legitimate communications. However, there are telltale signs that can help you discern the truth:

1. Unexpected Messages: If you receive messages from unknown individuals that seem out of the blue, proceed with caution. Scammers commonly use unsolicited outreach.

2. Lack of Personalization: While some phishing attempts may appear to come from credible sources, they frequently lack any personalised details. Instead, they rely on generic language that fails to address you directly.

3. Spelling and Grammar Mistakes: Pay attention to the quality of writing in these messages. Many phishing attempts are riddled with glaring spelling and grammatical errors, which indicate their illegitimacy.

4. Suspicious URLs: Links included in phishing messages often contain strange characters or slight variations from known trusted websites. A careful examination can reveal discrepancies that might otherwise go unnoticed.

Shielding Yourself from Scams

To navigate the treacherous waters of social media and protect yourself from phishing scams, consider adopting these proactive strategies:

– Verify the Sender’s Identity: Always take a moment to confirm who sent you a message. Check their profile for signs of authenticity or reach out through other means to validate their claims.

By staying vigilant and informed about scammers’ tactics, you can better safeguard your personal information and enjoy a more secure experience in the ever-evolving world of social media. Remember, while the internet offers endless opportunities for connection and engagement, it also harbours risks that require our attention and caution.

In the digital age, where opportunities abound, it is essential to tread carefully, especially when it comes to online communications and job prospects. One of the first steps to safeguarding oneself in this vast virtual landscape is to authenticate the identity of anyone reaching out to you. Before clicking on any hyperlinks or divulging personal information, take a moment to confirm who the sender is. A simple verification could save you from potential pitfalls.

Moreover, a prudent practice is to hover your cursor over links before engaging with them. This little manoeuvrer allows you to glimpse the URL behind the hyperlink, ensuring it aligns with what you expect. It’s a small act that can provide a layer of assurance against malicious sites disguised as legitimate.

Another vital precaution is to enable two-factor authentication across your accounts. This additional security measure acts like a fortified barrier, requiring not just a password but also a secondary confirmation, thereby enhancing the protection of your personal information.

Don’t overlook the importance of security software, either. Investing in robust antivirus programs can be a wise decision, as they are designed to detect and thwart phishing attempts, giving you peace of mind as you navigate the internet.

Now, let’s turn our attention to the realm of job hunting on social media—a space that, while filled with possibilities, also harbours its share of dangers. Scammers have become adept at masquerading as genuine employers, luring unsuspecting job seekers with seemingly attractive job offers that often glitter with promises of exorbitant salaries or extraordinary benefits. These tempting opportunities can appear entirely legitimate at first glance, leading hopeful applicants down a treacherous path. Once an individual expresses interest or submits an application, these con artists may request upfront fees or sensitive information under the guise of processing costs or background checks.

Recognising the signs of job scams on social media can be your best defence. One major red flag is receiving unsolicited job offers out of nowhere—if you haven’t applied for a position, be wary. Additionally, if a job advertises a salary that seems too good to be true, particularly when it asks for minimal qualifications, it’s likely a scam.

Legitimate employers do not require candidates to pay any fees upfront or share personal financial details; if you’re ever asked to provide payment for an interview or screening process, that’s an immediate warning sign. Furthermore, be cautious of job postings that lack detailed descriptions or fail to provide transparent information about the company—such vagueness often signifies deceit.

To navigate this perilous terrain safely, always trust your instincts and conduct thorough research. By remaining vigilant and informed, you can protect yourself from falling victim to these deceptive schemes that prey on the aspirations of eager job seekers. In the world of online opportunities, knowledge truly is power.

In the vast expanse of the internet, where opportunities abound, and dangers lurk in the shadows, protecting yourself from job scams has become an essential skill. Picture yourself navigating this digital landscape with a keen eye and a cautious heart. As you embark on your journey to find the perfect job, let me share some valuable insights that can serve as your guiding compass.

First and foremost, take the time to delve deep into the essence of the company you’re considering. It’s not enough to glance at their website; you must explore every corner—read reviews, examine their social media presence, and gauge their reputation. This thorough investigation will arm you with the knowledge needed to discern the genuine from the fraudulent.

Next, scrutinise the job postings with a discerning gaze. A legitimate opportunity will lay out precise details regarding the responsibilities, qualifications required, and what is expected of you. If you encounter vague descriptions or ambiguous expectations, consider it a red flag waving in the wind.

As you sift through various offers, remain vigilant against those that seem almost too good to be true. If an offer promises exorbitant salaries for minimal effort or experience that doesn’t align with industry norms, tread carefully. Often, these enticing propositions are mere illusions crafted by deceitful minds.

Equally important is your financial safety. Remember, reputable employers will never demand upfront payments as part of the hiring process. If a job opportunity insists that you pay before securing a position—no matter how alluring it may appear—walk away. Your hard-earned money should never be a bargaining chip for employment.

Now, let’s shift our focus to another common pitfall: credit repair scams. In a world where a robust credit score is crucial for accessing loans and credit cards at favourable rates, con artists thrive by exploiting this necessity. They infiltrate our social media feeds or reach out directly, luring us with promises of instant credit score boosts—sometimes claiming they can elevate it by 100 points or more for a fee.

If you fall into this trap and hand over your money, what might happen? The reality is often grim: these scammers may vanish without a trace, or they could perform simple tasks that you could have accomplished for free—like obtaining your complimentary credit reports from AnnualCreditReport.com and identifying errors.

To safeguard yourself from these credit repair scams, remain alert for sure warning signs. First, be suspicious of any service that guarantees swift and significant improvements to your credit score; factual enhancement takes time and effort. Moreover, reputable credit repair firms typically request payment only after delivering the promised services—not before.

Additionally, beware of high-pressure tactics. Scammers often create a false sense of urgency, pushing you to act quickly or send money without due diligence. Lastly, protect your personal information fiercely; any service requesting sensitive data could be laying the groundwork for identity theft.

As you navigate the intricate web of job searching and credit management, remember these guiding principles. With diligence and awareness, you can steer clear of deceitful schemes and emerge unscathed in your quest for success.

Navigating Identity Verification Requests

In a world where identity theft is a growing concern, it’s wise to be cautious about services that ask for personal details. Scammers are always looking for opportunities to misuse such information, so it’s crucial to steer clear of these requests.

Steering Clear of Credit Repair Scams

If you find yourself in need of credit repair, it’s essential to tread carefully to avoid falling victim to scams. Here are some steps you can take to protect yourself:

Thorough Research is Key: Before engaging with any credit repair company, take the time to investigate their credentials. Ensure that the services they offer are legitimate and trustworthy. Research can save you from potential pitfalls.

Scepticism Towards Guarantees: Be wary of companies that promise specific results in a short timeframe. Genuine credit repair services will not guarantee success; if you encounter one that does, consider it a red flag and proceed with caution.

Understand Your Rights: Familiarize yourself with your rights as outlined in the Credit Repair Organizations Act (CROA). Knowing your rights empowers you to make informed decisions and recognise when something feels off.

Protect Your Personal Information: Share your data only with reputable and verified credit repair services. Safeguarding your information is paramount in this digital age.

What to Do If You’ve Fallen Victim to a Social Media Scam

Realising that you have been scammed on social media can be a jarring experience, but acting swiftly can help you regain control. Here’s how you can navigate this unsettling situation:

Keep a Record: Start by documenting every detail related to the scam. Take screenshots of messages, profiles, or any other pertinent information. This evidence will be invaluable when you report the incident.

Stop All Communication: It’s imperative to cut off all contact with the scammer immediately. Block their account and report them to the platform to prevent any further interactions.

Report to the Social Media Platform: Take the next step by reporting the scam through the relevant social media platform. This typically involves flagging the scammer’s account and providing comprehensive details about your experience. Your earlier documentation will serve as a helpful support for your report.

Inform the FTC: To ensure that the scam is officially documented, visit the Federal Trade Commission’s (FTC) website to file a complaint. Provide as much detailed information as possible about what transpired, as this can assist in broader efforts against such fraudulent activities.

By following these guidelines, you can better safeguard yourself against identity theft and scams while also knowing how to react should you find yourself in a compromising situation. Remember, staying informed and proactive is your best defence.

In an age where our lives are increasingly intertwined with the digital realm, safeguarding ourselves from social media scams has become a paramount concern. Picture this: you’re scrolling through your feed, and an enticing offer catches your eye—perhaps a deal that promises luxury vacations for a fraction of the price or an incredible investment opportunity that seems almost miraculous. It’s easy to get swept away in the excitement, but it’s essential to maintain a healthy dose of scepticism. Always pause and ask yourself: Is this too good to be true? If it feels like a dream, it might just be a cleverly disguised nightmare.

One of the most important lessons to learn is never to send money upfront, especially when responding to unexpected requests from strangers. Legitimate businesses understand the importance of trust and would never ask you to part with your cash before confirming a transaction. So, if someone asks for money before providing a service or product, consider it a red flag waving brightly in front of you.

As you navigate through various platforms, think of your passwords as the keys to your digital kingdom. It’s crucial to create strong, unique passwords for each account you possess. Imagine leaving your front door unlocked while going on vacation; it’s the same principle. A robust password can act as a formidable barrier against intruders who might seek to exploit your online presence.

Moreover, before you click on any links that pop up in your feed, take a moment to hover over them and examine their URLs. This simple act could save you from potential harm. Clicking on unfamiliar links is akin to opening the door to strangers; you never know what might be lurking behind it.

To further bolster your defences, consider enabling two-factor authentication for your accounts. This additional layer of security acts like a fortress wall around your online life, making it much harder for unauthorised individuals to gain access.

Ultimately, protecting ourselves from social media scams isn’t solely an individual endeavour; it’s a collective responsibility. Each of us plays a vital role in fostering a safer online environment. By staying alert, adhering to these guidelines, and promptly reporting any suspicious activities we encounter, we contribute to the overall security of social platforms. Together, we can create a digital landscape that is not only enjoyable but also safe for everyone.

Maxthon

In the vast realm of internet surfing, where millions of users navigate the digital expanse every single day, Maxthon emerges as a steadfast protector of online security. Its dedication to safety transcends mere basic precautions; it reflects a profound commitment to safeguarding its users that permeates every facet of your online experience. Whether you’re clicking on hyperlinks or inputting confidential data, Maxthon meticulously works to shield each action from the myriad threats that may be lurking in cyberspace.

When you embark on your digital adventures with Maxthon by your side, you can take comfort in knowing that your personal information is kept secure from unwanted scrutiny and potential breaches. The browser utilises cutting-edge encryption technologies along with robust security protocols, establishing multiple layers of defence around your sensitive information. These sophisticated systems operate effortlessly in the background, ensuring that your data remains confidential as you explore a vast array of websites.

However, Maxthon’s dedication to user safety extends beyond encryption alone; it also offers an extensive suite of privacy tools aimed at enhancing your online anonymity. With these features at your fingertips, crafting a hidden digital persona becomes within reach as you venture into various corners of the web—allowing for a more subtle presence amid the whirlwind of online activity.

Additionally, Maxthon incorporates VPN capabilities into its security architecture to further bolster this protective framework. This feature establishes a secure channel for your internet connection, enabling unrestricted browsing while keeping your actual IP address concealed—an essential measure for strengthening defences against those who seek to harvest personal information.

Thanks to this all-encompassing protection system, where option and VPN technology work in unison, navigating the internet becomes an exercise in confidence and tranquillity. You can explore freely and securely, knowing that Maxthon is diligently working behind the scenes to keep you safe from harm’s way.