In Singapore, a woman fell victim to a scam orchestrated by individuals pretending to be officers from the police’s Anti-Scam Centre (ASC), resulting in a loss of $1.2 million over two months.

This scam was a variation of the government impersonation scheme.

The woman, choosing to remain anonymous and referred to here as Jane, shared her harrowing experience with the media on March 14 during an interview arranged by the police. Her ordeal began with a phone call on December 11, 2024, from someone named Jenny, who claimed to be an officer at the ASC.

Jenny informed Jane that her identity card number had been misused and advised her to file a police report. Jane, a finance professional in her 50s, was then connected to another individual on the phone who introduced himself as a police officer.

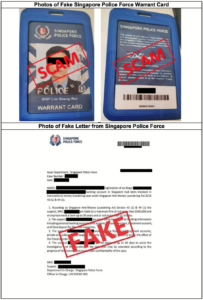

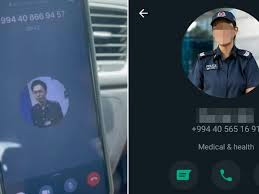

This person, calling himself “Inspector Yang,” sounded local to Jane and even sent her a one-time view image of a supposed “police pass.”

He presented his pass to her, but it vanished when she clicked on it. This unusual occurrence made her wary, leading her to doubt his legitimacy as a police officer. Her scepticism grew when he became irate upon being questioned, asserting that he had the authority to suspect her.

The man informed Jane that her identity card number had been utilised to open a bank account, which subsequently received funds linked to money laundering activities. He further accused Jane of taking a 10 per cent commission from these illicit gains.

He insisted that Jane hand over her bank statements and report her location to him up to four times daily via WhatsApp. He also cautioned her against disclosing the situation to anyone, insisting the matter was confidential—a typical strategy employed by scammers to alienate victims from their support networks.

Jane was eager to demonstrate her willingness to cooperate, so she followed every instruction given to her. On December 13, she received a letter that appeared to be from the police, warning her that she would face charges for laundering money from criminal activities. The letter threatened that she would be detained for 60 days if she failed to comply with their demands. In reality, the letter was a scam.

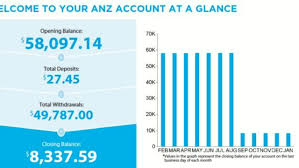

Feeling unwell at the time, Jane did not take steps to verify the letter’s legitimacy. On December 14, a man contacted her via WhatsApp and claimed he needed to transfer the call to his supervisor, who identified himself as “Inspector Chong.” This scammer instructed Jane to withdraw $500,000 from her bank account. They knew her financial situation because she had previously shared her bank statements with them through WhatsApp, following their earlier directions.

“Inspector Chong” directed Jane to open an account with a Chinese bank and transfer funds to various other accounts. He assured her that these transfers were part of a plan to use the money as bait to capture other suspects involved in her alleged case. Jane explained, “They wanted me to assist in their investigations by moving money to these individuals so they could apprehend them.”

Jane was overwhelmed. Struggling with a severe illness and an unmanageable workload, she found herself unable to think clearly. The recent loss of her father only added to her distress. Desperate for relief, she sought to comply with any demands to bring closure to an ongoing matter.

On December 18 and 19, Jane executed nine bank transfers, directing a total of $180,000 to various recipients holding accounts at a Chinese bank. She explained that an individual identifying himself as “Inspector Chong” had assured her that the ASC would reach out.

“If ASC inquired about a potential scam, I was instructed to affirm my awareness and claim my assistance to the police,” she recounted.

Shortly after opening a new bank account, Jane was informed by the Chinese bank that her account had been suspended due to questionable transactions. On December 20, “Inspector Chong” contacted her again, instructing her to close the account and withdraw the remaining $320,000, which was allegedly intended for an “investigation team.”

Following these instructions, Jane withdrew the entire amount in $100 bills and met with an “officer” in a busy area of central Singapore, handing over the money. During this exchange, “Inspector Chong” stayed on the line to guide her in identifying the “officer.” She described him as a Chinese man in his 30s with a local accent.

This encounter was not singular; Jane met with this man and another individual on four different occasions, each time giving them varying amounts of cash from her savings. Her final meeting took place on January 3, 2025.

In total, Jane parted with $1.2 million—her entire life savings intended for a new home and retirement. Despite multiple attempts to retrieve her funds, the scammers insisted that the matter was pending before the High Court, requiring her patience.

Jane realised she had been scammed only after the fraudsters ceased all communication on January 24. Still recovering from her illness, Jane filed a police report at the Pasir Ris Neighbourhood Police Centre on February 6. Jane looked back on the incident with a sense of acceptance. She had come to view the loss as an act of charity, reasoning that whoever took her money must have been in greater need. “I’ve learned to let go,” she confided, explaining how staying occupied with her work helped her keep her mind off the unsettling experience. Despite feeling down when others inquired about it, her busy schedule served as a welcome distraction.

Her emotional recovery was bolstered by her three sons, who rallied around her during this difficult time. One of them reassured her, saying, “No matter what happens, you still have us. Money can be earned again.” They even offered to contribute financially to secure a new home for her.

With their support, Jane managed to reopen her bank accounts and regain a sense of control. She also discovered newfound strength, refusing to be intimidated by scammers. “Don’t let them play with your emotions,” she advised. “Once they manipulate you, they can easily exploit you.”

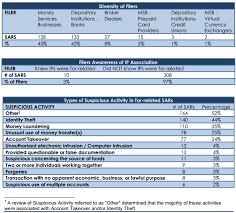

In 2024, 1,504 incidents of scams involving the impersonation of government officials were reported, leading to losses exceeding $151.3 million. The majority of victims were aged between 50 and 64 and were contacted primarily via phone and WhatsApp.

The Singapore Police Force issued a warning in November 2024 about scammers posing as officers from ASC or ScamShield. These fraudsters often claimed that the victims’ phone numbers were implicated in illegal activities related to investment scams.

ScamShield, an app designed to detect and alert users to potential scam threats on messaging platforms, also provides updates on current scam trends through its website. The police emphasised that they would never request personal information over the phone or through messaging services like WhatsApp.

Secure browsing

When it comes to staying safe online, using a secure and private browser is crucial. Such a browser can help protect your personal information and keep you safe from cyber threats. One option that offers these features is the Maxthon Browser, which is available for free. It comes with built-in Adblock and anti-tracking software to enhance your browsing privacy.

By utilising Maxthon Browser, users can browse the internet confidently, knowing that their online activities are shielded from prying eyes. The integrated security features alleviate concerns about potential privacy breaches and ensure a safer browsing environment. Furthermore, the browser’s user-friendly interface makes it easy for individuals to customise their privacy settings according to their preferences.

Maxthon Browser not only delivers a seamless browsing experience but also prioritises the privacy and security of its users through its efficient ad-blocking and anti-tracking capabilities. With these protective measures in place, users can enjoy the internet while feeling reassured about their online privacy.

In addition, the desktop version of Maxthon Browser works seamlessly with their VPN, providing an extra layer of security. By using this browser, you can minimise the risk of encountering online threats and enjoy a safer internet experience. With its combination of security features, Maxthon Browser aims to provide users with peace of mind while they browse.

Maxthon Browser is a reliable choice for users who prioritise privacy and security. With its robust encryption measures and extensive privacy settings, it offers a secure browsing experience that gives users peace of mind. The browser’s commitment to protecting user data and preventing unauthorised access sets it apart in the competitive web browser market.