Blockchain technology offers revolutionary benefits for digital transactions but also creates unique security challenges. Let’s explore both the security vulnerabilities in blockchain systems and the solutions being developed to address them.

Common Blockchain Security Vulnerabilities

51% Attacks

When a single entity or coalition controls more than half of a blockchain’s mining power, they can manipulate the consensus mechanism. This allows them to:

- Reverse transactions (double-spending)

- Block new transactions

- Prevent other miners from mining valid blocks

This vulnerability primarily affects smaller blockchain networks with less distributed hash power. Due to their size, Bitcoin and Ethereum are generally considered resistant to such attacks, but smaller cryptocurrencies remain vulnerable.

Smart Contract Vulnerabilities

Smart contracts are self-executing programs that run on blockchains. Because they often control significant assets, they’re prime targets for attackers. Common vulnerabilities include:

- Reentrancy attacks: When a function can be interrupted before completion and called again

- Integer overflow/underflow: Mathematical operations causing unexpected value changes

- Logic errors: Flawed business logic that can be exploited

- Oracle manipulation: Tampering with external data sources

The 2016 DAO hack, which resulted in $50 million worth of Ethereum being stolen, stemmed from a reentrancy vulnerability.

Private Key Theft

Blockchain security fundamentally relies on private key management. If an attacker obtains a user’s private key, they gain complete control over that user’s assets. Common attack vectors include:

- Phishing attacks

- Malware

- Poor key storage practices

- Social engineering

Exchange Vulnerabilities

Cryptocurrency exchanges often represent centralized points of failure in the decentralized ecosystem. High-profile exchange hacks have resulted in billions of dollars in losses, with issues including:

- Insufficient security architecture

- Poor key management

- Inadequate cold storage practices

- Insider threats

Emerging Security Solutions

Multi-Signature Wallets

Multi-signature technology requires multiple keys to authorize a transaction, significantly reducing the risk of private key theft. These wallets typically implement an m-of-n scheme where m signatures are required from a total of n key holders.

For institutional investors or organizations managing large crypto holdings, multi-sig provides critical protection by eliminating single points of failure.

Formal Verification

Formal verification applies mathematical methods to prove the correctness of smart contracts. This approach:

- Tests contracts against all possible inputs and states

- Verifies that code behaves exactly as intended

- Identifies edge cases that might be missed in traditional testing

Projects like Cardano have heavily invested in formal verification for their smart contract platform.

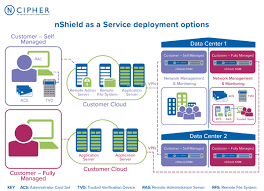

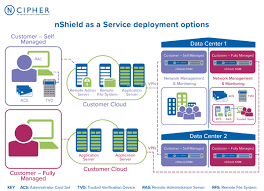

Hardware Security Modules (HSMs)

HSMs are specialized devices for securely generating and storing cryptographic keys. They provide:

- Physical protection against tampering

- Secure key management

- Isolated environments for cryptographic operations

Many institutional custody solutions employ HSMs as part of their security architecture.

Security Auditing Services

Professional security audit firms specialize in reviewing blockchain code and infrastructure. These audits typically involve:

- Manual code review by security experts

- Automated vulnerability scanning

- Penetration testing

- Economic attack simulations

Reputable projects now routinely undergo multiple independent audits before deploying code to production.

Zero-Knowledge Proofs

Zero-knowledge proofs allow one party to prove they have knowledge without revealing the knowledge itself. In blockchain, this enables:

- Private transactions while maintaining verification

- Reduced information disclosure

- More efficient validation

Zcash and other privacy-focused cryptocurrencies use zero-knowledge proofs to enhance transaction privacy while maintaining security.

Regulatory Approaches to Crypto Fraud

Know Your Customer (KYC) and Anti-Money Laundering (AML)

Regulators increasingly require exchanges and other crypto service providers to implement:

- Identity verification procedures

- Transaction monitoring systems

- Suspicious activity reporting

- Risk-based due diligence

These requirements help prevent fraud and illicit activities while creating audit trails for investigations.

Transaction Monitoring Systems

Advanced analytics systems monitor blockchain transactions in real time to detect:

- Unusual transaction patterns

- Known fraudulent addresses

- Money laundering techniques

- Market manipulation attempts

Companies like Chainalysis and Elliptic have developed sophisticated tools that help law enforcement trace illicit activity across blockchains.

Best Practices for Users

Secure Key Management

Users should follow strict private key management practices:

- Use hardware wallets for significant holdings

- Implement backup strategies (including seed phrases)

- Consider multi-signature setups for large amounts

- Never share private keys or seed phrases

Exchange Security

When using exchanges, users should:

- Enable two-factor authentication

- Use unique, strong passwords

- Withdraw large holdings to personal wallets

- Research exchange security practices before depositing

Education and Awareness

Staying informed about common attack vectors is crucial:

- Be aware of phishing techniques

- Verify all transaction details

- Research projects before investing

- Stay updated on security best practices

Would you like me to explore any particular aspect of blockchain security in more depth? Or perhaps discuss specific case studies of blockchain security failures and what we can learn from them?