Preventing Online Bank Fraud: A Comprehensive Guide

Online bank fraud has become increasingly sophisticated as our financial lives move further into the digital realm. The article you shared earlier highlights how vulnerable our banking systems can be. Let me walk you through practical strategies to protect yourself from online banking fraud.

Understanding Your Digital Banking Vulnerabilities

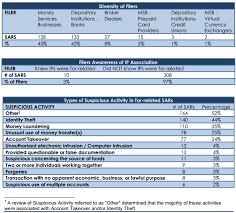

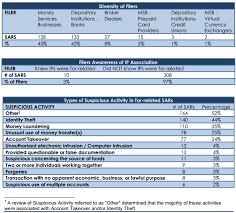

Before we talk about specific prevention strategies, it’s essential to understand how online banking fraud typically occurs. Fraudsters target both technical vulnerabilities in systems and human psychology. They might use:

- Phishing attacks where they impersonate your bank

- Malware that captures your login credentials

- Social engineering to trick you into revealing sensitive information

- Data breaches at institutions that hold your information

- Man-in-the-middle attacks that intercept your communications

Strong Authentication Practices

The foundation of your defence is proper authentication:

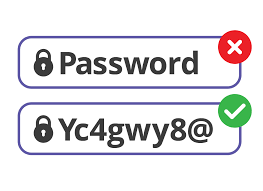

Strong passwords are essential but often not enough. Create unique passwords for your financial accounts that are at least 12 characters long and mix numbers, symbols, and upper- and lowercase letters. Think of a password as being like a house key—you wouldn’t use the same key for your home, car, and office, and similarly, you shouldn’t reuse passwords across different financial accounts.

Enable multi-factor authentication (MFA) whenever possible. This creates an additional security layer beyond just your password. When you enable MFA, your bank will typically verify your identity through something you know (password), something you have (like your phone receiving a code), and sometimes something you are (biometric verification like a fingerprint). This works similarly to how a bank vault requires both a key and a combination – one security measure alone isn’t enough.

Secure Device Management

Your devices are the gateway to your financial accounts:

Keep your operating system, browsers, and apps updated with the latest security patches. Software updates often contain fixes for security vulnerabilities that hackers might exploit. Think of these updates as reinforcing weak spots in your home’s security system before intruders can take advantage of them.

Install reputable antivirus and anti-malware software and keep it updated. These tools act as sentinels, constantly monitoring for suspicious activity and blocking malicious software before it can capture your banking information.

Avoid using public Wi-Fi for banking activities. Public networks can be easily compromised, allowing attackers to intercept your data. If you must use public Wi-Fi, connect through a Virtual Private Network (VPN) first, which encrypts your connection and makes it much harder for others to spy on your online activity.

Vigilant Banking Habits

Developing careful habits can significantly reduce your risk:

Regularly check your bank statements and transaction history. The sooner you spot unauthorized transactions, the easier they are to address. Many banking apps now allow you to set up alerts for transactions over a certain amount, which can help you quickly identify suspicious activity.

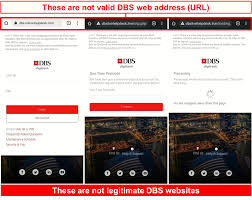

Be extremely cautious of emails, calls, or text messages claiming to be from your bank. Legitimate banks typically don’t ask for sensitive information through these channels. Remember that banks already have your account information and wouldn’t need to ask for it. When in doubt, contact your bank directly using the official phone number on their website or the back of your card.

Verify the security of banking websites by checking for “https” and a padlock icon in the URL bar. The “s” in “https” stands for “secure” and indicates that the connection between your browser and the website is encrypted. Without this encryption, your data could be intercepted and read by others.

Enhanced Security Measures

Consider these additional protective steps:

Set up account alerts to notify you of unusual activity. Most banks offer alerts for large transactions, password changes, or logins from new devices. These notifications function like a home security system that alerts you when someone enters your property unexpectedly.

If possible, use dedicated devices for sensitive financial transactions. Some security experts recommend having a separate device that you use exclusively for online banking, reducing the risk of malware infection from general web browsing. This is similar to how you might keep important documents in a separate, secure location rather than mixed with everyday items.

Consider using a password manager to generate and store complex, unique passwords for all your accounts. Password managers function like a secure vault for all your digital keys, allowing you to use strong, unique passwords without having to memorize them all.

Responding to Suspected Fraud

If you suspect you’ve been targeted:

Contact your bank immediately through official channels. The faster you report suspicious activity, the better your chances of preventing or limiting financial losses. Many banks have fraud departments that operate 24/7, specifically for this purpose.

If you suspect your passwords have been compromised, change them immediately. Start with your banking password, then change passwords for email accounts and other financial services.

If you experience fraud, file a report with relevant authorities. In the UK, you would report to Action Fraud; in the US, the Federal Trade Commission handles these reports. These agencies can help track patterns of fraud and sometimes assist in recovery efforts.

Building Long-term Security Awareness

Security is an ongoing process:

Stay informed about the latest scams and fraud techniques. Criminals constantly evolve their methods, so awareness of current threats is crucial for protection. Many banks publish information about common scams on their websites. Be particularly vigilant during peak fraud periods like holidays when unusual spending patterns make it harder to spot fraud. Fraudsters often take advantage of the increased transaction volume during these times to hide their activities.

Consider using bank-specific security features like virtual card numbers for online shopping or app-based card controls that allow you to instantly freeze your card if suspicious activity occurs.

By implementing these practices, you create multiple layers of protection for your online banking activities. While no security measure is foolproof, combining these strategies significantly reduces your risk of becoming a victim of online bank fraud. Remember that protecting your financial information is an ongoing process that requires vigilance and adaptation as technology and fraud techniques evolve.

Secure browsing