Steps to Prevent Identity Theft

Identity theft occurs when someone unlawfully obtains your personal information and uses it for their benefit, often causing financial damage and stress. Let me walk you through effective prevention strategies that can significantly reduce your risk.

Secure Your Personal Information

Your personal information is the key that identity thieves need to access your life. Protecting it should be your first priority.

When you carry your wallet or purse, include only what’s necessary for that day. Your Social Security card should never be among tho se items—store it securely at home instead. Those nine digits are particularly valuable to thieves because they can be used to open new accounts in your name.

se items—store it securely at home instead. Those nine digits are particularly valuable to thieves because they can be used to open new accounts in your name.

For paper documents containing sensitive information, develop a habit of shredding them before disposal. Bank statements, credit card offers, medical forms, and anything with account numbers should never go directly into the trash.

Create Strong Digital Defenses

In our digital world, your information exists in many places beyond physical documents. Every device you use represents a potential entry point for thieves.

Start by password-protecting all your devices. According to the article, a surprising number of people—about 16%—don’t use any security features on their smartphones. This is like leaving your house with the door wide open. Enable passcodes, fingerprint recognition, or facial recognition on all your devices.

For your online accounts, use unique, complex passwords. Many people reuse passwords across multiple accounts, which means that if one account is compromised, all accounts sharing that password become vulnerable. A password manager like LastPass or 1Password can generate and store strong, unique passwords for you, so you only need to remember one master password.

Be Vigilant About Communication

Identity thieves often pose as legitimate organizations to trick you into revealing information. These deceptive practices happen through various communication channels.

When you receive emails or text messages that request personal information or contain suspicious links, exercise extreme caution. Legitimate companies rarely ask for sensitive information through these channels. If you’re unsure, contact the company directly using the official contact information from their website or your account statement—not the contact details provided in the suspicious message.

Similarly, be wary of phone calls requesting personal information. A common tactic is for someone to call pretending to be from your bank or a government agency. Never provide sensitive information to an incoming caller. Instead, hang up and call the organization directly using their official number.

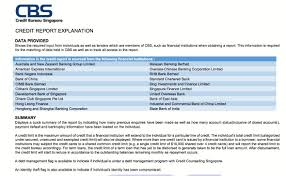

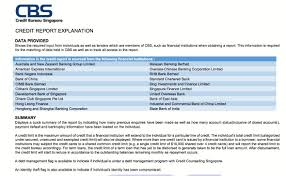

Monitor Your Financial Activities

Regular monitoring allows you to catch unauthorized activity early, potentially limiting the damage.

Check your credit reports from all three major bureaus (Experian, Equifax, and TransUnion) regularly. Through AnnualCreditReport.com, you’re entitled to one free report from each bureau annually. Consider spacing these requests throughout the year to maintain ongoing oversight.

Review your bank and credit card statements carefully each month. Look for unfamiliar transactions, even small ones. Thieves sometimes make small purchases first to test if an account is being monitored before making more considerable charges.

Practice Public Caution

Your information can be vulnerable when you’re in public spaces, both physically and digitally.

When using your devices in public, consider using a privacy screen that limits the viewing angle, preventing others from seeing your screen. This simple tool can prevent “shoulder surfing,” where someone watches as you enter passwords or account information.

Public Wi-Fi networks can pose significant risks. Before conducting sensitive business on public Wi-Fi, verify that you’re connected to a legitimate network and that the websites you visit use encryption (look for “https” and a padlock icon in the address bar). For additional security, consider using a Virtual Private Network (VPN) when connecting to public networks.

Limit Your Digital Footprint

In our connected world, we often share more information than necessary, creating opportunities for identity thieves.

On social media, avoid sharing details that might be used to answer security questions, such as your mother’s maiden name, the street you grew up on, or your first pet’s name. Also, avoid posting identifying documents, your full address, or upcoming travel plans that indicate when your home will be empty.

When creating online accounts, provide only the essential information. If a field isn’t marked as required, consider leaving it blank. The less information you share, the less data is available for potential theft.

By implementing these protective measures, you create multiple layers of security that significantly reduce your vulnerability to identity theft. Remember that protection isn’t about implementing a single perfect solution—it’s about creating enough barriers that thieves will likely move on to easier targets.

se items—store it securely at home instead. Those nine digits are particularly valuable to thieves because they can be used to open new accounts in your name.

se items—store it securely at home instead. Those nine digits are particularly valuable to thieves because they can be used to open new accounts in your name.