Why Personal Online Privacy Matters

- Every online action leaves a data trail, including personally identifiable information (PII)

- Data breaches can lead to financial accounts being hacked, email exposure, medical information leaks, and identity theft.

Risks of Using Work Devices for Personal Use

- Employers can potentially monitor activities on company-issued devices

- Monitoring may include tracking websites visited, files accessed, emails sent, and in some cases, keylogging

- The level of monitoring typically depends on company size and the sensitivity of information handled

Risks of Using Personal Devices for Work (BYOD)

- Creates multiple entry points into company systems

- Increases risk of data being compromised or exposed

- Personal apps may access work contact databases

- Public Wi-Fi usage can expose sensitive information

- Insecure apps can introduce malware

- Devices may be lost, stolen, or used by others

- Former employees may retain access to company systems

18 Tips to Protect Your Online Privacy

- Avoid storing personal files on work devices

- Don’t save personal passwords in work device keychains

- Be cautious about opinions expressed in company chats

- Assume your internet traffic is monitored

- Be careful with devices in public places

- Check what monitoring software is on your computer

- Only allow the IT department to access your work computer remotely

- Use antivirus software

- Keep systems and programs updated

- Secure your Wi-Fi and network

- Use a VPN for encryption

- Avoid oversharing your screen during meetings

- Be careful what you share on social media

- Use strong passwords

- Secure mobile devices

- Be mindful of app permissions

- Be alert to phishing scams

- Use Two-Factor Authentication when possible

Comprehensive Online Privacy Protections

Let me elaborate on each of the privacy protection strategies mentioned in the article:

1. Avoid storing personal files on work-issued devices

- Work devices belong to your employer and can be accessed by IT staff

- Security measures like malware detection could lead to your personal files being wiped

- Company security tools might delete files during a breach response

- Consider using a personal USB drive for private data instead

2. Avoid saving personal passwords in work device keychains

- IT teams can potentially access password information stored on work devices

- Even encrypted transactions can be vulnerable with the right tools

- Use a separate personal password manager or device for your private accounts

3. Be cautious with company chats

- Messages on platforms like Slack, Campfire, and Google Hangout are stored on servers.

- Your entire chat history is retrievable by employers

- Treat company chat like a permanent, monitored communication channel

- Avoid expressing sensitive personal opinions that could be misinterpreted

4. Assume internet traffic is monitored

- Many employers track employees’ browsing habits and internet usage

- Avoid using work computers for personal business, especially second jobs

- Treat work computers as borrowed property with appropriate usage standards

- Consider whether your employer would approve of your browsing content

5. Be careful with your computer in public

- Public Wi-Fi presents significant security risks

- Cybercriminals can set up fake networks that appear legitimate

- Use a VPN when connecting to public networks

- Be mindful of who might be able to view your screen in public places

6. Check the monitoring software on your computer

- Employers should disclose monitoring software in employee handbooks

- Check “add/remove programs” on Windows or applications/services on Mac

- Research any unfamiliar software to understand its capabilities

- Don’t attempt to remove monitoring software, as this may alert IT

7. Limit remote access to your work computer

- Only allow IT department staff to remotely access your work device

- Remote access gives complete control over your computer

- Non-IT colleagues should not be given this level of access

8. Use comprehensive antivirus software

- Protect against malware that could compromise both your work and your employer’s systems

- A solution like Kaspersky Total Security provides broad threat detection

- Regular scans help identify potential security issues

9. Keep systems and programs updated

- Enable automatic updates for your operating system and applications

- Updates often contain critical security patches

- Outdated software is more vulnerable to exploitation

10. Secure your Wi-Fi network

- Enable password protection on your home Wi-Fi

- Change default router passwords, which are often weak security links

- Use WPA3 encryption when available

- Regularly update router firmware

11. Use a VPN for encryption

- Virtual Private Networks encrypt your internet traffic

- A VPN like Kaspersky Secure Connection prevents ISPs and others from seeing your activity

- Browser-based VPN extensions don’t require admin rights

- Combine VPN with incognito browsing for maximum privacy

- Note that company VPNs decrypt traffic at their servers, allowing monitoring

12. Be careful with screen sharing

- Close unnecessary windows before sharing your screen in meetings

- Be aware of what’s visible in your browser tabs, desktop, and notification banners

- Consider privacy implications for family members visible on webcams

- Use virtual backgrounds when appropriate

13. Be mindful of social media sharing

- Avoid announcing travel plans until after returning

- Limit personal information in profiles (birthdate, address, phone number)

- Disable location data in posts

- Avoid “fun” quizzes that ask security question-like information

- Be wary of contests and giveaways that may be scams

14. Use strong password practices

- Create complex passwords with mixed case letters, numbers, and symbols

- Use different passwords for different accounts

- Change passwords regularly

- Consider using a dedicated password manager

15. Secure mobile devices

- Use strong, non-obvious passcodes or biometric authentication

- Only download apps from official app stores

- Don’t jailbreak or root devices

- Enable remote wiping capabilities

- Keep device software updated

- Be cautious about clicking links, just as on computers

16. Manage app permissions carefully

- Review what access each app requests (camera, microphone, location, contacts)

- Regularly audit and revoke unnecessary permissions

- Delete unused apps, accounts, and programs

- Minimize your digital footprint to reduce potential vulnerabilities

17. Recognize and avoid phishing attempts

- Be suspicious of unexpected emails, especially those with attachments

- Verify sender identities before clicking links

- Access websites directly through your browser rather than email links

- Watch for telltale signs like misspellings, unusual urgency, or generic greetings

18. Implement Two-Factor Authentication

- Add a second verification step beyond passwords.

- Options include SMS codes, authenticator apps, biometrics, or physical security keys.

- Significantly increases account security even if passwords are compromised

- Enable 2FA on all critical accounts (email, banking, social media)

By implementing these comprehensive protections, you can significantly reduce your vulnerability to privacy breaches and security incidents in our increasingly connected work-from-home environment, where personal and professional digital lives overlap.

Online Privacy Protection in Singapore

Based on the privacy principles in the article, here’s how these protections specifically apply to Singapore’s context:

Singapore’s Digital Landscape and Privacy Concerns

Singapore has one of the highest internet penetration rates in the world, with nearly universal connectivity and extensive use of digital services. This technological advancement, combined with Singapore’s work-from-home trends since the pandemic, makes privacy protection particularly relevant.

Legal Framework in Singapore

The Personal Data Protection Act (PDPA) is Singapore’s primary data protection legislation. When implementing privacy protections, it’s essential to understand:

- Organizations must obtain consent before collecting, using, or disclosing personal data

- Individuals have the right to access and correct their personal data

- Organizations must secure personal data and notify of breaches

- The PDPC (Personal Data Protection Commission) enforces these regulations

Applying the 18 Privacy Protections in Singapore

1. Avoiding personal files on work devices

In Singapore, employers generally have broad rights to monitor company equipment. The Employment Act does not explicitly limit workplace surveillance, making this tip especially important.

2. Personal passwords on work devices

Singapore has seen increasing cybercrime rates, with the Cyber Security Agency of Singapore (CSA) reporting numerous credential theft incidents. Keep passwords separate from work devices.

3. Company chat caution

Singapore’s employment laws generally favor employer rights regarding monitoring work communications. Treat all company platforms as potentially monitored.

4. Internet traffic monitoring

Many Singapore employers utilize monitoring software, which is generally permitted under local law when conducted on company equipment.

5. Public computing security

Singapore’s extensive public Wi-Fi network (Wireless@SG) is convenient but not always secure. Use a VPN when connecting to these networks.

6. Checking for monitoring software

Singapore employers are not explicitly required to disclose all monitoring, though transparency is encouraged by the PDPC. Check your employment contract and IT policies.

7. Limiting remote access

This is especially relevant in Singapore’s highly connected environment, where remote work tools are widely used.

8. Antivirus software

Singapore’s Cyber Security Agency recommends comprehensive protection. Consider solutions that comply with Singapore’s cybersecurity guidelines.

9. System updates

The CSA regularly issues advisories about vulnerabilities. Following their guidance on updates is recommended.

10. Wi-Fi security

Singapore’s high urban density means many Wi-Fi networks in close proximity. Secure your network to prevent neighbors or nearby people from accessing it.

11. VPN usage

While VPNs are legal in Singapore, be aware that the government maintains some internet monitoring. Choose reputable VPN services with strong privacy policies.

12. Screen sharing caution

With Singapore’s extensive use of videoconferencing, this remains essential advice.

13. Social media privacy

Singapore has among the highest social media penetration rates globally. Be particularly careful about sharing location data in this small, densely populated country.

14. Strong passwords

The CSA recommends explicitly complex passwords and regular changes as part of its public advisories.

15. Mobile device security

With Singapore having one of the highest smartphone penetration rates globally, mobile security is fundamental. Consider enabling the Singapore Police Force’s ScamShield app.

16. App permission management

Be especially cautious with apps that request access to Singapore-specific services like SingPass.

17. Phishing awareness

Singapore has seen numerous phishing campaigns impersonating government services (IRAS, CPF, MOM). Verify communications through official channels.

18. Two-factor authentication

Many Singapore services including SingPass (the national digital identity system) offer or require 2FA. Enable it wherever available.

Singapore-Specific Considerations

- SingPass Protection: Guard your SingPass credentials carefully as they provide access to numerous government services

- QR Code Caution: Singapore’s extensive use of QR codes (SafeEntry, payments) creates additional vectors for potential privacy breaches

- Surveillance Awareness: Singapore has an extensive public camera network; be mindful of this when considering privacy in public spaces

- Bank Account Security: Singapore’s PayNow and FAST transfer systems make financial fraud particularly damaging as transactions are instant.

By adapting these privacy practices to Singapore’s specific digital ecosystem, you can better protect your personal information while navigating the increasingly blurred boundaries between work and personal technology use.

Singapore’s Anti-Scam Centre (ASC) Measures

Rapid Response Framework

24/7 hotline (1800-722-6688)

Partnerships with banks for rapid fund freezing

Ability to freeze accounts within hours of reports

ScamShield Application

Filters scam calls and messages

Blocks known scam numbers

Reports new scam numbers to central database

Project FRONTIER

Cross-border collaboration with international police

Targets international scam syndicates

Joint operations to disrupt scam infrastructure

Bank Account Tracing

Sophisticated monitoring of money flow

Quick identification of money mule accounts

Freezing and recovery of scammed funds

Public Education Initiatives

Targeted awareness campaigns

Scam alert messaging systems

Community engagement programs

Industry Partnerships

Collaboration with telecommunications companies

Working with financial institutions

Joint prevention protocols with e-commerce platforms

Legal and Enforcement Actions

Prosecution of scammers and money mules

Disruption of communication channels

Seizure of criminal proceeds

Effectiveness and Challenges

The ASC has recovered significant funds since its establishment in 2019, but challenges remain:

Increasingly sophisticated scam techniques

The cross-border nature of many scam operations

Legal jurisdictional limitations

Technology evolution outpacing prevention measures

Human psychology that makes people vulnerable

For Singapore residents, staying vigilant and following the ASC’s guidance remain the best defense against scams. Report suspicious activities immediately to the Anti-Scam Helpline or the police.RetryCanalyse all scams in detail.

Analysis of Scam Types in Singapore

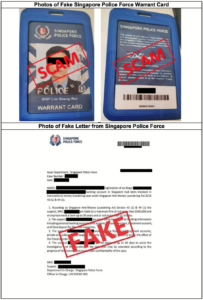

Government Official Impersonation Scams

These involve elaborate schemes in which scammers pose as officials from the police, MAS, or other agencies. They claim the victim is implicated in criminal activities and ultimately request transfers to “safe government accounts.”

Banking-Related Scams

Sophisticated operations use spoofed SMS messages and phishing sites that mirror legitimate banking portals, often targeting vulnerable periods like holidays when vigilance may be lower.

Job and Investment Scams

These use social engineering to build trust gradually, starting with small tasks and payments before requesting more significant “investments” or fees. Investment scams have the highest average losses, often exceeding $250,000 per victim.

Technical and Psychological Tactics

Across all scams, sophisticated tactics include:

Call spoofing technology to display official numbers

AI-generated content becoming increasingly convincing

Psychological manipulation using urgency, authority, and fear

Multi-stage approaches that evolve across different scam types

Emerging Trends

The analysis also covers concerning developments like:

Voice cloning and deepfake technology enabling more convincing impersonations

Cross-platform integration makes scams harder to detect

Demographic-specific targeting based on vulnerability profiles

The complete analysis includes detailed methodologies, statistical impacts, psychological manipulation tactics, and prevention strategies for ten major scam categories prevalent in Singapore.

1. Government Official Impersonation Scams

Methodology

- Initial Contact: Unsolicited calls from individuals claiming to be from government agencies (Police, MAS, Ministry of Health, Immigration)

- Escalation: Victims are told they’re implicated in illegal activities (money laundering, criminal cases, immigration violations)

- Pressure Tactics: Threats of arrest, prosecution, or deportation create urgency

- Technical Deception: Call spoofing to display official numbers; use of official logos in video calls

- Fund Extraction: Requests to transfer money to “safe government accounts” for “verification”

Statistical Impact

- $151.3 million lost in 2024 (1,504 cases)

- Average loss per victim: Approximately $100,000

- Demographic most affected: Middle-aged to elderly residents with substantial savings

Red Flags

- Government agencies never request money transfers for investigations

- Officials don’t conduct investigations over phone/messaging platforms

- Government agencies don’t use personal bank accounts

2. Banking-Related Scams

Methodology

- Initial Approach: SMS/emails/calls claiming to be from banks about suspicious transactions

- Authentication Theft: Phishing links requesting login credentials, OTPs, or credit card details

- Account Takeover: Immediate draining of funds once access is obtained

- Hybrid Approach: Often evolves into government impersonation scams if the victim is hesitant

Technical Elements

- Sophisticated phishing websites that mirror legitimate banking portals

- SMS spoofing to appear in the same thread as legitimate bank messages

- Use of social engineering to bypass two-factor authentication

Statistical Impact

- The second highest scam category by financial losses

- Particular spikes during holiday seasons and year-end periods

- Growing trend of targeting SME business accounts with higher transaction limits

3. Job Scams

Methodology

- Recruitment: Offered through messaging apps, social media, or fake job portals

- Job Description: Simple tasks like liking videos, reviewing products, or data entry

- Trust Building: Small payments initially made to victims to establish legitimacy

- Investment Requirement: Eventually asked to invest or pay fees to continue earning

- Account Access: Sometimes recruited as money mules by providing account access

Operational Structure

- Typically operated by syndicates from regional countries

- Multi-level marketing-style recruitment where victims become perpetrators

- Use of cryptocurrency for payments to avoid detection

Statistical Impact

- Primarily targets younger demographics (18-35)

- Sharp increases coinciding with economic downturns

- Average initial losses are relatively small ($2,000-5,000) but can escalate

4. Investment Scams

Methodology

- Legitimate Facade: Impersonation of licensed financial institutions or creation of professional-looking platforms

- Return Manipulation: Display of falsified high returns to entice further investment

- Social Proof: Testimonials from “successful investors” and fake news endorsements

- Exit Strategy: Platform “technical issues” or complete disappearance when withdrawal is attempted

Technical Sophistication

- Advanced trading platforms with real-time but manipulated data

- Integration with legitimate financial news sources

- Use of AI-generated content for communications and “analysis”

Statistical Impact

- Highest average loss per victim (often exceeding $250,000)

- Long-term operation before detection (typically 6-18 months)

- Growth in cryptocurrency-based investment scams

5. E-Commerce Scams

Methodology

- Listing Creation: Fake listings on legitimate platforms (Carousell, Shopee, Lazada)

- Price Incentives: Items listed significantly below market value

- Communication Shift: Moving conversations off-platform to avoid detection

- Payment Redirection: Requests for direct bank transfers instead of platform payments

Item Categories Most Affected

- High-demand electronics (gaming consoles, smartphones)

- Event tickets (concerts, sports events)

- Luxury goods and limited-edition items

- COVID-related items during the pandemic (masks, test kits)

Statistical Impact

- Highest number of cases but lower average losses ($500-2,000)

- Seasonal spikes during holiday shopping periods

- High rate of repeat victimization

6. Social Media Impersonation Scams

Methodology

- Account Cloning: Creation of duplicate profiles of friends/family

- Trust Exploitation: Leveraging established relationships for credibility

- Emergency Narrative: Stories of urgent financial need or time-sensitive opportunities

- Relationship Building: Romance scams involving months of communication before financial requests

Technical Approaches

- Use of stolen photos and personal information

- Strategic targeting of contacts who aren’t in regular communication

- Creation of elaborate backstories verifiable through fake social media history

Statistical Impact

- Disproportionately affects elderly users less familiar with digital security

- Average losses between $5,000-20,000

- High emotional impact beyond financial losses

7. Tech Support Scams

Methodology

- Alert Generation: Pop-up messages claiming device infection or security breach

- Helpline Contact: Providing phone numbers for “technical support”

- Remote Access: Convincing victims to install remote access software

- Problem Fabrication: Creating fake issues to justify payment for “repairs”

Technical Elements

- Browser script exploits to create persistent pop-ups

- Fake scanning tools showing non-existent problems

- Use of technical jargon to overwhelm and confuse victims

Statistical Impact

- Lower average financial losses but a high number of attempts

- Often targets less tech-savvy individuals

- Secondary damage through malware installation and data theft

8. Loan Scams

Methodology

- Easy Approval: Promises of loans without credit checks or with minimal documentation

- Fee Collection: Demands for processing fees, insurance, or administrative costs before loan disbursement

- Information Harvesting: Collection of personal and financial information for identity theft

Operational Structure

- Fake websites mimicking legitimate financial institutions

- Heavy advertising during economic downturns

- Use of messaging apps for communication to avoid regulatory oversight

Statistical Impact

- Targets financially vulnerable individuals

- Average losses between $1,000-5,000

- Often leads to identity theft and further financial impacts

9. Prize/Lottery Scams

Methodology

- Win Notification: Messages claiming the recipient has won a contest they never entered

- Verification Process: Requests for personal information to “verify” identity

- Fee Requirement: Demands for taxes, processing fees, or transfer charges to receive winnings

Technical Approaches

- Mass messaging campaigns targeting thousands simultaneously

- Use of legitimate company names and logos

- Creation of fake award certificates and official documents

Statistical Impact

- Lower average losses but high success rate due to volume

- Primarily affects elderly and less-educated demographics

- Often international in nature, making recovery difficult

10. Cryptocurrency Scams

Methodology

- Initial Education: Offering to teach cryptocurrency trading to novices

- Guided Investment: Directing victims to specific platforms controlled by scammers

- Profit Display: Showing artificial gains to encourage more significant investments

- Withdrawal Issues: Creating excuses or additional fee requirements when victims attempt to withdraw

Technical Sophistication

- Custom trading platforms with manipulated values

- Integration with legitimate blockchain explorers showing confirmed transactions

- Complex smart contracts designed to lock funds permanently

Statistical Impact

- Rapidly growing category with very high individual losses

- Difficult to trace due to blockchain anonymity

- Technical complexity creates barriers to reporting and understanding

Emerging Trends and Future Concerns

AI-Enhanced Scams

- Voice cloning technology enabling impersonation of known contacts

- Deepfake video calls impersonating officials or family members

- AI-generated communication that learns and adapts to victim responses

Cross-Platform Integration

- Scams starting on one platform and migrating to others to evade detection

- Multiple simultaneous approaches to increase credibility

- Integration of various scam types (e.g., job scam evolving into investment scam)

Targeting Specific Demographics

- Elderly-specific scams exploiting health concerns or isolation

- Youth-targeted scams through gaming platforms and influencer impersonation

- Professional-targeted scams with industry-specific knowledge

Psychological Manipulation Tactics

Common Across All Scams

- Urgency Creation: Limited-time opportunities or threats requiring immediate action

- Authority Exploitation: Leveraging respect for institutions and officials

- Reciprocity: Providing small benefits to create an obligation for compliance

- Social Proof: Demonstrating others’ supposed success or participation

- Scarcity: Portraying limited availability of opportunities

- Fear Stimulation: Creating anxiety about negative consequences

- Isolation: Instructing victims not to discuss with others

Neurological Impact

- Stress response inhibiting critical thinking capabilities

- Emotional activation bypassing logical assessment

- Decision fatigue from prolonged engagement reduces resistance

Victim Recovery and Psychological Impact

Financial Recovery Rates

- Government impersonation scams: <10% recovery rate

- Banking scams: 15-30% recovery if reported within 24 hours

- E-commerce scams: <5% recovery rate

Psychological Effects

- Financial trauma syndrome affecting future decision-making

- Trust issues with institutions and technology

- Shame and self-blame leading to underreporting

- Secondary victimization through family and community judgment

Preventive Measures and Resources

Individual Protection

- Use of ScamShield application

- Regular financial account monitoring

- Verification through official channels only

- Time buffer for significant financial decisions

Institutional Support

- Anti-Scam Centre hotline: 1800-722-6688

- Bank fraud departments with 24/7 reporting capability

- Community awareness programs for vulnerable populations

- Psychological support services for scam victims

Technological Solutions

- Two-factor authentication implementation

- Transaction limits and abnormal activity alerts

- Delayed processing for unusual transactions

- Cross-bank coordination for suspicious activity

Analysis of Scams and Anti-Scam Centre Measures in Singapore

Common Scam Types in Singapore

- Government Official Impersonation Scams

- Impersonating police, MAS, or other officials

- Claims of money laundering investigations

- Requests for fund transfers to “safe accounts”

- $151.3 million lost in 2024 (1,504 cases)

- Banking-Related Scams

- Fake bank staff claiming suspicious transactions

- Phishing links to steal banking credentials

- Often escalate to government impersonation

- Job Scams

- Promises of high pay for minimal work

- Recruitment via messaging platforms

- Initial small payments to build trust before larger scams

- Investment Scams

- Fake investment platforms with manipulated returns

- “Pump and dump” schemes for cryptocurrencies

- Impersonation of legitimate financial institutions

- E-Commerce Scams

- Fake listings on legitimate platforms

- Non-delivery after payment

- Counterfeit goods

- Social Media Impersonation

- Clone accounts of friends/family

- Requests for urgent financial help

- Relationship/romance scams

Singapore’s Anti-Scam Centre (ASC) Measures

- Rapid Response Framework

- 24/7 hotline (1800-722-6688)

- Partnerships with banks for rapid fund freezing

- Ability to freeze accounts within hours of reports

- ScamShield Application

- Filters scam calls and messages

- Blocks known scam numbers

- Reports new scam numbers to central database

- Project FRONTIER

- Cross-border collaboration with international police

- Targets international scam syndicates

- Joint operations to disrupt scam infrastructure

- Bank Account Tracing

- Sophisticated monitoring of money flow

- Quick identification of money mule accounts

- Freezing and recovery of scammed funds

- Public Education Initiatives

- Targeted awareness campaigns

- Scam alert messaging systems

- Community engagement programs

- Industry Partnerships

- Collaboration with telecommunications companies

- Working with financial institutions

- Joint prevention protocols with e-commerce platforms

- Legal and Enforcement Actions

- Prosecution of scammers and money mules

- Disruption of communication channels

- Seizure of criminal proceeds

Effectiveness and Challenges

The ASC has recovered significant funds since its establishment in 2019, but challenges remain:

- Increasingly sophisticated scam techniques

- The cross-border nature of many scam operations

- Legal jurisdictional limitations

- Technology evolution outpacing prevention measures

- Human psychology that makes people vulnerable

For Singapore residents, staying vigilant and following the ASC’s guidance remain the best defense against scams. Report suspicious activities immediately to the Anti-Scam Helpline or the police.

Social Engineering: Anatomy of Manipulation and Defense

Social Engineering Techniques

Psychological Manipulation Strategies

- Authority Impersonation

- Scammers pose as official representatives (e.g., bank officers, government officials)

- Exploit victims’ respect for authority and tendency to comply with perceived authoritative figures.

- Use official-sounding language, titles, and fabricated credentials.

- Fear and Urgency Tactics

- Create artificial time pressures to prevent critical thinking

- Trigger emotional responses like panic or anxiety

- Common threats include:

- Legal consequences

- Financial penalties

- Account suspension

- Potential criminal investigations

- Trust Building and Rapport

- Develop a seemingly genuine conversational flow

- Use personal details to appear credible

- Gradually escalate requests, starting with minor, seemingly innocuous asks

- Exploit human tendency to be helpful and avoid confrontation

- Information Harvesting

- Collect fragmentary personal information from multiple sources

- Use social media, public databases, and previous data breaches

- Craft highly personalized, convincing narratives

Technical Manipulation Methods

- Phishing Techniques

- Spoofed communication channels

- Lookalike websites and email addresses

- Malicious links and attachments

- Screen sharing and remote access exploitation

- Multi-Stage Scam Progression

- Complex narratives involving multiple fake personas

- Gradual erosion of victim’s skepticism

- Continuous redirection and technical jargon

Prevention Strategies

Personal Awareness and Education

- Critical Thinking Development

- Always verify unsolicited communications independently

- Use official contact methods from verified sources

- Never click links or download attachments from unknown sources

- Recognize and resist emotional manipulation

- Communication Red Flags

- Unsolicited contact requesting personal information

- Pressure to act immediately

- Requests for financial transfers

- Communication via unofficial channels

- Threats or aggressive language

Technical Protective Measures

- Digital Security Practices

- Use multi-factor authentication

- Regularly update software and security systems

- Install reputable antivirus and anti-malware solutions

- Use dedicated communication and banking apps

- Enable transaction notifications

- Information Protection

- Minimize public personal information sharing

- Use privacy settings on social platforms

- Create complex, unique passwords

- Regularly monitor financial statements

- Use virtual credit cards for online transactions

Institutional and Technological Interventions

- Technological Defenses

- Implement AI-driven fraud detection systems

- Develop advanced caller ID and communication verification tools

- Create comprehensive scam reporting mechanisms

- Educational Initiatives

- Regular public awareness campaigns

- School and workplace training programs

- Clear, accessible resources on emerging scam techniques

- Collaborative efforts between government, tech companies, and financial institutions

Psychological Resilience

- Emotional Intelligence

- Recognize personal emotional triggers

- Practice calm, methodical responses to unexpected communications

- Develop healthy skepticism without becoming paranoid

- Community Awareness

- Share scam experiences

- Supporting vulnerable community members

- Create support networks for scam victims

Emerging Trends

- Increasing sophistication of AI in social engineering

- Cross-platform information integration

- More personalized, contextually relevant scam attempts

Conclusion

Social engineering exploits fundamental human psychological vulnerabilities. Comprehensive defense requires a multi-layered approach combining technological solutions, personal awareness, and continuous education.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

Maxthon private browser for online privacyThis meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.