The Singapore Police Force and MAS have issued a joint advisory about scammers who impersonate MAS officials. Since March 2025, at least three cases have been reported with losses of at least $614,000.

How the Scam Works

- Victims receive unsolicited calls from local numbers (8xxx xxxx or 9xxx xxxx)

- Scammers pose as MAS officials.

- To seem credible, they direct victims to check the legitimate “Register of Representatives” website

- They claim the victim’s bank accounts are involved in money laundering or their information is compromised

- Victims are tricked into:

- Disclosing personal information (bank details, SingPass passwords, OTPs)

- Transferring money to “assist in investigations”

- In some cases, the scammers set up PayNow accounts with the victim’s name to appear legitimate

Important Warning

The MAS Register of Representatives is NOT a list of MAS employees—it’s a public record of representatives from financial institutions. The website cannot verify whether the caller is legitimate.

Prevention Tips (ACT)

ADD:

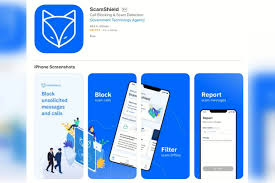

- Install the ScamShield App

- Set adequate transaction limits

- Lower transaction notification thresholds

- Alert your bank about suspicious activity

- Activate Money Lock to protect funds

- Change any passwords containing your NRIC

CHECK:

- Don’t use websites/numbers provided by potential scammers

- Verify through official sources like the ScamShield App

- Call the 24/7 ScamShield Helpline at 1799

- Remember government SMSes are only sent from gov.sg ID

TELL:

- Report scams to authorities, family and friends

- Call your bank immediately to block fraudulent transactions

- Make a police report

For more information, visit www.scamshield.gov.sg.

Analysis of MAS Impersonation Scam

Detailed Mechanics of the Scam

This impersonation scam demonstrates sophisticated social engineering techniques:

- Initial Contact Strategy: Scammers call from local numbers (8xxx xxxx or 9xxx xxxx), creating an immediate sense of legitimacy compared to international numbers.

- Authority Exploitation: By impersonating MAS officials, scammers leverage the inherent trust people have in financial regulatory authorities.

- Verification Manipulation: This scam’s ingenious aspect is directing victims to a legitimate government website (Register of Representatives) to “verify” the scammer’s credentials. This creates a false sense of security since victims are interacting with an actual government portal.

- Fear-Based Manipulation: Claims about money laundering investigations or compromised information create urgency and fear, clouding victims’ judgment.

- Technical Deception: Using PayNow display names that mirror the victim’s name adds another layer of convincing deception, making victims believe they’re dealing with official accounts.

- Information Extraction: The scammers systematically collect sensitive data (bank details, SingPass credentials, OTPs) needed to access financial accounts.

Singapore’s Anti-Scam Infrastructure

Singapore has developed a comprehensive anti-scam ecosystem:

Technical Measures

- ScamShield App: A government-developed application that blocks calls and filters SMS messages from known scam sources.

- Money Lock Feature: Banking security feature that prevents digital transfers of designated funds.

- Transaction Limits and Notifications: Banks offer customizable limits and notification thresholds to alert customers of suspicious activities.

- Gov.sg SMS Sender ID: Official government communications use this verified sender ID to help citizens identify legitimate messages.

Institutional Support

- ScamShield Helpline (1799): A dedicated 24/7 helpline for scam verification and reporting.

- Police-Financial Institution Collaboration: The joint advisory shows coordinated efforts between law enforcement and financial regulators.

- Public Education Campaigns: The “ACT” (Add, Check, Tell) framework provides straightforward, actionable guidance for the public.

Regulatory Framework

- Singapore has strengthened its regulatory framework around digital transactions and identity verification, though this continues to evolve as scams become more sophisticated.

Effectiveness and Challenges

Despite these measures, the reported losses ($614,000 from just three cases) indicate significant challenges:

- Social Engineering Effectiveness: Even with awareness campaigns, sophisticated psychological manipulation continues to succeed.

- Technical Limitations: Traditional verification systems (like checking legitimate websites) can be weaponized within scam narratives.

- Rapid Evolution: Scammers continually adapt tactics to overcome new security measures.

- Digital Trust Issues: The ability to spoof PayNow display names highlights vulnerabilities in systems meant to establish trust.

Improving Scam Prevention

To further enhance protection against such scams, Singapore could consider:

- Enhanced Verification Systems: Developing more robust two-way verification systems for government and financial communications.

- Temporary Transaction Delays: Implement cooling-off periods for unusual transactions.

- Behavioral Analysis: Using AI to detect unusual transaction patterns before funds leave accounts.

- Cross-Platform Alerts: Creating synchronized alerts across multiple communication channels when suspicious activities occur.

- More profound Public Education: Moving beyond awareness to teaching critical thinking skills around digital authority and verification.

Singapore’s multi-faceted approach to combating scams represents one of the more comprehensive systems globally, but the evolution of scam tactics necessitates continuous improvement and adaptation.

Applying for Jobs in Singapore: A Guide

If you’re looking to work in Singapore, here’s a comprehensive guide to help you navigate the job application process:

Employment Pass Options

For Professionals/Skilled Workers:

- Employment Pass (EP): For foreign professionals, managers, and executives.

- Minimum qualifying salary: S$5,000+ per month (higher for older, more experienced candidates)

- Requires relevant qualifications and work experience

- Typically valid for 1-2 years initially, renewable

- S Pass: For mid-skilled foreign employees.

- Minimum qualifying salary: S$3,000+ per month

- Requires diploma or technical qualifications

- Subject to quota limitations

- Personalized Employment Pass (PEP): For high-earning EP holders or overseas professionals.

- More flexibility, not tied to a specific employer

- Higher salary requirements

For Entrepreneurs/Business Owners:

- EntrePass: For entrepreneurs looking to start a business in Singapore.

Job Search Strategies

Online Job Portals:

- MyCareersFuture.sg (government-backed)

- JobStreet

- Indeed Singapore

- eFinancialCareers (finance sector)

Networking:

- LinkedIn professional groups

- Industry-specific events and webinars

- Professional associations in your field

Recruitment Agencies:

- Consider industry-specific agencies

- Michael Page, Robert Walters, and Kelly Services are reputable options

Application Process

- Resume Adaptation:

- Use Singapore’s CV format (similar to Western formats)

- Highlight relevant skills and achievements

- Include all educational qualifications

- Cover Letter:

- Address specific job requirements

- Explain your interest in working in Singapore

- Mention your eligibility for work passes

- Interview Preparation:

- Research Singapore business culture

- Be prepared for technical assessments

- Virtual interviews are common for overseas applicants

- Work Pass Application:

- Typically handled by the employer after job offer

- May require authenticated copies of certificates

- Medical examination is often required

Important Considerations

Industry Focus:

Singapore has strong demand in sectors like:

- Financial services

- Information technology

- Healthcare

- Education

- Manufacturing

- Maritime

Cultural Fit:

- Singaporeans value punctuality, respect for hierarchy, and collaborative work

- Multicultural environment requires adaptability

- English is the primary business language

Cost of Living:

- Housing is expensive (30-40% of salary)

- Public transportation is affordable and efficient

- Healthcare is high-quality but can be costly

Timeline Expectations

- Job applications: 2-4 weeks for initial responses

- Interview process: 2-6 weeks, depending on position level

- Work pass processing: 3-5 weeks after job offer

- Relocation: 1-3 months total from job offer to arrival

Additional Resources

- Ministry of Manpower website (mom.gov.sg)

- Contact Singapore (contactsingapore.sg)

- Singapore Economic Development Board (edb.gov.sg)

Remember that Singapore has qualification assessment systems like COMPASS (Complementarity Assessment Framework) that evaluate how well foreign candidates complement the local workforce. Highlighting your unique skills and how they benefit Singapore’s economy will strengthen your application.

- Since March 2025, scammers have stolen at least $614,000 by impersonating MAS officials.

- They call victims from local numbers (starting with “8” and “9”)

- Scammers direct victims to check the Register of Representatives online portal to verify their identity

- However, this register doesn’t list MAS employees – it’s for individuals conducting regulated financial activities

- Victims are told their accounts are involved in money laundering or their information is compromised

- Believing they’re helping with an investigation, victims share personal information or transfer money

- Sometimes, scammers use PayNow accounts with display names matching the victim’s name to appear legitimate

The authorities emphasize that legitimate government officials would never:

- Ask people to transfer money over the phone

- Requesting banking details or personal information

- Ask you to install apps from unofficial stores

- Transfer a call directly to the police (unless you call 995 for emergencies)

This is a good reminder for everyone to be vigilant about unsolicited calls claiming to be from authorities, especially those creating urgency or fear about investigations. Never share personal information or make transfers to unknown parties, regardless of how legitimate they might appear.

Analysis of the MAS Impersonation Scam

This MAS impersonation scam demonstrates several sophisticated tactics that make it particularly effective:

- Authority impersonation – By posing as MAS officials, scammers exploit Singaporeans’ respect for authority figures and financial regulatory bodies

- Verification misdirection – Using a legitimate government portal (Register of Representatives) as “proof” of identity creates a false sense of security

- Fear-based manipulation – Claims about money laundering or compromised information create urgency and anxiety

- Technical sophistication – Local phone numbers and PayNow names matching victims suggest organized operations

- Social engineering – Framing victims as “helping an investigation” exploits people’s desire to cooperate with authorities

Anti-Scam Measures in Singapore

Singapore has implemented several anti-scam initiatives:

Government-Led Approaches

- ScamShield App – Developed by the National Crime Prevention Council and Government Technology Agency to block scam calls and messages

- Anti-Scam Centre (ASC) – Established by the Singapore Police Force to coordinate responses to scams and recover funds.

- Interministerial Committee on Scams – Coordinates whole-of-government approach to scam prevention.

- Public education campaigns – Regular alerts via news media, social media, and SMS notifications about emerging scam patterns

- CSA Safer Cyberspace Masterplan – Framework for enhancing cybersecurity awareness

Banking Sector Protections

- Delay in fund transfers – Banks implement cooling-off periods for large or suspicious transfers

- Transaction alerts – Notifications for unusual account activity

- Scam warning screens – Pop-up warnings during digital banking transactions

- Two-factor authentication – Required for financial transactions

- PayNow transfer limits – Default limits on daily transfers

Community Initiatives

- Anti-scam hotlines – Dedicated channels for reporting suspected scams

- Neighborhood watch programs – Community vigilance networks

- Seniors outreach – Targeted education for vulnerable populations

Despite these measures, scammers continue to evolve their tactics. The MAS impersonation scam shows that even with sophisticated defenses, social engineering can bypass technical safeguards by exploiting human psychology and trust in institutions.

For continued improvement, Singapore might consider:

- Further reducing default transaction limits

- Implementing AI-based behavioral analytics to detect unusual transaction patterns

- Enhancing cross-border cooperation to pursue international scam syndicates

- Continued public education, specifically about verification processes for government officials

The Anti-Scam Centre (ASC) of the Singapore Police Force has collaborated with four major banks (DBS, OCBC, Standard Chartered, and UOB) to combat scams using Robotic Process Automation (RPA) technology. Their efforts between January and February 2025 have been quite successful:

- They disrupted over 900 scams (job scams, investment scams, fake friend call scams, and e-commerce scams)

- Sent over 9,000 SMS alerts to more than 7,000 bank customers identified as potential victims

- Prevented potential losses of over $58 million

The Police are encouraging the public to “ACT” against scams:

- ADD security features like ScamShield app and two-factor authentication

- CHECK for signs of scams by verifying information and being cautious of too-good-to-be-true offers

- TELL authorities and others about scam encounters

For more information, people can visit www.scamshield.gov.sg or call the ScamShield Helpline at 1799. The Police Hotline is also available at 1800-255-0000.

This appears to be a press release from the Singapore Police Force dated March 5, 2025.

Analysis of Different Scam Types and Prevention Methods

Common Scam Types

Investment Scams

- Characteristics: Promise of high returns with low or no risk, pressure to act quickly, unregistered investments

- Tactics: Fake investment platforms, impersonation of legitimate financial institutions, manipulated screenshots of “profits”

- Target: Often, individuals seeking financial growth, retirees, or those with savings

Job Scams

- Characteristics: Too-good-to-be-true job offers, requests for upfront payments, minimal qualifications needed

- Tactics: Fake job portals, requests to purchase equipment or training, tasks involving money transfers

- Target: Job seekers, students, and people looking for work-from-home opportunities

E-commerce Scams

- Characteristics: Significantly discounted prices, limited verification options, suspicious payment methods

- Tactics: Fake shopping websites, non-delivery after payment, counterfeit products

- Target: Online shoppers looking for deals

Fake Friend Call Scams

- Characteristics: Impersonation of friends/family, urgent requests for money, emotional manipulation

- Tactics: Hacked social media accounts, spoofed phone numbers, created emergency scenarios

- Target: People with active social networks, particularly older individuals

Prevention Methods

Technical Protections

- Install anti-scam apps like ScamShield.

- Enable two-factor authentication on all accounts.

- Set transaction limits on banking platforms

- Use secure payment methods with buyer protection

- Verify website security (https, secure payment icons)

Behavioral Strategies

- Research before investing or purchasing (company registration, reviews)

- Never share personal information or verification codes

- Take time to verify urgent requests, especially those involving money

- Call friends/family directly through known numbers to verify requests

- Be skeptical of unsolicited contact, especially regarding finances

Educational Approaches

- Stay informed about current scam trends.

- Attend community awareness programs

- Share scam experiences with others

- Follow updates from police and financial institutions

- Teach vulnerable populations (elderly, youth) about digital safety

Reporting Mechanisms

- Report suspicious activities to relevant authorities immediately

- Flag suspicious accounts on social media platforms

- Inform banks of suspicious transactions

- Use dedicated scam reporting hotlines

- Document all communications with potential scammers as evidence

Institutional Responses

- Banking verification processes for unusual transactions

- Police rapid response teams like Singapore’s Anti-Scam Centre

- Public-private partnerships for information sharing

- Automated detection systems using AI and machine learning

- Proactive customer alerts about potential scam activities

The most effective approach combines technical safeguards with education and behavioral awareness, creating multiple layers of protection against increasingly sophisticated scam attempts.

Maxthon

Maxthon has set out on an ambitious journey aimed at significantly bolstering the security of web applications, fueled by a resolute commitment to safeguarding users and their confidential data. At the heart of this initiative lies a collection of sophisticated encryption protocols, which act as a robust barrier for the information exchanged between individuals and various online services. Every interaction—be it the sharing of passwords or personal information—is protected within these encrypted channels, effectively preventing unauthorised access attempts from intruders.

This meticulous emphasis on encryption marks merely the initial phase of Maxthon’s extensive security framework. Acknowledging that cyber threats are constantly evolving, Maxthon adopts a forward-thinking approach to user protection. The browser is engineered to adapt to emerging challenges, incorporating regular updates that promptly address any vulnerabilities that may surface. Users are strongly encouraged to activate automatic updates as part of their cybersecurity regimen, ensuring they can seamlessly take advantage of the latest fixes without any hassle.

In today’s rapidly changing digital environment, Maxthon’s unwavering commitment to ongoing security enhancement signifies not only its responsibility toward users but also its firm dedication to nurturing trust in online engagements. With each new update rolled out, users can navigate the web with peace of mind, assured that their information is continuously safeguarded against ever-emerging threats lurking in cyberspace.